Japanese candlestick patterns came a long way since it was invented in the 18th century by a trader named Munehisa Homma. Nowadays every forex trader uses candlestick patterns for their trading activities.

When comparing with other trading indicators forex candlestick patterns are far more reliable and accurate if you know how to use them correctly.

In this article, we are going to talk about two main topics, the first one is How to Read Candlestick Patterns and the second one is How to Trade Candlestick Patterns in a Proper Way.

We will go through some of the most important forex candlestick patterns and will explain how to trade those pattern in a profitable way.

First, Let’s see what are those Japanese candlestick patterns are?

What are Candlestick Patterns in Forex Trading?

Japanese candlestick patterns differ from the classical line chart or bar chart. They give more insightful data above price actions and above all, they are very easy to interpret when comparing with other chart types in forex.

Now have a look at the image below.

The sketch above points out all the information a forex candlestick pattern will give you. The two candles in the sketch above are a bullish (left one in green colour) and a bearish (right one in red colour) candle.

Each candle represents four things, Open, Close, Highers price reached and Lowest price.

Open – Open price of the candlestick pattern.

Close – The Price which the candle was closed.

Highest Price – The highest value the price reached in a particular time period.

Lowest Price – The lowest value the price reached in a particular time period.

Note that the bearish candle moves in down and the close price is below the open price. The same thing applies in bullish candlestick can but in oppositely.

Now have a look at the clean naked forex chart vs messy forex with lots of indicators.

Which one do you choose? Clean chart, right?

Okay, now you know what info a single candlestick gives you.

Next, let’s see how to trade candlestick patterns in forex trading with relevant examples.

How to Trade Candlestick Pattern in Forex Trading

A forex candlestick chart provides information about the behaviours of buyers and sellers in visually and easy to interpret way during a particular time period, it can be 1 Hour, 4 Hour or Daily.

Traders use forex candlestick pattern as a confirmation for their trades and that is a great way to improve the odds of a particular trade.

Utilizing forex candlestick patterns to trade price action is very common forex trading technique that uses by a number of forex traders around the globe.

But you can increase the probability of a price action trade by 10X when combining candlestick patterns with additional confirmation like support and resistance zones or chart patterns or with indicators.

A great example of this is the Fakey Candlestick Pattern, which is taught by Nial Fuller in his blog. He has a great article about this pattern click here to check it out.

Forex candlestick patterns are chart formation, which indicates difference behaviours of buyers and sellers. By using these pieces of information we can find higher probability trade setups.

Forex candlestick patterns come as single candlestick patterns, Dual candlestick patterns or triple candlestick patterns.

Now. let’s walk through some of the most profitable and commonly used candlestick pattern. Also, we will take a look at how to trade these candlestick patterns one by one.

Single Candlestick Patterns

Single candlestick patterns consist of one candle which provided information about buyers and sellers. Let’s talk about some of the single candlestick patterns with real chart examples.

Doji Candlestick Pattern

This pattern indicates a Reversal or Indecision in the market.

Doji is very easy to identify. This pattern formed when the close price closes at the exact same level where it has opened. Hence the Doji candlestick pattern appears as a dash with a wick.

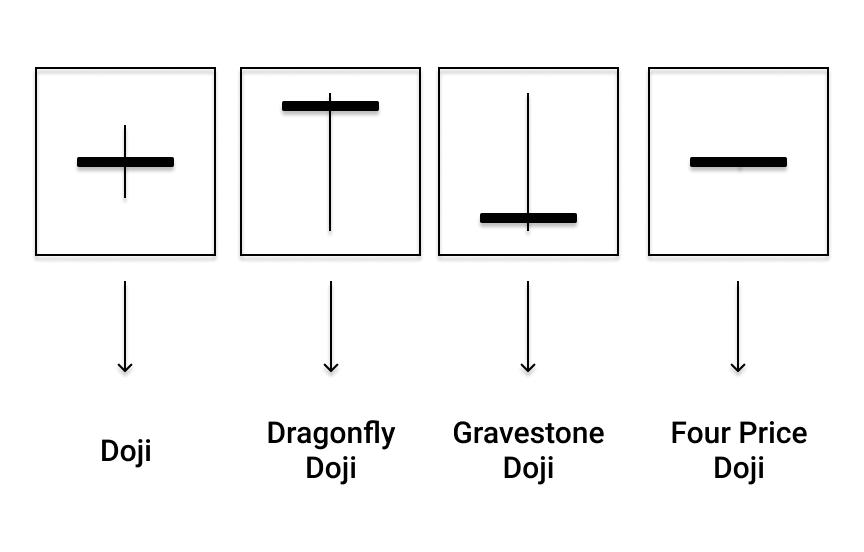

The Doji candlestick pattern also comes with different formations. Have a look at the picture below.

