There are numerous ways to trade in the forex market. some use technical analysis, fundamental analysis while novice traders trade base on their gut feeling and losing their money.

No matter what method of analysis you used, to be a consistence profitable forex trader you need to have a solid trading strategy that works for you and above all, you have to stick with it.

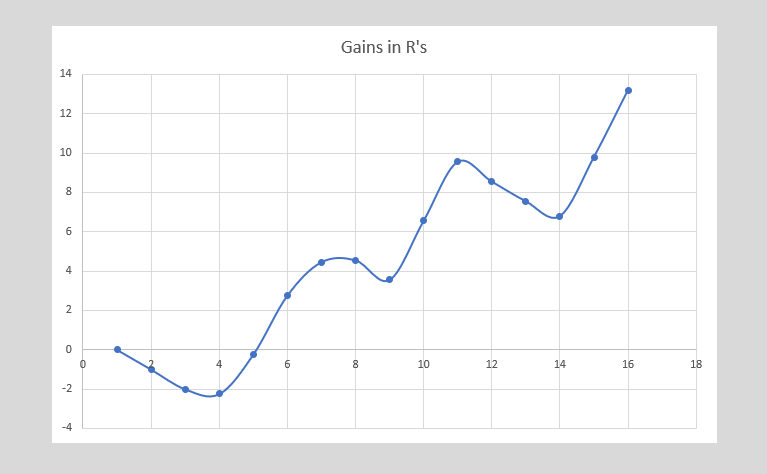

This post will cover how to used price action trading strategy on the daily chart on any currency pair. Most importantly we are going to talk about my favourite trade entry technique that will always help me get favourable reward to risk ratio and consistency profits. Have a look at my trading equity curve for 2020 so far.

Do you want results like this? Then stay with me till the end.

First two month of 2020 was a great month for Trade Revenue Pro. All the price action trades we executed works in our favour and we were able to create new equity highs every week during the period last two month.

We took four trades that we executed so far as the evidence to show you how we use price action trading strategy and retracement trade entry technique to maximize our trading gains.

First of all, we have to find which time frame is suitable for this trading strategy and trade entry technique.

Trade Only on the Daily Chart.

Why? because I only backtested in the daily chart. Even when trading live account on the daily chart this price action trading strategy provides me great results over and over.

Not only that there are a lot of benefits comes along with the daily chart.

- Daily chart provides more reliable price action trade setups.

- You can earn more by trading less on the daily chart.

- The daily chart helps you to prevent over-trading.

- Risk and Leverage can be reduced if you choose to trade on the daily chart.

- Daily chart reduces noises from the smaller timeframe.

- The daily timeframe provides quality swing trading opportunities.

and there are more.

Read this post about how to effectively trade daily chart in forex to learn how to execute profitable trades in the daily chart.

Okay, enough nonsense. Let dive into first trade example.

EURAUD Long Trade – Bullish Engulfing Trade Entry Technique

This trade helps us to gain a profit little over 3R. And the best thing is we didn’t use any indicators or any complex trading system and this trade based on pure price action.

All we used is simple price action and basic technical analysis methods only. Let’s see how we execute this EURAUD long trade step by step.

