Everyone stepped in the world of forex to be consistence profitable forex traders. Unfortunately, most of the newbies come into forex trading to earn some extra cash and they think forex trading is just another way to earn money online. That is false!

You have to treat trading as a business if you want to become a consistently profitable trader who earns money consistently month after months.

Let me ask you a question. What is the difference between consistently profitable traders and consistently losing traders? What is the gap between these two types of traders?

Let me know your thought in the comment section.

In my perspective, there are three things that separate successful traders from losing traders – Trading Psychology, The Way They Treat Trading and The Way They Behave in the Market.

Specifically, we are going to talk about How to treat trading like a business. Here what we are going to talk,

- Have a Vision for Your Trading

- Fund Your Trading Business Properly

- Think in Longterm – Don’t trade like you are going to retire tomorrow

- Have a Clean Trading Office That inspired you

- Have a trading Plan for Your Trading Business

- Don’t Present Yourself all Over the Market – Have a Proper EDGE over the Market

- Have a Strict Daily Trading Routine & Follow it Continuously

- Think of Your Trading Setups as Product and Services

- Losses are Invetible

- Know Exactly Where Your Costs are Coming From

- Find a Trustworthy Broker

- Have a Trader Development Plan

- Always Protect Your Trading Capital

- Have Solid Trading Journal That Helps You Understand ins and out of Your Trading Business

Let’s dive in…

Have a Vision for Your Trading

Every business out there whether it is big or small must have a vision statement. A Vision Statement describes the desired future position of the business. Elements of the vision statement reflect the business purpose, goals and value.

Now lest see some of the vision statements of Big companies out there.

- Amazon – Our vision is to be earth’s most customer-centric company to build a place where people can come to find and discover anything they might want to buy online.

- PayPal – PayPal s vision statement is we believe every person has the right to participate fully in the global economy. We have an obligation to empower people to exercise this right and improve financial health.

- PepperStone – a world of digitally-enabled trading for traders to embrace the challenge and opportunity of global markets.

As you already know you should treat trading as a business if you want to scale your trading business and earn 7 figures from forex trading.

Let me ask your question. What is your vision statement in trading?

If you don’t have one you better start creating a one that reflects how you are going to grow your trading business.

You probably wondering what to include in the trading vision statement, right? To know what to include in your vision statement, first, you have ot find out why your are going to trade trading forex.

Let’s assume that you are aiming for 1% a month, then you probably need 5 to 10 trades per months and you need to focus on the intraday timeframe as well. Now your job is to craft a vision statement based on those factors. It is as simple as that.

Once you have a complete vision statement that inspired you, print it and post it where you can see it while trading forex.

Next. Let’s talk about another factor you should consider if you want be treat trading as a business.

Fund Your Forex Trading Business Properly

Forex trading is easily accessible and anyone can open a trading account with $100 some brokers even allow traders to trade from $50 as well.

Do you think these traders are going to trade for the long term?

I see these kinds of traders as people that come to the forex market just to taste how the things are working and most probably these traders are not going to hang around a long time.

If you are serious about forex trading and want to treat trading as a business you should consider the starting capital of your trading business. Of course, you can start trading forex with a small trading account, But you are going to make lots of mistakes.

Instead, practice on a demo account and starting live trading with reasonable trading capital.

Think in Long Term – Don’t Trade Like You Are Going to Retire Tomorrow

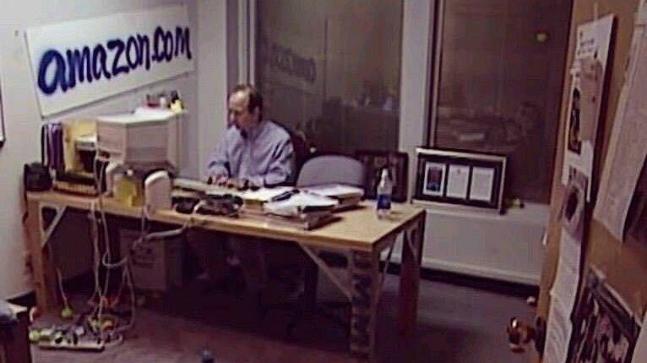

Have you identified the picture below? That is Jeff Bezos in 1994 in his garage working on Amazon.com. In the early stage of Amazon, there are sold books. But now you can find a wide variety of items from amazon not only that, Jeff Bezos is the wealthiest man in the earth right now.

So, How Jeff Bezos able scale amazon into a such a big company? That is called Long Term Thinking.

How this related to forex trading?

Forex trading has a higher failure rate, right? It is almost around 95%. The sad truth is it is getting higher and higher.

The main reason for this is that most new traders come into forex trading with a wrong mindset. They picture forex trading as a short-term activity where traders make money on a daily basis.

This is wrong.

To scale your trading business, first, you need to think in the longer term.

30% to 50% is all you need annually. Compound this for 10 years and you’ll be amazed by results.

