Introduction

Losing a trade in forex is painful, right? And it even painful to watching a losing trade turn deeper and deeper until it hit our stop loss.

The reality is, in forex trading, we can’t avoid losing trades and they are part of the trading. This is why forex risk management is important.

But what if I told you that there is a way to reduce your trading losses in forex trading which helps you to achieve a smoothed rising equity curve over time.

Yeah! we called this trading technique as The Art of Cutting Losses Short and think of it as one trading technique that falls under the forex risk management.

If you trade forex for a while, then you probably come across with the old saying – “Cut your Losses and Let Your Winner Run”.

Today in this blog post we are going to learn how to cut your losses short, So then you can have small losses followed by big winners which eventually lead to consistence growth of your trading account.

So, how we are going to reduce our trading losses?

In here we are not going to talk about placing a stop loss order or calculate position size. This is not the purpose of this article.

Rather we are going to learn about an active stop loss management technique that will help to reduce the amount to the money you’re going to lose in any particular trades.

An Active Stop-loss Management Technique. What is it?

Let’s think about that you are in a long trade and stop loss of this trade is 50PIPs. After some times the price starts falling and your trade keeps on losing. Now what?

1. Are you wait until your stop loss gets hit?

Or

2. Are you going to close your trade early so that you can cut your losses short?

Which one is the better option?

If you choose the first one You get a full loss (-1R), and if you choose the second option you get a small loss, not only that, by choosing the second option you can easily recover your losses later.

When considering the above two factors, It’s clear that the second option is the best and has the most benefits.

But How we know Exactly when to cut our trading losses short? This is where price actions and market structures come into play.

But first, Let’s get a brief Idea about Risk management in forex and the Importance of Risk Management in trading.

What is Forex Risk Management & Why it is Important?

Forex risk management involves difference trading actions that let forex traders protect their trading account from losing trades.

Risk per trade varies from a trader to trader. Which mean some forex traders can risk more than 2% per trade, while some of the traders are risking less than 1% per trade.

However, Risking more means higher change of sizeable returns – but also a greater chance of significant loss as well. Therefore, being able to reduce trading losses, while increasing potential gains, is a crucial skill for any forex trader to have.

As forex traders, how to apply forex risk management to our trading?

Forex risk management can include establishing the correct position size, placing your stop loss at the right place, and control your emotional ups and downs when trading and finally close your losing trades early.

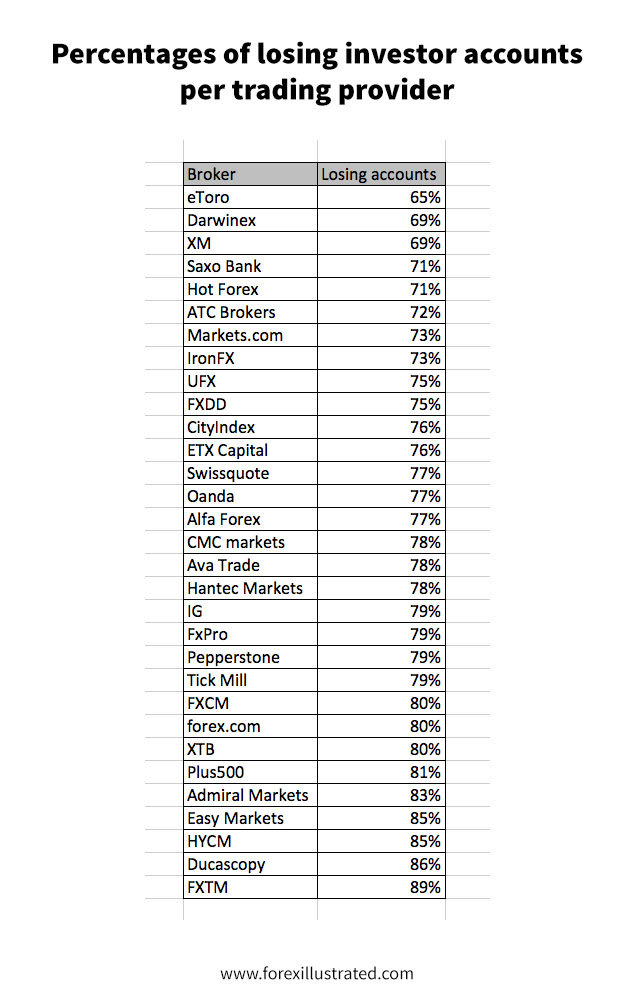

Now let’s see why forex risk management is very important. Have a look at the table below – which describe the percentage of losing investors account by different brokers.

