We’ve been focusing closely on AUDNZD and NZDUSD over the last week. Among these two trade ideas, we are still keeping eyes on AUDNZD for the upcoming week as well. This trade idea became little complicated as the price started to consolidate at the level of the daily structure. We will be talking about this trade idea in today analysis.

Till then let’s talk about NZDUSD trade that we observed last week. We were expecting a reversal after a break below of local structure level, But before price break below the local structure level, it moves even higher, proving that buyers still have some influence over the market, But not so long and eventually price ended up breaking below the local structure level, all the way down to the target level that we predicted.

Have look at that trade below.

Enough of the past and let’s takes AUDNZD and CADJPY to see how we are going to trade these pairs in the week ahead.

Disclaimer: Trade Revenue Pro’s view on the Forex Charts is not advice or a recommendation to trade or invest, it is only for educational purposes. Don’t Blindly Buy or Sell any Asset, Do your own analysis and be Aware of the Risk.

Keep in mind, These are Just Market Predictions and not a Trade Signal or Trade Ideas, At Trade Revenue Pro We are Using Daily Time Frame to Identify Major Price Movements and Push Down 4-Hour Time Frame to Get Favourable Risk to Reward For Our Trades, Furthermore, We are Using Tight Risk Management Method to Preserve Our Trading capital.

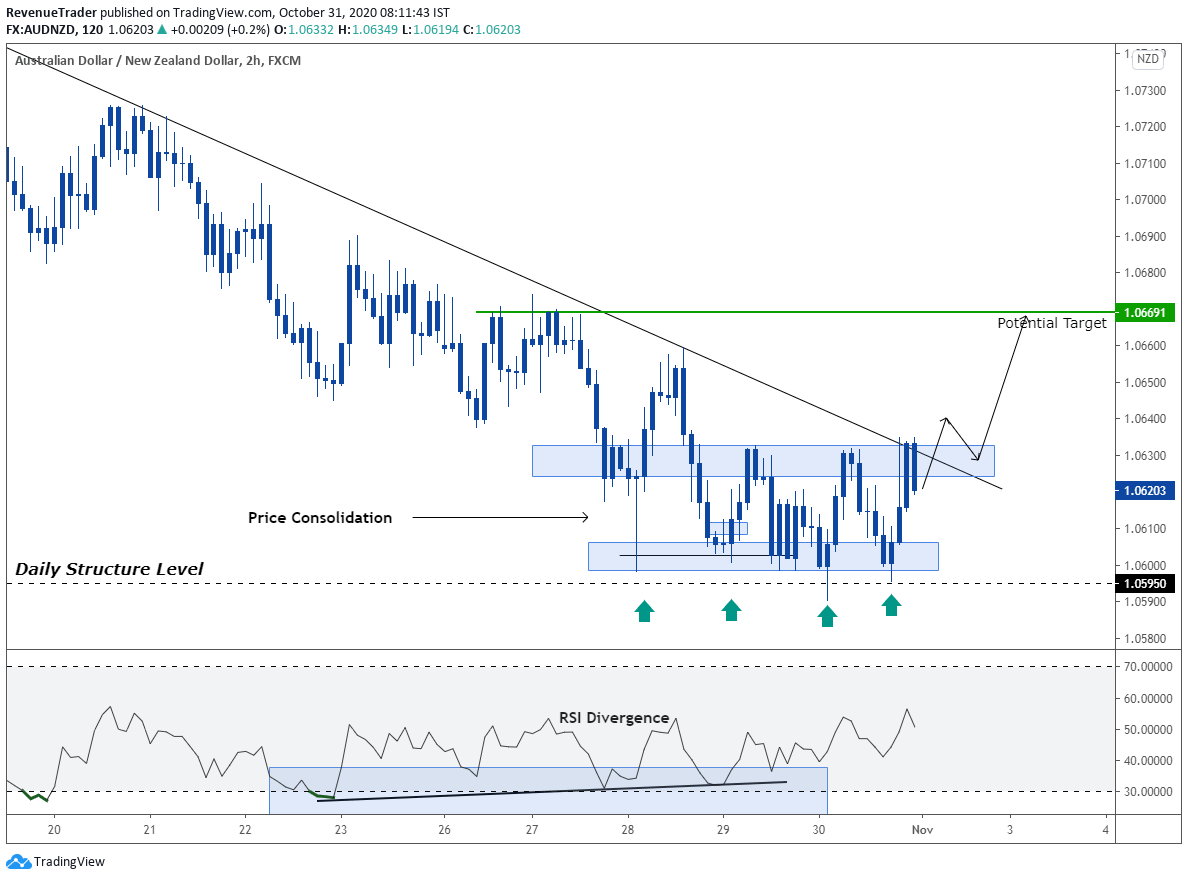

AUDNZD – Price Start to Consolidate Around Daily Structure Level

Key Level – We’ve been watching this pair since last week. Hence the key level we are looking remain same and this is a level which comes from the daily and if you switch back daily chart, you will see the price tested and respect this level in multiple occasion.

Trend Structure – As the above chart has shown, from a technical point of view, we can see that AUDNZD is still in a downtrend. But as price approached the daily structure level seller are struggling to keep on moving further down. This is a strong indication that telling there is an aspect of buying pressure around this level of structure.

Range Market – Another thing we can observe at the daily structure level is that as price approach to this level it starts to consolidate which indicate there are equal buying and selling pressure.

Trendline – Breakout, this is what we’re waiting for as reversal traders. If the price breaks above the trend line, it is a simple indication that the on-going downtrend is invalidated.