Rome was not built in a day, but Hiroshima and Nagasaki were destroyed in a day.

Have a Clean Trading Office That Inspired You

Having a clean trading setup is very important if you want to treat trading as a business. Why is that?

Because a clean trading setup improves your productivity which allows to taking quality trades and overall it allows you to stay calm throughout the trading day.

Also, a clean trading setup reminds yourself that trading is something you take seriously.

Personally, I have separated a small space in my room for trading. Whenever I sit on my trading desk I shut down social media and Netflix and give my 100% focus on trading. This doesn’t mean that I stay glued to the screen all day.

All I have is charts, Printed trading plan and vision statement in front of me.

I found that when I keep my trading space clean and organized, I work better and I enjoy my trading day more. I highly encourage you guys to have a clean trading setup.

Have a Trading Plan for Your Trading Business

The trading plan includes all the trading activities you are going to do throughout the day or week.

Successful traders just don’t open up charts and start trading. They first prepared for every possible outcome and then only they are going to attack. The preparation is very important.

My trading week usually starts on Sunday. I go through all the charts on Sunday and mark important trading opportunities for the upcoming week.

That way I can focus on trading setups and execute trades according to the trading plan.

If you already have a trading plan, your trading plan should answer a specific question like:

- Which currency pairs will you trade?

- What strategy will you focus on? (Swing trading, Day trading or Intraday trading)

- What is your trading process? (From identifying to closing trades)

- How you manage your risk and money?

Another benefit of a trading plan is, it allows you to fine-tune your trading goals. know when to adjust risk, and it helps you to manage overall risk, money and trading strategy according to the different market conditions.

A trading plan is the most important piece of paper that you need if you want to treat trading as a business.

Next…

Don’t Present Yourself all Over the Market – Have a Proper EDGE over the Market

There are endless opportunities in the forex market every day that we can take advantage of. But is it possible to focus on all these trades?

NO!, Right?

If you are willing to take all of these trading opportunities that present in the market, then you will probably end up having lots of emotional trading problems. Maybe you will end up losing some money too.

Hence, You should need a Proper trading edge over the market to extract consistent profits.

So, What exactly is a trading edge?

A trading edge is a way of approaching the market every trading day. It helps you identify trading opportunities that match your personality and have a higher probability.

The truth is that majority of forex traders don’t even know it exists. That is why only a handful of forex trader become a success while the majority of traders struggling to earn consistent money.

So how to find a profitable trading edge?

For me trade trend reversal. That is where I have edge over the market. Basically, I’m focusing on trending market and patience waiting for a reversal of an established trend. And if I can see a perfect setup, then I will execute that trade.

The point here is, Identify where you are comfortable in taking trades (trending market, momentum market, etc) and then build a trading plan based on that.

Have a Strict Daily Trading Routine & Follow it Continuously

If you are serious about forex trading and want to treat trading as a business, then you should need a trading routine that helps you to stay consistent throughout the week.

Your trading routine should include the following aspect,

- When you analysis the market. (Pre-market preparation).

- How to adjust your trade during the week.

- When you are going to record your trades. It is on a daily basis or a weekly basis.

- When to stop trading (when things are not going according to you).

Another thing you should focus on making trading routine is your day to day lifestyle.

Have a trading routine that matches with your day to day life will help you stay consistent throughout the week.

Think of Your Trading Setups as Product and Services

Every business has a product or service to sell to generate profits, right? The business knows everything about their products. How it builts, where it is from, what is the benefit of using that product, what are the struggles are and many more.

The same principals are applied to trading as well.

As a forex trader, your trading setups and your trading strategy are your products. Your trading rule and the trading edge will the defining quality of the trade setup.

The important thing is that you should know about ins and outs of your trading setups.

- You must know about when your trading strategy work

- What kind of market condition is not working

- In which timeframe and currency pair to use it

- How to improve the odds and,

- How to manage risk and money to generate maximum profits while reducing the risk.

Losses are Unavoidable

Losses are part of trading and they are unavoidable. The thing is losses are coming with lots of emotional pains and most of the traders struggle to manage these emotional ups and downs. As a result of that traders are ended up making lots of trading problems.

The worst trading mistake that traders can make in a situation like this is switching to another trading system. Switching another system is okay if the strategy is proven to be not working, But jumping to another ship after a one losing trade is only going to widen your learning curve.

So, You have to treat trading losses the same way you treat the profitable trades. Start to love trading losses. There is no other way around.

Know Exactly Where Your Costs are Coming From

Every business has various kind of costs, right? They need to buy materials, hire workers, invest in marketing and many more. Knowing those costs and managing them wisely helps business to cut their loses and grow consistently.

You should apply the same principle to the trading if you want to treat trading as a business.

Start identifying the costs in your trading. Here are some of the trading costs common among every forex traders. These costs are usually coming from brokers part.

- Spread and Broker fees.