According to the table above, 89% of the retails trader’s accounts are lost. Which mean 10% of retails traders manage to stay in the game.

What is the gap between these two traders? is it their trading strategy or their emotions or else how they manage their risk in the forex market.

One of the major components that separates these two groups traders is the forex risk management.

As you saw true chances of being a forex trader is less, but if you can implement a good risk management plan in forex trading you can easily achieve your trading target.

With that mind let’s dive in what we are here to learn.

For the sake of this article, let’s assume that you have a proven trading strategy – it can be a price action trading strategy, a reversal trading strategy or a trend trading strategy.

Also assume that before you placing trades, you calculate correct position size and placed trades.

After placing the trade, you have two outcomes. A profit or a loss. But there is one thing that you can control. It is your risk.

Rather than waiting for your stop loss get hit, It is better to cut your losses when you know that the trade is not going to work in your favour.

Okay, let’s take a real forex chart and see how to cut our trading losses early.

The Art of Cutting Losses In forex Trading

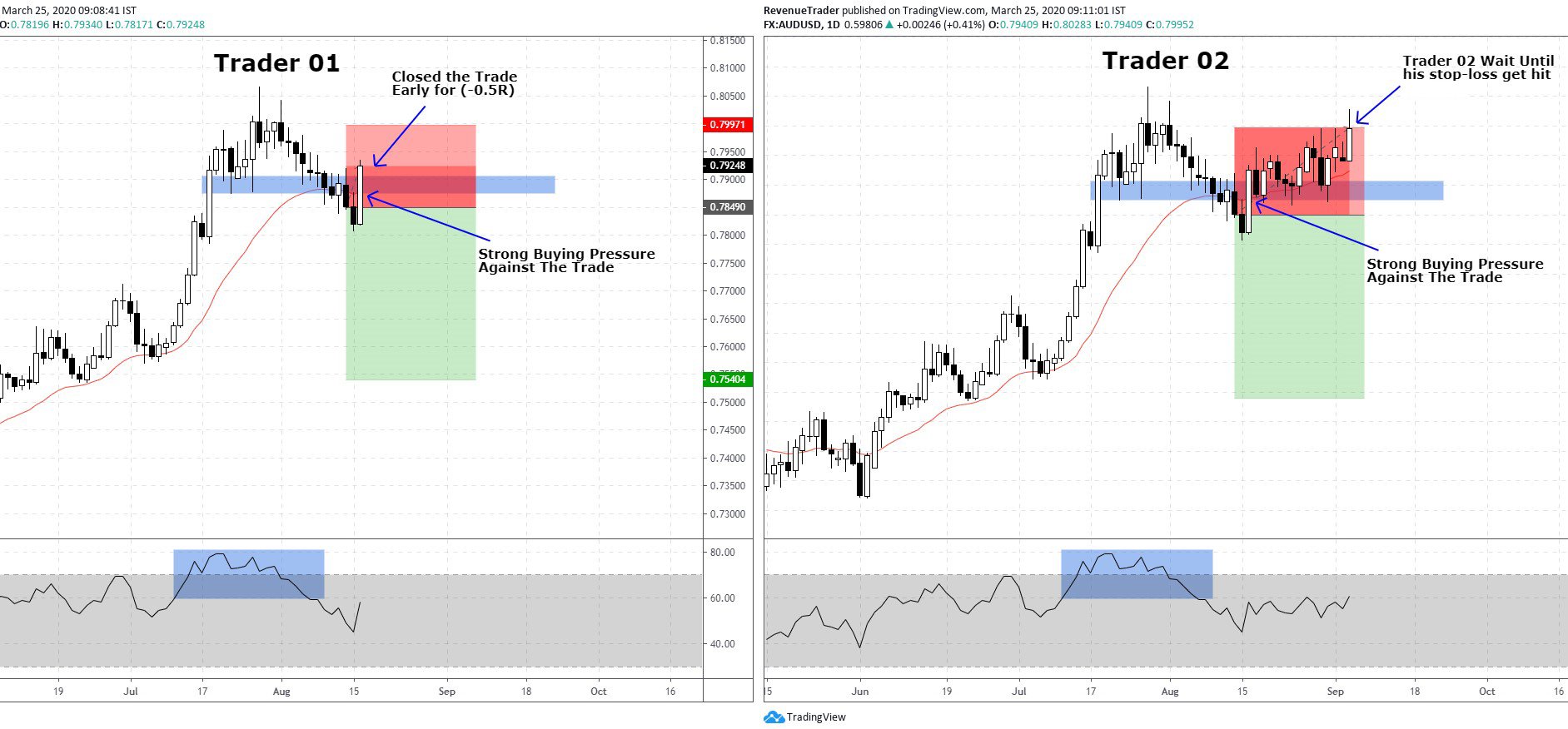

Have a look at the two trading charts below. Both trader 01 and trader 02 have the same trading strategy.

On the left chart, trader 01 enter the short trade as price broke below the blue zone and the trader 02 on the right side did the same as well. Both of these traders did the same thing from analysing to entering the trade.

But there is one thing that these two traders did differently. It is how they cut their losses.

On the left chart, trader 01 closed his position as soon as he saw the buying pressure that builds on this pair. Therefore trader 01 able to cut his losses half.

However, trader 02 wait until his stop loss gets hits and he eventually ended up with a full loss.

Let’s assume that both traders use the same risk of 2% per trade and according to that trader 01 only loss -1% of his trading account while the trader 2 is losing the whole -2% of his forex trading account.

See if you act like trader 01, then you can minimize your trading losses easily and not only that, by minimizing your losses it is easier to bounce back from your trading losses as well.

Next, have a look at the GBPCAD trade I executed in last week.

I short this pair as price broke below the local structure level (blue zone marked in the chart). But after that, I saw that price is struggling to go down which mean that there are some buyers are willing to place their buy orders, right?

