If you’ve ever seen the statistics regarding the failure rate of the trading industry, all of these statistics are basically telling you that you’re going to fail as a trader.

In fact, research conducted by many organizations consistently shows a higher failure rate among traders.

Based on those studies…

- 97% of day traders lost money over a 300-day period, according to Brazilian futures traders.

- Between 1995 and 2006, another study of day traders in Taiwan found that only 5% of them were profitable.

- And, According to a study of forex traders conducted by the US Securities and Exchange Commission, 70% of traders lose money every quarter on average, and traders often lose 100% of their money within 12 months.

- A study of eToro day traders found that roughly 80% of them lost money over the course of a year, with a median loss of 36%.

And there are thousands of studies done based on this subject and it constantly proves that only a handful of people will become and remain successful as traders.

So, why is it so hard to consistently make money in trading? Or is it even possible to become a long-term trader?

Yes, becoming a consistent and long-term trader is certainly achievable.

However, if you are susceptible to the 7 things we will discuss later, you will have a hard time being a successful trader.

Now here are those 7 points we are going talk about,

- Quantity of misleading information out there.

- We are trading in an ever-changing landscape.

- Having unrealistic expectations.

- Not having a clear understanding of the risks associated with trading.

- Ignoring the trading psychology.

- Denying to accept the harsh truth.

- Jumping from one trading system to another trading system.

With that let’s dive in.

1. Quantity of Misleading Information Out There.

If you’re new to trading or an experienced trader, you’re probably aware that there are thousands of trading-related resources available on the internet, including websites, social media groups, trading chat rooms, online courses, and YouTube channels.

In reality, the vast majority of these web resources contain misleading information. Therefore, finding the right place or person to learn how to trade the financial markets is challenging.

According to surveys conducted by regulatory agencies, the majority of trading education-related businesses are considered to be Forex frauds.

When you consider the amount of false information out there, it’s no surprise that most new traders ended up on the wrong path and gave up trading just because they felt being a trader is so hard and stressful.

Actually, It is not an issue with the market that makes trading hard; rather, it is a problem caused by relying on misleading information.

So, how can you avoid being scammed by false information and fake trading gurus and experts?

Let’s talk about the solutions.

Solutions – Avoid Being Scammed in Trading

According to GiamBrone’s research, they categorize the trading scam list that has been involved in trading fraud in the past and present.

Based on that research, as a trader, you should avoid from…

- Signal Sellers

The signal seller scam involves a person or a firm providing information on which trades to make and suggesting that this information is based on professional forecasts that will produce money for the inexperienced trader. They normally charge a daily, weekly, or monthly price for this service, but they do not provide any information that would help the trader profit. They will normally have a flurry of testimonials from ostensibly credible sources in order to garner the trader’s trust, but they will do nothing to forecast profitable trades in reality.

- High Yield Investment Programmes

High yield investment programs are typically a Ponzi scheme in which a high rate of return is guaranteed in exchange for a little initial investment in a Forex fund. In actuality, the initial investors are paid back from the wealth generated by current investors, and a steady flow of new investors is required to keep the cash coming; once there are no more participants in the scheme, the owners often close it down and collect all of the money.

- Managed Accounts

There are several examples of managed accounts, which might be a sort of Forex scam. These scams usually include a trader collecting your money and using it to buy a variety of luxury products for themselves rather than investing it. When the victim asks for their money back, there isn’t enough money to repay them.

- Manipulation of Bid/Ask Spreads

These types of scams have lessened over time, yet they still exist. This is why choosing a Forex broker who is registered with a regulatory organization is critical. Spreads of roughly 7-8 pips, rather than the usual 2-3 pips, are used in these types of scams.

- Online Trading Course

There are thousands of online education companies related to trading that can be found on the internet and the shocking news is that most of these companies only teach you the basic stuff by charging around $500 to $1000. In reality, most of this stuff can be learned for free.

Try your best to avoid these things especially when you are starting out as a trader.