The Doji candlestick pattern indicates a reversal sign when it formed after an extended move. Why is that?

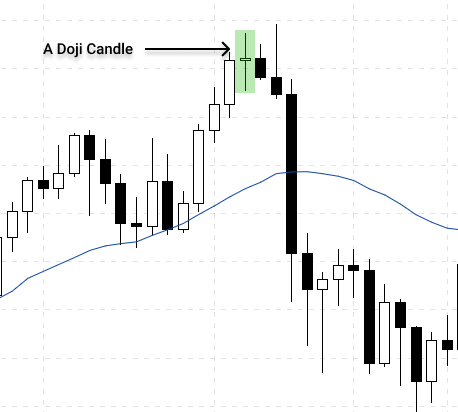

During an extended bullish move (or bearish), the occurrence of the Doji candle indicates the indecision between and buyers and sellers, hence this could result in a market reversal. Now let’s see this in a real forex chart.

According to the above chart snippet, Price strongly moved into the upside which indicates the buying pressure in the market. But after the occurrence of Doji candle, buyers struggle to move price further up, right? that indicate the indecision in the market.

See what happened after that? Price fell like a waterfall, right?

Okay, next we will see how to read Spinning Top pattern in forex trading.

Spinning Tops Candlestick Pattern

This forex candlestick patterns have the undefined characteristic.

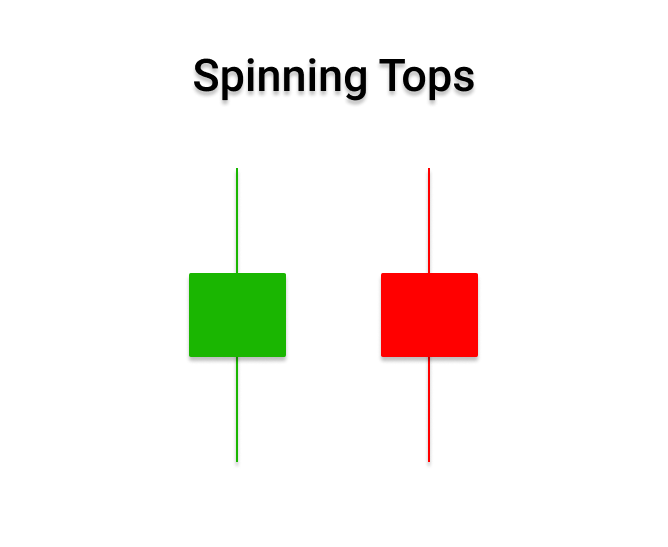

The spinning tops could be bearish or bullish. This looks the same as the Doji candle but instead of the dash in Doji, the spinning top has a very small body and long upper and lower candlewick, which have approximately the same size. Have a look at the picture below.

Spinning top candlestick pattern indicates that buyers and sellers are fighting against each other to dominate the market but in the end, both parties ended up losing.

Nevertheless, if we spot this candlestick pattern in an uptrend or downtrend market we can anticipate a trend reversal.

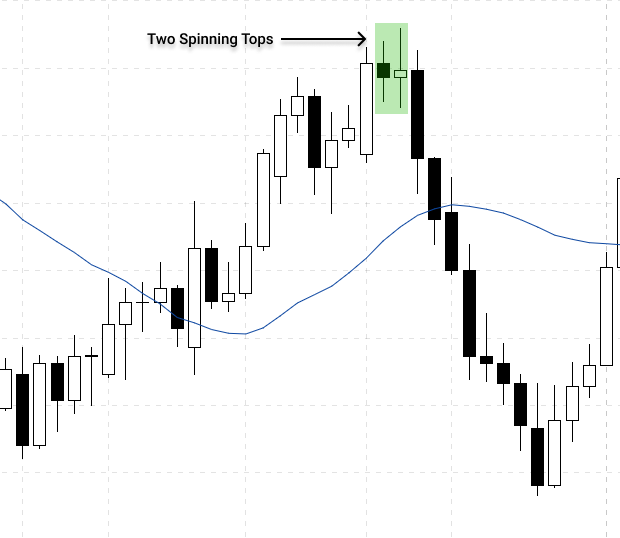

Have a look at the real forex chart below.