RSI Divergence – RSI also showed Divergence at the daily structure level. This indicates the lack of selling pressure at support level marked in the chart.

Market Forecast – Right now AUDNZD is ranging conditions which indicate a lack of selling pressure and as long as the price keeps on trading below the trendline we have to accept that the market is still in a downtrend. But when we consider the market confluences we talked above, it is clear that the selling pressure is slowly slipping away. But the question is how can we confirm whether or not the selling pressure is over. That’s why we’re keeping our eyes wide open on the trend line and the local structure level to breakout to the upside. If that happened, there is a higher chance of changing whole trend structure.

Trade Idea – If price break above the local structure level and trendline, we will look for a retest of the structure level to enter the trade by placing 1.06691 as take profit.

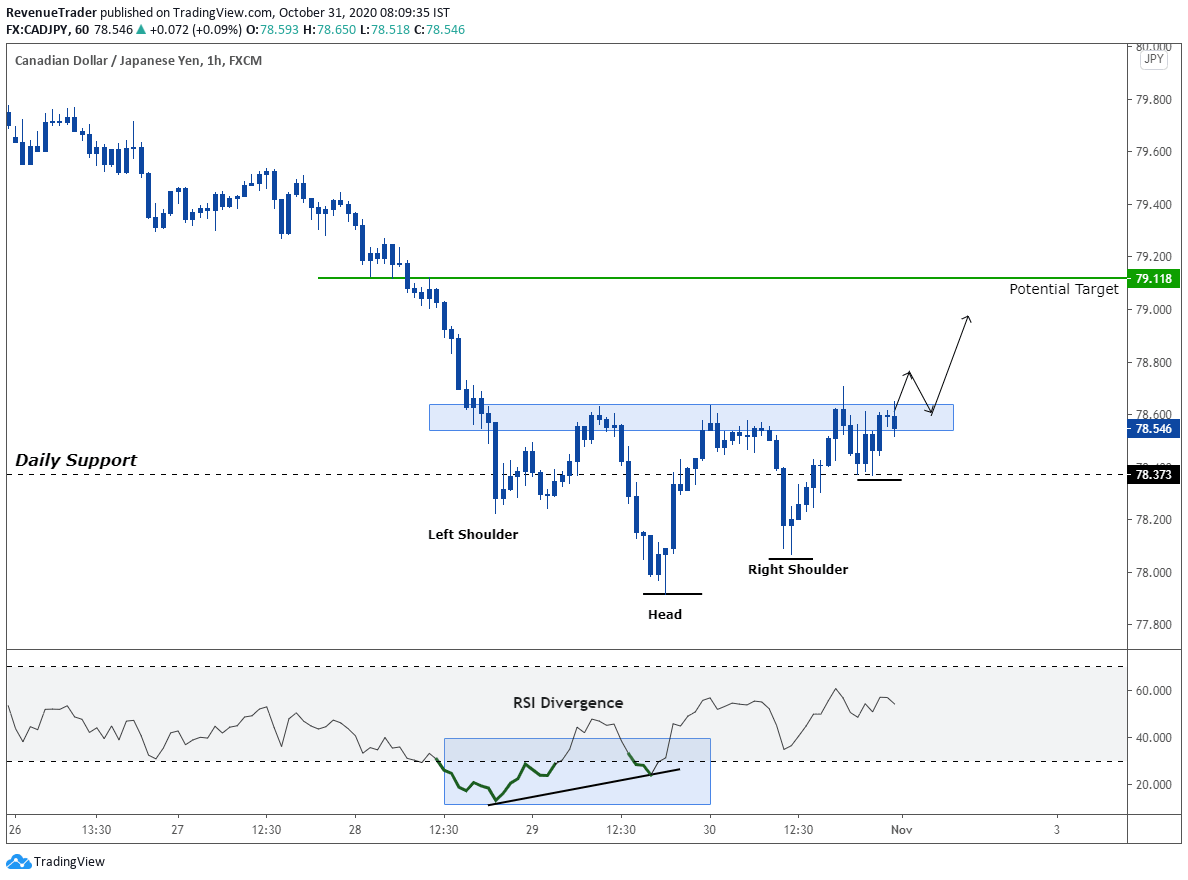

CADJPY – An Inverted Head and Shoulders Pattern at Daily Support

Key Level – As seen in the above chart, the price is traded at a support level of 78,373, which comes from the daily chart. Looking at the chart, we can see that this level acts as support and resistance in the past. This makes this level a higher probability area for trading.

Inverted Head and Shoulders pattern – An inverted head and shoulder pattern at the daily support level indicate the weaknesses of the on-going downtrend. If we looked at this pattern in buyers and sellers perspective, It is clearly indicating that sellers are losing momentum while buyers are slowly building the bullish momentum around the 78.373 daily support level.

RSI Divergence – RSI divergence is also indicating the lack of selling pressure around the daily support level. This is an additional confluence for our trade idea.

Market Forecast – Right now the inverted head and shoulders pattern is completed. Now it is one or two candles away from breaking above the local structure level marked in the chart. When considering other trading confluences we have to accept the fact that there is a higher probability chance of breakout to the upside. If that happens, whole fundamentals here are going to change.

Trade Idea – If breakout to the upside of the local structure level happened, we will consider going long after price retest the local structure targeting 79.118 as take profit.

Head over to our Trading Blog to learn more about how to trade forex with Proven Trading Techniques and Strategies.

Want more Trade Ideas – Head over to Trade Idea Page.

That is all for this week and If you want constant trade updates – consider following us on Tradingview.

Also, consider following us on social media and Pinterest, Instagram and Facebook.