First, open a demo account and try to feel the market, and then from there decide how and where you should get started in trading. Do your own research when choosing an education program and a forex broker.

2. We Are Trading in an Ever-Changing Landscape.

The market, as we all know, changes every second, minute, and hour. The current market situation will not be the same in a week’s time. It is always changing and progressing through different stages.

Therefore we can consider the Forex Market as an ever-changing landscape in which no one can predict whether the market will rise or fall.

This resulted in uncertainty and because of that we never know the outcome of our trades until they are closed, and we never know whether or not our analysis will be correct. That is the nature of the forex market.

Now think about for a moment, how we can put our hard-earned money into an uncertain market like the forex market, where we have no control over the outcome of our trades.

It is not easy to risk our money in this way, right?

This is yet another reason why trading is hard, and it is, in my opinion, one of the primary reasons why many beginning traders give up.

But… every problem has a solution.

Solution – Manage Your Risk in an Uncertain Environment.

When trading in an uncertain environment we never know the outcome of a single trade or series of trades.

For sometimes it can be five winners and two losers, or sometimes it can be five losers and two winners. The sequence of winners and losers we never know but we know that all of the outcomes are going to be randomized.

To put it another way, I can say that, the outcome of single trades will be random, but your overall performance will be consistent over the series of trades, only if you stick to the risk management and risk to reward ratio.

Let me explain this…

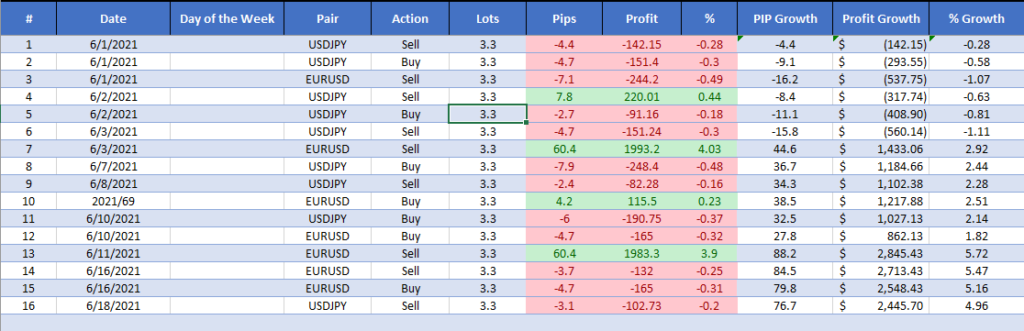

Have a look at the screenshot of our trading log below.

At a glance, you can see that there are lots of losing trades and only a few winning trades according to the above trade log. Or in another word, we can say that these results are totally randomized.

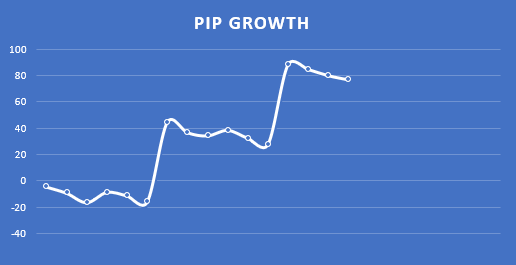

But do you believe me if I told you that these random outcomes culminate in consistent results? Well, have a look at the equity chart for the above trades.

Although the trade outcomes were randomized, the equity chart is still steadily rising and this is a great example of what it means by the Random Outcome but Consistent Result.

I think you got the idea here.

Now keep in mind that, when trading in an uncertain environment like the forex market, never expect the certainly.

Be comfortable with the uncertain and the randomness. If you do, your risk management and money management strategies will accumulate those random outcomes into consistent gain over the long term.

Cultivate your mind to think in this way, if you do so, being a trader will never be a hard thing for you.

3. Having unrealistic expectations

Just like most other traders, I got into trading because of the rich and flashy lifestyle traders show on Instagram.

I used to think that trading was a get-rich-quick scheme, and I still remember the moment when I tried to double my trading account quickly by risking 5% to 10% per trade, and guess what? I ended up blowing two trading accounts.