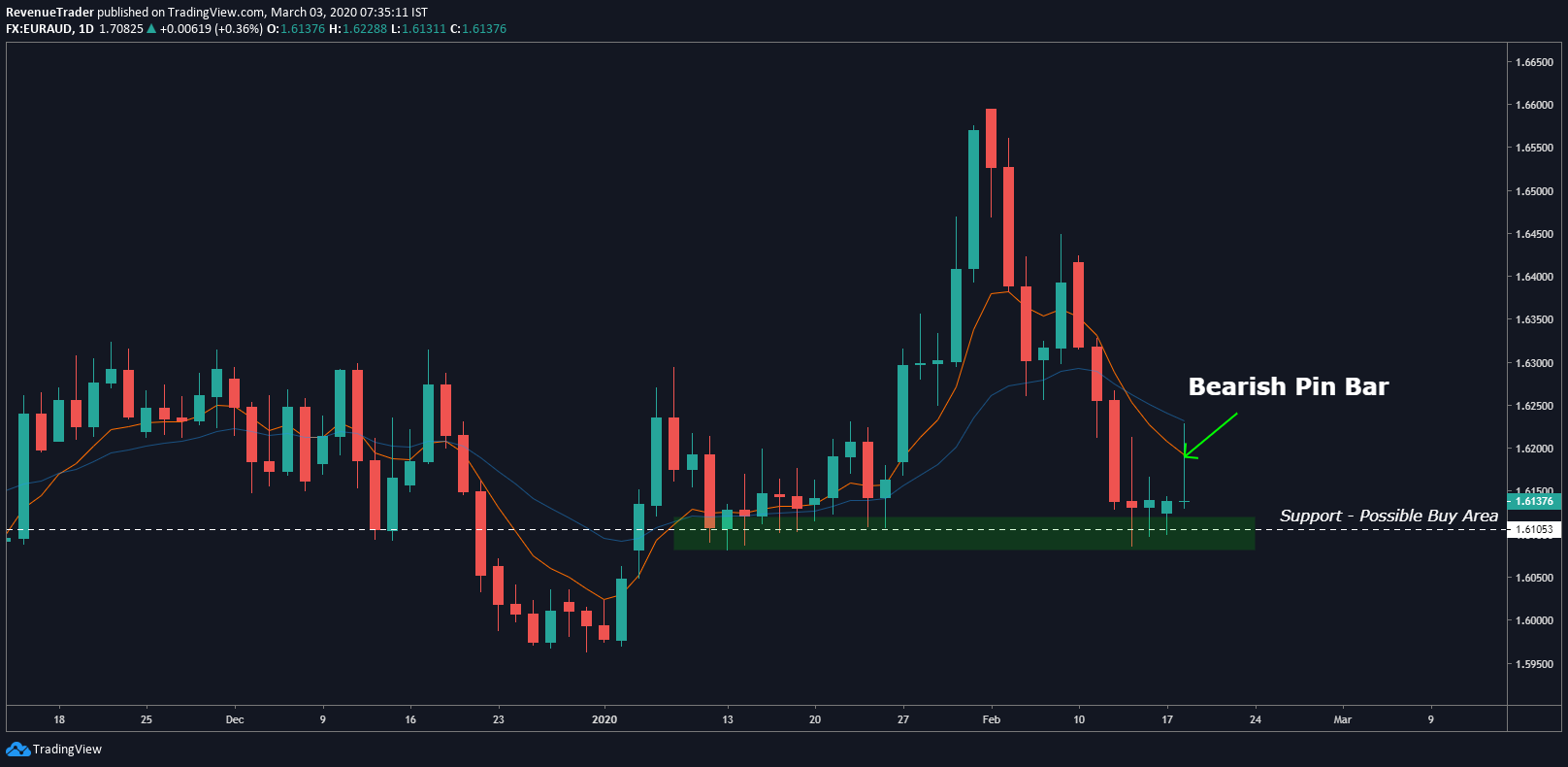

In the above chart, you can clearly see that price is stalling at the support at the moment which means we are looking to buy. Right. But it still too early to pull the trigger and we have wait for more buying pressure.

Right now we have one clue, three Doji candles which indicate indecision between buyers and seller at the support (look at the chart above). let’s move forward and see what will happen.

Have a look at the bearish pin bar in the above chart. What is that mean?

It means that buyers tried to push the price higher but they ended up failing. That is a red sign for our trade idea. Let’s see what going to happen in the next upcoming days.

