Having an easy to follow trading strategy with a crystal clear set of rules will help you improve as a forex trader more than following a trading strategy with a lot of indicators. These kinds of strategies only make trading more complex.

Therefore, you should keep your trade simple. Perhaps simplicity is the missing component in your trading career.

Remember what they said: “Keep it Simple Stupid”.

In this article, we are going to talk about a simple trading strategy. This 20 EMA Bounce Forex Trading Strategy is a price action trading strategy that uses the 20 EMA.

It is a very easy trading system that even a complete newcomer to forex trading can effortlessly follow.

Related Reading: What is Moving Average in Forex & How to Use it (4 Practical Ways)

To get started all you need is:

- 20 exponential moving average, and…

- For trade entries, we are going to use price actions.

Also, you can apply this trading strategy to any currency pair and timeframe…

…But only under one condition. That is the volatility.

The volatility should be present. Or else you end up trading in the range market.

Now, how do we find such volatile market conditions?

Best Time to Trade 20 EMA Strategy

Well, I recommend trading when the markets are moving fast and there is a lot of volatility in place, and the London and New York trading sessions are ideal for this.

Next…

What is the Purpose of Using 20 EMA?

The 20 EMA act like dynamic support during an uptrend and in a downtrend the 20 EMA act as a dynamic resistance.

Let’s clear things by using real forex charts.

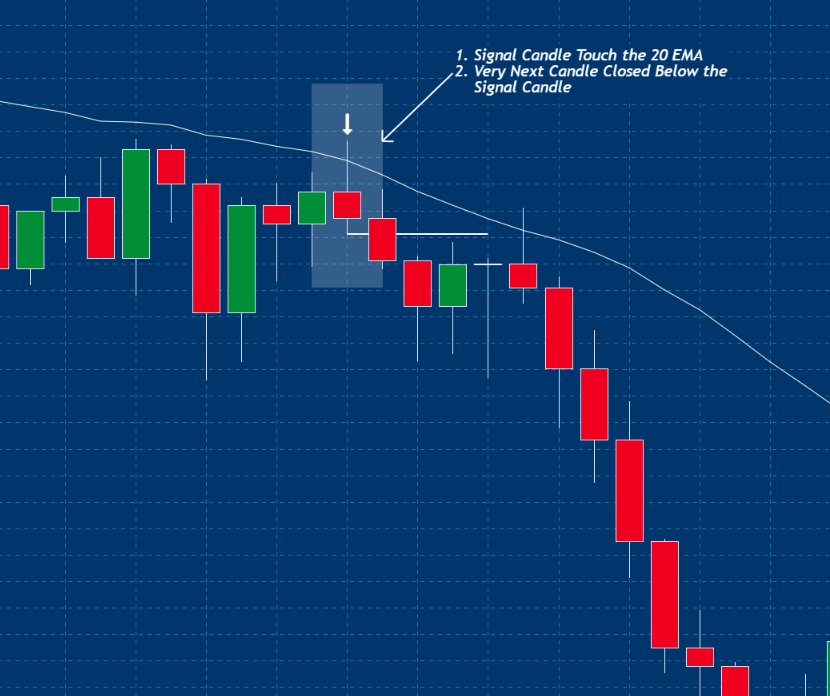

As we all know, in a downtrend price will continually move lower but at some point, the price will make minor pullbacks to the 20 ema and then if the trend is still strong we will another price continually move lower.

This is called retest of 20 ema and this can happen multiple times during a short downtrend.

As a forex trader, you are now waiting for the retest to occur on 20 EMA, and in this case, you are only looking at one candlestick…the SIGNAL candlestick, which is where you may place your orders.

The signal candlestick is the one that returns to the 20 ema line for the first time after the price has been moving away from it for some time. It is not a genuine SIGNAL CANDLESTICK if the second candlestick after the signal candlestick is still near the 20 EMA line, even though that candle is still below the 20 EMA.