This helps me to realize that trading is not about a Get-Rich-Quick scheme and having such unrealistic expectations and also lack of work-life balance are the leading causes why is being a trader is so hard.

So, how do these people on social media end up making so much profit? Well, 99% of these profits are fake, which is why these guys are known as Instagram Traders, who have the supernatural ability to predict every price movement from top to bottom.

And the majority of these people are really not just traders; they’ve all got a trading course that claims to double your trading account month after month.

Now tell me, with this mentality, would people be able to trade?

Nope. Most of these individuals will have a hard time consistently trading the market and will eventually give up on trading.

This is the danger of having unrealistic expectations. Not only does this make trading hard, but it also drives people to seek out the Holy Grail trading system, which you will never find in trading.

Therefore be careful what you are expecting from the market if you really want to make trading easier.

If you have an unrealistic expectation and wish to change your mindset, there are a few solutions available to you.

Solution – How to Get Real

Trading psychology is a defining factor of your success as a trader. If you can’t effectively manage your emotional ups and downs, and stress in trading, you will have a hard time trading every day.

Adds unrealistic expectations to that, your stress level will be skyrocket.

That is why you should be real.

First and foremost, be realistic when trading. For example, instead of attempting to double your trading account every month, aim for a monthly return of roughly 2% to 4%, which will add up to a considerable profit over time.

Not only is this quite possible, but limiting your expectations will also significantly lessen your stress. So that you can trade the market with a calm mind.

Also don’t think that you should stay in front of the chart all day long to make money. If you do so you will miss lots of life opportunities. Therefore ask yourself that “how can I enjoy my life, if I spent all of my time in front of the chart.”

This is not trading and keep in mind that; There is More to Life Than the Daily Grind.

And finally never ever listened to – Instagram traders, Signal Providers, and Course Sellers. You don’t need them to learn how to trade the market.

Have your own beliefs and expectations.

Related: Why do Traders Have Unrealistic Expectations About Forex Trading?

4. Not having a Clear Understanding of the Risks Associated with Trading.

Whether you’re new to the trading or a seasoned trader, everyone knows that there is a huge risk associated with trading. Even though they know this, most of them are not trading, they simply gamble their own money in the market.

These kinds of traders risk around 5% or more for a single trade and most of the time their trading account suffers from huge drawdowns like 30% to 50%.

In reality, most of these traders would never be able to last more than three months in the market.

When it comes to this category of traders, the majority of them will eventually give up trading since they have lost all of their money, while others will refund their trading account and resume trading in the same manner as before, and will eventually blow their trading account.

Only a few percentages of traders are going to learn about the risk management side of things.

And eventually, everyone else will consider trading as the most difficult endeavour they have ever undertaken, and for some, trading will seem like an impossible thing to do.

If you continuously risk your hard earn money like this, you will never be able to become a sustainable forex trader and of course, trading will become hard for you.

Keep in mind that, before you become a trader, be a risk manager, and here are some tips to effectively manage your risk.

Solution – Be a Risk Manager

Knowing your risk appetite is the first step toward protecting your trading capital.

For some, risking roughly 2% or more is okay, while for others, 2% feels like too much risk.

Therefore, identify your risk appetite and start from there. Also, take into consideration that if you’re just starting out, taking small positions will help you to stay in the game for a longer period of time, allowing you to learn.

Here are some suggestions for managing and protecting your trading funds.

- Risk around 1% – 2% on a single position. Anything above is too much risk and you will experience bigger drawdowns if you do so.

- Limit your daily drawdown. Minus 5% per day is good.

- Limit the number of open positions. If you really want to open 5 or more trades per day make sure that you are taking a small risk on each position. This will help you have small downward swings in your equity curve.

- Have a maximum drawdown limit like 10% or 12%. This will save your account from bleeding out and make sure to scale down your risk when you are getting closer to this maximum drawdown level.

- Grade your trades. For example, if you have a valid trade setup in a choppy market, make sure to risk low on those trades and vice versa, when you have a trade opportunity in high probability areas, take your normal risk and manage trade effectively.