Just like the previous example in the Doji, two spinning top candlestick patterns formed after an extended bullish move, That indicates buyers are losing momentum over the market after an extended move. So what happened after that?

Seller stepped into the and drive price all the way. That is very strong bearish momentum, right?

Okay, Let’s talk about one of the most popular single candlestick patterns – A Hammer Candlestick pattern.

Hammer Candlestick Pattern

This forex candlestick pattern indicates the reversal of a bearish trend. This candlestick pattern popular for trading reversals around key support and resistance levels. We will talk about this in detail in the upcoming topic.

The hammer candlestick has a small body, a small upper wick and long lower wick which indicate buying pressure. Have a look at the image below.

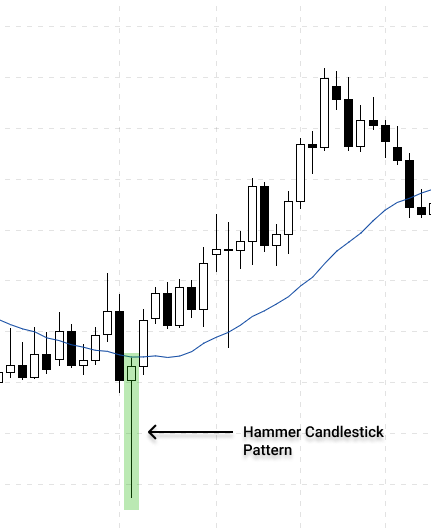

The occurrence of Hammer candlestick during a downtrend indicates reversal signs. Have a look at the forex chart below.

According to the above chart, you can see that a hammer candlestick pattern with a long lower wick, which indicate buying pressure. So what happened to the market after that candle? Buyers stepped in and move price higher, right?

Now let’s talk about the Shooting Start candlestick pattern which is the opposite form of the previous candlestick pattern.

Shooting Star Candlestick Pattern

This is the mirror image of the Hammer candlestick pattern. Instead of a bearish trend reversal, Shooting Start candlestick indicates bullish trend reversals. Have a look at the image below,

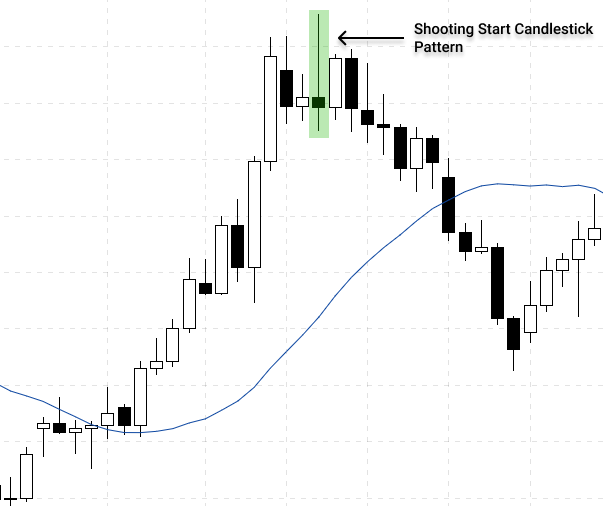

Just like the previous candlestick pattern this pattern also has reversal characteristic but in oppositely. If you find this pattern after a strong uptrend, it usually indicates a reversal. Have a look at the real forex chart below.

As the chart marked above, a shooting star candlestick pattern occurred after a strong uptrend. This indicates buyers are struggling move price higher and as a result of that price start to move down.

Okay, so far we talked about 4 widely-used single candlestick patterns – Doji, Spinning Tops, Hammer and finally Shooting star candlestick pattern.

Next, Let’s talk about forex candlestick patterns that consist of two candles.

Double Candlestick Patterns

Double candlestick pattern consists of two candles, by observing these two candlestick patterns we can come up with higher probability trade ideas. Let’s talk about widely used double candlestick patterns in details.