So, if that happened, what to do? the best option is to reduce your risk or in another word Cut your losses Short.

According to the chart above, you can see that I closed my position for half loss.

See being able to identify small market changes using price actions & other market clues can help you determine when to cut your loss.

Now have a look at the chart below,

Just like the previous example, we placed a buy order as price broke above the local structure level (blue zone marked in the chart).

Now have a look at the blue horizontal lines marked in the chart. These are called market structure levels and normally when price approaches these levels market tends to bounce back from these levels.

Therefore cutting our losses when price approaches these structure level is an effective way to reduce your losses.

According to the chart above, you can see that, we moved our stop loss order in between entry and initial stop loss after price hit the first structure level (First blue horizontal line marked in the chart). That way we can cut our trade loss if price bounce from that level.

And finally, we moved our stop loss order to breakeven as price action hits the second structure level. That way we can have a risk-free trade.

As you already understand you only had two outcomes from trade, a win or loss. If it is a win, it is good for your trading account.

But what happens if it is a loss, are you planning to sit in front of the screen until the price hits your stop loss Or are you planning to cut your losses short so that you can minimize your trading losses.

You should go with the second option. As forex traders, our first job is to minimize our trading losses, that way when your trading strategy provides winning trades you can make new equity high consistently.

Now It’s Your Turn

If you are struggling to grow your trading account, then you might consider implementing this trading technique (cut your trading losses) to your trading plan.

Take a few trades you placed, and find out that is there a way to cut losses from those trades you executed. Hopefully, you will find a way to cut your trading losses.

“Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected.” – George Soros

According to George Soros quotes above, The forex market is always changing, the market goes up and down, sometimes the market moves in sideways.

Therefore when you are in a trade, the market can go in favour, Or it can go against you.

What is the best thing to do in a situation like this?

The best thing to do is Control What You Can Control like the Risk Management and cutting your losses.

I hope that this article will help you and if you have any problem feel free to put a comment in the comment section.

Consider following us on Instagram and Facebook.