- Cut losses on trades that are not reacting to your original trade idea. I mean Why hold a trade if it is not moving according to your trade plan. That is a risky trade and you should cut losses immediately.

Just like these rules, make sure to established a few effective risk management rules to preserve your trading capital so that small losers here and there will not bother you and also being a trader will never be so hard for you.

Remember that Risk Come Before the Reward.

5. Ignoring the Trading Psychology.

Trading Psychology is the way you approach, think about the market, and feel about the market and your trades. Your knowledge about trading psychology affects your behaviour in the forex market, which in turn affects your trades’ performance. Apart from the other aspect of trading (entries, risk management, etc.), what REALLY matters is your psychology of trading.

Without that being a trader is hard, because in trading even if you got all other aspects like risk management, money management, and technical analysis correct, you will never be able to trade with confidence in an adverse market condition.

Think about for a moment, without right emotional intelligence how are you going to manage losing streaks like 5 to 10 losing trades in a row or how are you going to manage 7% to 10% drawdowns?

No matter how much trading experience you have, allowing your emotions to control you will cloud your decision-making process, leading to bad trades or trades outside of your trading strategy, which will eventually result in poor trading behaviour.

Now, if you have a trading strategy with a positive expectancy stop wasting time and energy worrying about which way the market will go, whether they will make a profit or loss. These kinds of thinking will result in stress and wrong buy and sell decisions.

Then if you have positive expectancy for your strategy, you should spend time understanding your emotional biases like greed, fear, hope, euphoria, panic, and keep them in check.

So if you want to trade with ease, here are a few ways to have the right psychology of trading like a successful trader, that will increase the probability of your success in the forex market.

Solution – Work on Your Trading Psychology

The best way to learn about trading psychology is by watching how successful traders manage their emotional ups and downs.

One thing that successful traders have in common is that they never become overconfident in their trading knowledge. Because they know that it will give them the false belief that their views and decisions are always right.

A successful trader is careful not to fall into the trap of his own biases, opinions, and market views. Instead, he keeps a trading journal to record his trading activities. Which later assist him to understand his trading problems related to their trading psychology.

Therefore make a habit of recording everything in your trading journal. This is will later help you to find your emotional problems so that you can work on those problems.

Another big emotional problem that traders constantly face is Greed.

To avoid being greedy when trading forex, have realistic expectations and avoid chasing unrealistic targets like 10% or more per month. 2% to 4% per month is good and it reduces your stress as well allowing you to trade calmly in adverse market conditions.

Finally, you should always monitor your Susceptibility for Making psychology Errors and work those and fix them if you really want to trade with ease.

6. Denying to Accept the Harsh Truth.

More than half of the retail traders I’ve met with over the years say that trading Forex for a living is their ultimate ambition.

This is unsurprising, considering that traders can earn money from anywhere in the globe with an internet connection.

Who can resist the luxury of sitting on the beach drinking a mojito while earning a thousand bucks a day?

Unfortunately, while this is technically possible, it isn’t the whole story.

You know, after more than a decade in this industry, I’ve discovered a few facts regarding full-time trading that many people are unaware of.

Sure, trading Forex for a living has its advantages… However, it is not as easy as you may believe.

Trading full-time is really hard, that is the truth, and here are a few reasons why trading full-time is hard;

- No matter how good you’re, your average monthly profit will be less than 5%, and this is also unsustainable over the long run. If you are lucky, you might get an average 5% monthly return over the first 12 months, but it is very unlikely that you’ll manage such trading performance.

- Another bitter truth about trading is that you need money to make money. Let’s say that you’re targeting roughly around 2% monthly gain then you need around $40,000 trading account to do this. Sometimes you need even more trading capital.

- In trading, stress is always present. Unlike the regular job where you get paid for showing up and doing some work, with full-time trading, however, it different game, If you make a mistake or have a terrible day, you actually lose money. Sometimes a lot of it. And if you depend on your trading income for your living expenses, that’s where the real stress comes in. Think about having a losing month and having to dip into your savings to cover all of your bills.