Bullish and Bearish Engulfing Pattern

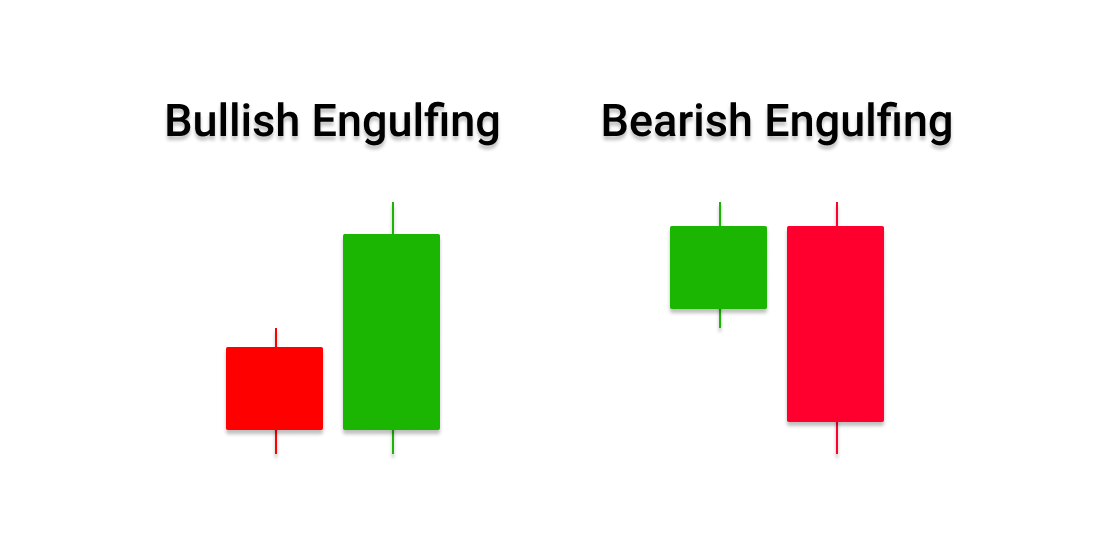

The Bullish engulfing and Bearish engulfing pattern consists of two candles.

In Bullish engulfing candlestick pattern, we get a small bearish candle followed by a bigger bullish candle, usually, in this pattern, the second candle totally engulfs the first bearish candle.

And the bearish engulfing pattern consists of a small bullish candle followed by a bigger bearish candle that is bigger enough to engulf the previous candle. Have a look at the picture below.

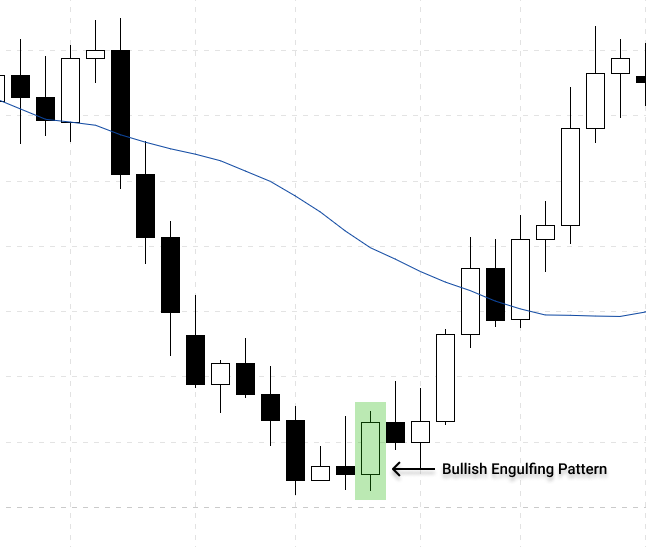

Both Bullish engulfing and Bearish engulfing patterns have reversal characteristic where the bullish engulfing pattern indicate bearish trend reversals while the bearish engulfing pattern indicates bullish trend reversals. Have a look at the real forex chart below,

According to the above chart, you can see that market was in a strong downtrend. But have a look at the bullish engulfing pattern marked in the chart above. What happened after that? Whole fundamental changed and downtrend convert into the whole new uptrend, right?

That is the power behind the engulfing candle.

Okay, let’s move into the last type of forex candlestick formation which is candlestick patterns consists of there candles.

Triple Candlestick Patterns

Just like the word said triple candlestick patterns consist of three candles. Let’s talk about these candlestick patterns in detail.