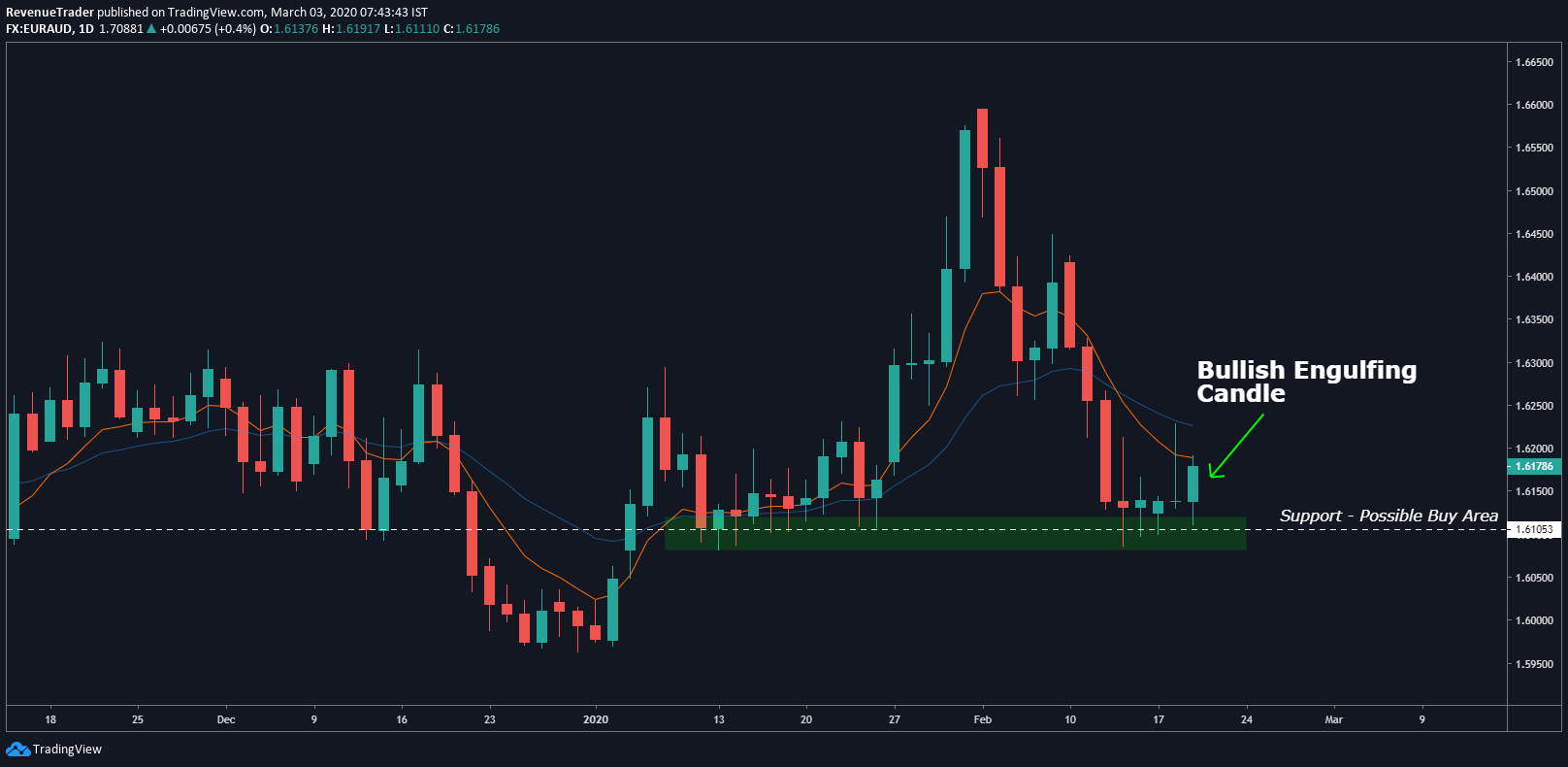

On the very next day, we were able to see a bullish engulfing candle at the support level (look at the above chart) which indicates buying pressure at the support level and not only that, the bearish pin bar pattern said earlier now becomes a failed-pin bar pattern because of the bullish engulfing pattern at the support level.

Now all set. Let’s see how to time our entry.

For this trade, I use the engulfing bar trade entry technique which is very simple yet a powerful price action trade entry technique. Let’s see how it works.

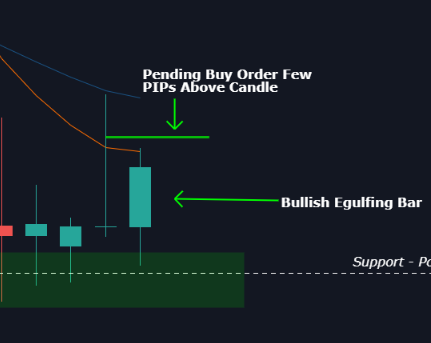

Have a look at the EURAUD daily chart above. Can you understand the trade entry technique we used here?