That is why being a trader is so hard.

But…

It is 100% possible to make a living out of trading. Here are a few solutions and tips to really understand these harsh truths and live with them.

Solution – The Faster You Accept the Truth, The Quicker You will Become a Trader.

First of all, make sure that your expectations are realistic. If you have unrealistic expectations, and you are still not willing to accept that it is unrealistic, then you will be stuck in the loop forever.

Therefore you should accept the truth, whether you like it or not.

Here are a few things you should know as a trader and make sure to align your goals in trading around these points.

- Accept that your monthly will be less than 5% and also you will be able to finish every month with profit. Some months are profitable and some months are not.

- You need to be capitalized if want to live with trading. Roughly around $50K to $100K account is sufficient for this.

- Trading is uncomfortable. Because the market is uncertain, you will never know what is going to happen next. There be comfortable with unforgettable.

- You will not be able to trade sitting on the beach. Because trading required laser eye focus to execute trades without breaking any rules. Keep in mind that distractions are our enemy.

- Learning to trade takes time and you will never be a profitable trade by learning a few chart patterns and strategies.

Most traders will never accept these points. They want to learn a few strategies and earn from the day after and will lose their trading account.

This will expand your learning curve as a trader. Therefore be realistic and understand how the market work and how the income flow into your trading account and what you need to go through to become profitable.

If you do this while still accepting the bitter truth, I’m sure you be successful as a trader and being a trader is never going too hard for you.

Related: 11 Bitter Truth About Forex Trading (Reality Check)

7. Jumping from One Trading System to Another Trading System.

No matter from what kind of background you have come into trading, the first thing you will do is that finding a trading strategy or a chart pattern to trade the market. I think I’m right on this, if yes let me know in the comment section.

Since these traders are obsessed with finding that holy grail trading system (which does not exist) they will outlook other aspects like trading psychology, risk management and money management.

In reality, what is important are trading psychology, risk management and money management. They are the 90% of trading and the rest 10% is your trading strategy and yet the vast majority of traders constantly looking for that perfect trading strategy each and every day.

For some traders, one or two losing trades are enough to abandon their current trading strategy to find another trading strategy that is better than the previous one.

This is a pattern lots of traders are stuck in. They are constant loop and often you will that their trading strategy changes every week.

So, if you’re not sticking to one trading strategy and not building your confidence on that one trading strategy, there is no doubt that being a trader will be so hard for you.

So what is the solutions for this looping behaviour? Let’s talk about this.

Solution – Stop Chasing Trading Systems

There is no such thing called a perfect trading system. Therefore stop looking for that. It will only waste your time.

Then understand that every trading strategy is suffering from losers whether you have a trading strategy with a 99% win rate, you still have a 1% of chance to lose trades.

And in reality, most of the strategies that successful traders use are correct only 40% of the time.

Therefore rather than jumping from one trading strategy to another one, focus on backtesting a trading strategy that suits your personality and build your confidence in that trading strategy and gradually improve it to a killer trading strategy that allows you to consistently grow your trading account.

This is 100% better than finding a new trading strategy.

Why…

Because you will ins and outs of your trading strategy. You can master things like when and when not to take a trade, applying risk for different types of trade setups and most important this will build unwavering confidence in your trading strategy so that you can overcome any adverse condition that the market throws at you.

Therefore stop chasing that perfect trading strategy and of course make sure to give full attention to things like risk management, money management most importantly trading psychology.

Related: Reversal Trading Strategy – 5 Step Process to Identify Trend Reversals

Okay, that is it. These are 7 things why being a trader is so hard.

Now it is your chance. Let me know in the comment section if you’re susceptible to any of these points we talked about so far. I hope that together we can overcome these and become better traders.

If got something valuable out of this article, show your love by sharing this article with your friends. Remember that sharing is caring.

Related Reading: Is Forex Worth It – How to Find More Balance in Your Life as a Trader – (10 Simple Ways)