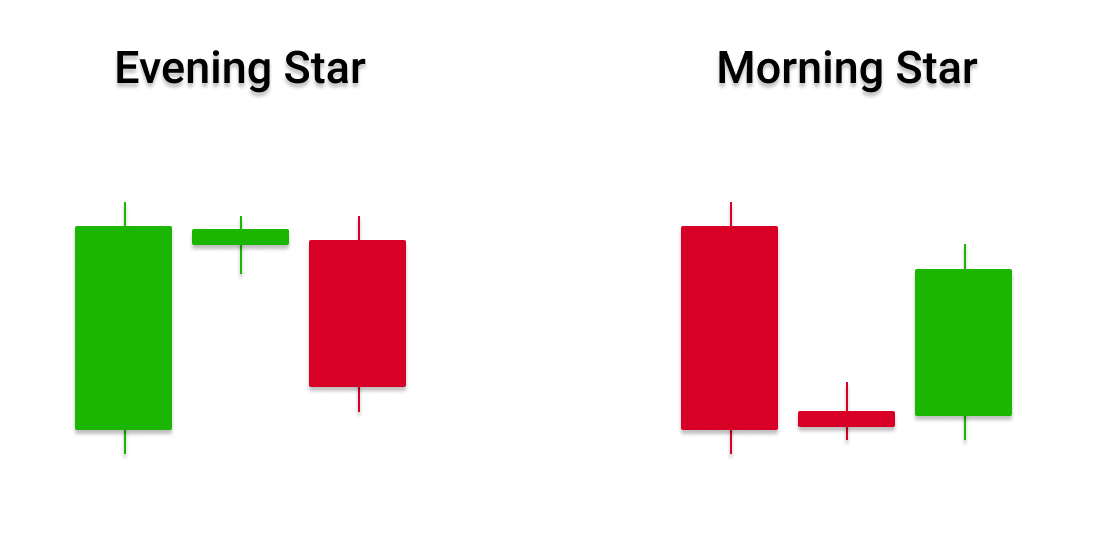

Morning Star and Evening Star

Both of these candlestick patterns have reversal characteristics. The Evening star indicates the reversal of bullish trend while the morning star indicates the reversal of the bearish trends. When using with support and resistance we can get high probability trade setups.

The morning star candlestick pattern consists of a bearish candlestick followed by a small candlestick (identical to Doji candle), followed by a bullish candlestick which larger or equal to the first candlestick.

The evening stat candle is the opposite of the morning star pattern. It starts with a bullish a candle, followed by a small candle (look like Doji), followed by a bearish candle which is bigger than half of the first candle. Have look at the image below.

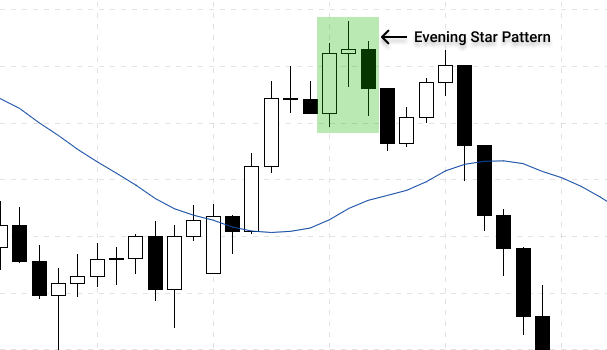

Let’s take a real forex chart to see how this forex candlestick pattern work. Have a look at the chart below.

According to the above chart, you can see that price was in bullish condition until the occurrence of Evening start pattern which indicates a lack of bullish momentum. After that sellers stepped into the market and move the price lower with strong bearish momentum.

The same set of principals work in morning start as well but in oppositely.

Now let’s move into the next forex candlestick pattern which Three Soldiers candlestick pattern.