- Interest rate differentials.

- Margin requirements and tax condition.

And here are some other trading costs that come from your side.

- Missing Opportunities (Profitable trade that you didn’t take because of your trading invested in elsewhere or You had enough losing trade already).

- Psychological Costs (Lose of confidence over a losing trade).

- Head costs (Anything that is distracting you from making better trading decisions).

Finally, there is Technical and Education cost.

- Subscription for the trading platform and Educations

Find a Trustworthy Broker

Choosing a forex broker is heavily based on traders needs. Let’s say you are planning to day trade which means you need a tight spread, right? On this case, you can go with an ECN broker. You will pay a commission on trades but the spreads are much tighter.

Or if you planning to go with swing trading which involved higher timeframes. Then also you have a big pool of potential brokers left.

You also have to consider some of the other factors when choosing a good forex broker.

Security – This is the most important thing you should consider when choosing a broker. You are not going to hand over your trading capital to a broker who simply claims we are legit, right? Fortunately, most of the broker are transparent when it comes to the security side of things.

So when choosing a broker, first you should find out whether your broker is regulated under the following regulatory agencies.

- United States: National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC)

- United Kingdom: National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC)

- Australia – Australian Securities and Investment Commission (ASIC)

- Switzerland – Swiss Federal Banking Commission (SFBC)

Payment Methods – Find out what are the payment methods different forex broker offers and go with the broker that allows you to deposit money and withdraw your trading profit hassle-free.

Trading Platform – You can find a vast amount of trading platform out there. Different forex traders offer different trading platforms. Some of them are better while some of them are focus on simplicity like Metatrader 4 (MT4) and Metatrader 5 (MT5). Find out what are the technologies that your brokers are offer and go with the one that meets your requirements.

Recommended Broker – XM.com

You also need to focus on your improvement as a forex trader, right? The one thing that helps your grow is having a trader development plan.

Have a Trader Development Plan

As a trader, it’s not enough to protect and grow your trading capital, right? You should focus on your improvement as well. What kind of improvements?

Assume that you have a trading strategy on hand which generate consistent profits over months. Is that enough?

No. Maybe your strategy is generating consistence profit But at some point your trading strategy suffer from trading losses. On that time you will have to face the psychological side of thing.

So on that time, if you can’t control your emotions ups and down, then you probably going to make lots of trading mistakes, maybe you will end up blowing your trading account.

To prevent this you have to focus on your side of the development just like the way you improve your trading strategy.

You can start by pay attention to your trading performance, learning from other traders and investing time on trading psychology.

Related – 20 Forex Trading Habits to Level Up Your Trading Career

Always Protect Your Trading Capital

Trading capital preservation is the most important thing when it comes to trading. If you can’t protect your capital then you cannot survive in this ever-changing forex market.

I have come across many traders who lose their trading capital completely at the early stage of their trading career and some of them are not that unfortunate and end up 40% to 60% of their trading capital.

So how to protect your trading capital?

Simple, Prioritize the RISK first, then go for the Profit. What is this mean?

Start limiting your risk per trade to 1% to 2% per trade. That way you can stay long this game.

You can also set a maximum drawdown limit which means you are going stop trading for the week or month when you hit your maximum drawdown level.

Next…

Each of your trade outcomes must have any of the following results,

- A Small Profit

- A Big Profit

- A Small Loss

- Breakeven Trade

But, what if you got a Big Loss. All of the gains will be lost, right?

A big loss triggers your emotions and it makes you revenge trading and what if revenge trading also failed? Then you ended up having a bucket of losing trades with a big drawdown, right?

So focus on protecting your trading capital.

Related – The Art of Cutting Losses Short – Forex Risk Management

Now it is time to talk about the last method on how to treat your trading as a business.

Have Solid Trading Journal That Helps You Understand ins and out of Your Trading Business

A trading journal is one of the most effective tools for understanding trader’s performance and improves traders performance. This is where you are going to record all of your trading activities for future references.

With a trading journal, forex traders can develop profitable trading strategies based on the historical trades recorded in the trading journal.

Another major benefit of having a trading journal is that you are aware of what is going on in your trading.

For example, Assume that you are in a drawdown, okay.

So, If you have a trading journal in a situation like these, you know exactly what to do. A good trading journal will help you to reduce the risk in this kind of scenario.

I highly encourage you to keep an organized record of your trading performance. That way you can learn from past winning and losing trades. However, past performance cannot predict future performance, But you can use your trading journal to learn from your past trading activities to identify emotional trading errors, why did you go with this trade and many more.

Now It’s Your Turn

So far we talk about 14 ways how you can treat trading as a business, right?

Now I’d like to hear from you. What factor do you like the most?

Or maybe I didn’t mention one of your favourite way to treat trading as a business. Either way, let me know by leaving a comment in the comment section below.

Also, consider following us on social media – Facebook and Instagram.

One Response

This is so apt. Thank you for this!