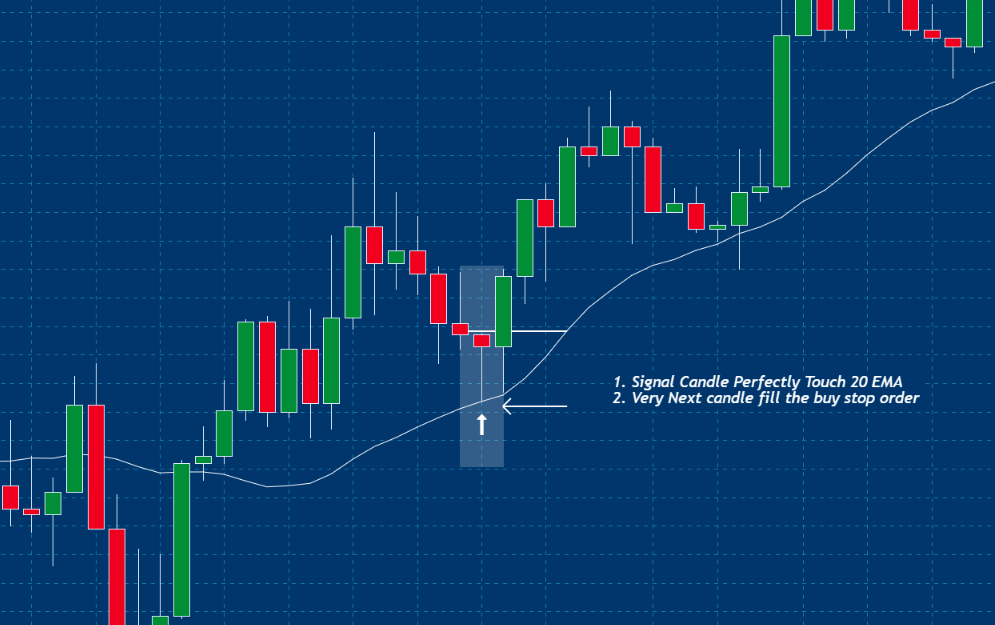

So, I’ve talked about the scenario in terms of selling setup… How about the buying setup?

It’s the exact opposite, and you should be able to figure it out very fast after looking at the charts below.

Rules for the 20 EMA Bounce Forex Trading Strategy

Rule #1 – When the price is closing above the 20 ema it is considered as an uptrend and when the price is closing below the 20 ema it is considered as a downtrend.

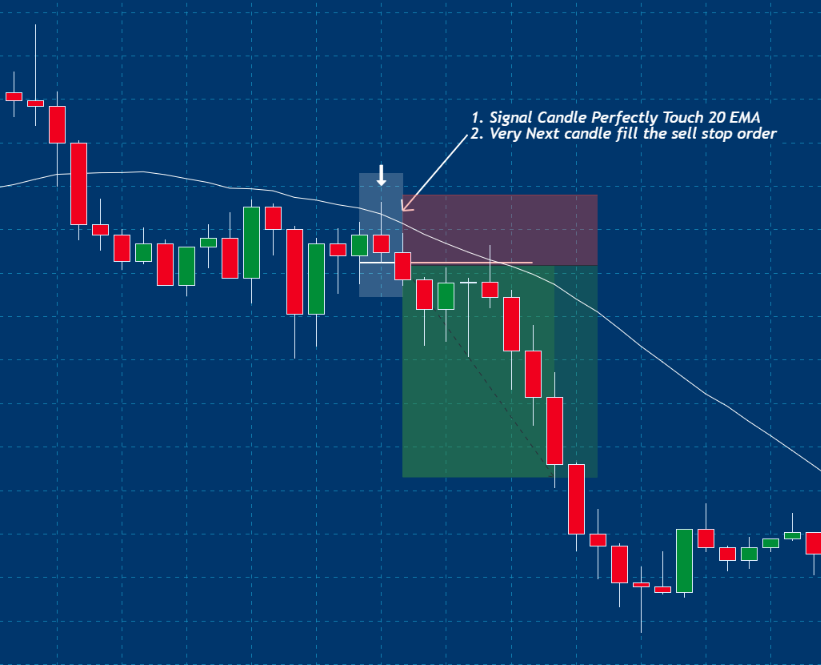

Rule #2 – The SIGNAL candlestick is the one that first touches the 20 ema. Because your buy or sell pending orders are based on the high and low of the signal candlestick, it is the only candlestick you should be interested in.

Rule #3 – In an uptrend market, you place your buy stop pending order a few pips above the high of the signal candlestick. If that order is not activated by the next candlestick that forms, you cancel your order.

Rule #4 – In a downtrend market, place your pending sell stop order a few pips below the low of the signal candlestick but if that pending order is not activated by the next candlestick that forms, then you need to cancel that pending order.

Rule #5 – Place your stop loss a few pips (5-10 pips depends on what timeframe you are using as well) below the low of the signal candlestick for a buy trade and above the high of the signal candlestick for a sell trade.

With that let’s take a few trade examples and discuss how to place trades.

Trade Examples and Trade Breakdowns

Buy Trade Example 1:

Buy Trade Example 2:

Sell Trade Example 1:

Sell Trade Example 2:

How to Place Take Profit Targets

There are two options you can use.

- You can previous swing level for placing your take profits. For example, you can use the previous swing high as a take profit level for a long trade vice versa you can use the previous swing low as a take profit for short trades.

Or…

- You can set the take profit target 3 times what you risked initially. In this case, if your risk is 10 pips then your take profit should be 30 pips.

That is it. This is a simple forex trading strategy that anyone can use. But this is not a holy grail therefore expect to have losing trades while trading this strategy and again make sure to add a tight risk management plan for this trading strategy that way you can minimize the downside of your trading account.

There is an article on forextradingstrategies4u on how to avoid invalid trade setup when trading with 20 ema. I highly recommend you guys to go there and read it.

Here is that article 👉 Avoid Unnecessarily losses when trading with 20 ema.

Now let me know in the comment section. What do you think about this trading 20 ema bounce trading strategy?

Related Reading: 17 Unknown Forex Trading Secrets Every Trader Should Know About

With that make sure to share this trading strategy with friends.