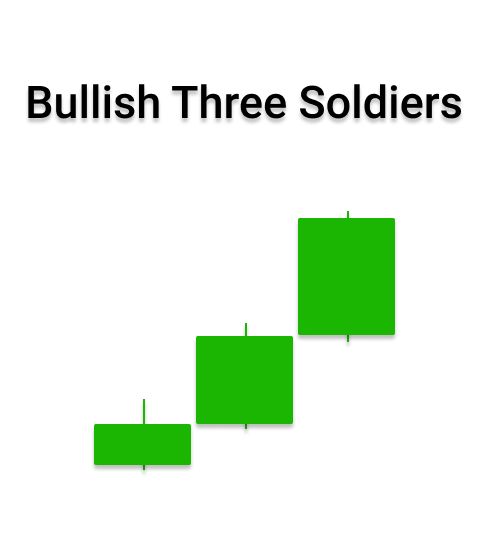

Three Soldiers Candlestick Pattern

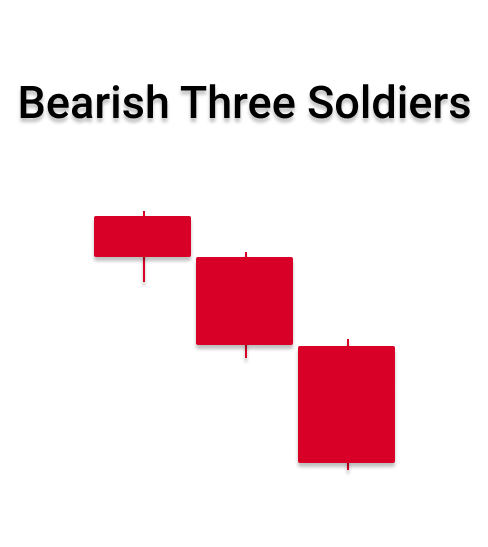

Just like any other candlestick pattern three soldiers pattern also have reversal characteristics and this candlestick pattern comes as bearish and bullish formation.

The three soldiers candlestick pattern consists of three bullish candles in a row. A smaller bullish candle, a bigger bullish candle (which closes near its highest point) followed by another bigger candle bullish which is bigger than the second candle. Have a look at the picture below.

Bearish Three soldiers pattern have the following characteristic,

- A smaller bearish candle

- A bigger bearish candlestick

- An even bigger bearish candlestick.

Have a look at the image below.

Now that we have gone through some of the most profitable and widely used candlestick patterns in forex trading.

But there is a question, Can we trade these pattern whenever they occur? Technically we can. But doing that you will blow your trading account within a few weeks.

Identifying a forex candlestick pattern is just a part of price action trading.

Then how to actually trade these candlestick patterns in forex? The answer to this question is Confluences.

Now, what are the confluences? Confluences trading factor that supports our trading idea like support and resistance, supply and demands, breakouts and Fibonacci levels.

Let’s see how to trade candlestick patterns in forex trading with relevance trade examples.

How to Trade Candlestick Pattern in Forex

We can get higher profitable trade setups if we can combine candlestick patterns with other trading confluences.

What do I mean by that?

Let’s take a support level for an example. We already know that there is a higher chance of price bounce from this level, right?

What if we get a Hammer candlestick pattern (bullish pin bar) right at this support. This improves our odd, right? This is what we need to maintain in order to extract consistence profit from forex trading.

Okay, let’s see how this work using trade examples.

Trade Example One – Bearish Engulfing Candle at Resistance

Have a look at the chart above, first, you can see that price respect to the blue zone as a support and a resistance in multiple times which indicate this level is very strong.

Where is the price right now? At the resistance level. So this means we need looking for short, right?

Have a look at the Box 01 marked in the chart above, what you see there? Lots of Doji candles with a shooting star candle(observe box 1).

These candlestick patterns indicate the indecision at the resistance level and the shooting start in the resistance level indicate the selling pressure that builds on this resistance level.

And eventually, we got a bearish engulfing pattern (have a look at the chart) which indicate the real aggression of the sellers. So now there are lot trading confluences aligned in our favour, right?

Okay now have a look at the final result of this forex price action trade.

Next, let’s talk about one more trade example before wrapping this article.

Trade Example Two – Evening Start Candlestick Pattern at Weekly Resistance

According to the above chart, you can see that the market was in a downtrend until the price hit support level comes from the weekly chart. After that price struggle break below the weekly support level and as a result of that price ended up forming an inverted head and shoulder pattern which indicate the market reversal.

Now have a look at the circle marked in the chart above. What happened there? Price broke above the neckline, right? This even confirms the reversal.

After the breakout price retraces back the neckline and retests it with a strong bullish engulfing candle. Just like the previous trade, all the trading confluences are aligned nicely. Now we have a higher probability trade setup, now it is a matter of executing a trade, right?

Have a look at the final result of the trade below.

Nice profit, right?

What is the secret behind these two trade?

The reason why these two trade resulted in profit is that both of these two trade executed at the high probability trade area and we also combine the candlestick patterns with other trading factors which improve the trade odds.

What happened if we trade every candlestick pattern that occurs. We probably ended up having lots of losing trade, right?

So keep in mind that Quality over Quantity.

A quality candlestick trade with proper risk management and money management techniques can make you consistence profit months after months if you can manage you emotional ups and the down.

So what is your favourite forex candlestick pattern? Let me know in the comments section.

Do me a one last favour by following us in social media – Facebook and Instagram.

One Response

With having those confluences and quality, even what percentages of chances that trade will go favor????