It is a very simple trade entry technique that helps us to time our trade very effectively.

First, you have to wait for candle close. This very important. Then place limit order few PIPs above the candle. Have a look at the example below.

Finally, place a stop loss below the engulfing bar and take profit at the recent structure level.

Here is the final result.

As you guys saw, rather than using complex trading strategies It is better to stick a simple trading strategy like the one we used here price action trading for more consistency profits.

Next, Let’s talk about EURJPY Short trade.

EURJPY short trade- Bearish Engulfing trade entry technique

Just like the Previous trade, we were able to gain another 3R from EURJPY.

We used the same price action trade entry technique but in oppositely.

Have a look at the EURJPY daily chart below.

At glance, we can see that price is located in daily resistance zone along with the ascending channel top where we can expect a price reversal.

Also, we can see that the candles are getting smaller and smaller when they come closer to the resistance zone. This is the first reversal clue off the resistance zone but we need more clues off this resistance level before deciding to go short.

Next, have a look at the chart below.

On the very next day, occur of bearish engulfing candle indicate the selling momentum off the resistance zone. Now we got enough confluence to go short on EURJPY.

To understand how we applied the trade entry technique in this, look at the daily chart below.

Just like the previous trade, we use the same trade entry technique by placing the sell limit order few pips below the bearish engulfing candle and we placed stop loss above the engulfing candle and for take profits, we used the nearest market structure level.

Here is the final result.

So far we talk about how to use a bearish engulfing candle as an entry technique.

Let’s move into the last two trade examples.

In these last trade examples, we use different trade entry technique called retracement entry technique.

Why use retracement trade entry technique?

Sometimes we have to face with trade opportunities when we were unable to maintain favourable reward to risk ratio. When those type of scenarios arises, we used retracement trade entry techniques to get favourable reward to risk ratio for our trades.

Okay, let’s see how it work in real trading charts.

GBPJPY Short – Retracement Entry Technique

Again this is another trade opportunity that helps us create new equity high in our trading equity curve by using a slightly different trade entry technique comparing to the previous price action trades.

Have look at the GBPJPY daily chart below.

At glance, we can see that price is bouncing between support and resistance zones (blue zones) which mean we going trade in ranging market condition.

To get profitable trades in the ranging market we have to focus on trading only on range top and range bottom. That is what exactly we are to do here.

According to the GBPJPY daily chart above, Currently, price is at the range top which is a good area to trade. Now it is time to wait for more confluences.

Have a look at the next chart below.

Big bearish engulfing candle off the resistance level, that is interesting right.

But there is a problem. any guesses?

Price is too far away from the resistance zone which makes it difficult to get favourable reward to risk ratio.

This is where the retracement trade entry technique come in to play.

Have look at the chart below which describe the retracement trade entry technique.

As the above chart describes, we place a pending order 40% to 50% above after closing bearish engulfing candle which helps us get favourable reward to risk ratio for our trade.

And finally, as we expect price did retrace back and filled our entry order before it continuously going downward.

Here is the final result of the GBPJPY price action trade.

As you guys saw, we were able to book +3R in this tight range with the help of retracement trade entry technique.

before wrapping this article about price action trading strategy, Let’s observe another trade example taken by the help of retracement trade entry technique.

USDCHF short trade – retracement trade entry technique

Have a look at the USDCHF daily chart below,

Once again price is holding resistance level which acts as support in the previous.

As soon as price hit the resistance level market start to move down. As a result of that market ended up opening a big bearish engulfing candle and closing it too far away from the resistance zone.

So, again we have to use the retracement trade entry technique. otherwise, we were unable to get favourable reward to risk ratio for USDCHF short trade. Have a look at the chart below.

Just like the previous example, price did retrace back and filled our sell limit order which helps us to gain to massive +3.41R gain on this single trade.

Have a look at the chart below to check how this trade played out.

As you guys saw, all the trade examples we talked above was taken based on the price action trading strategy. we didn’t use any magic trading indicator or any complex trading system to get this trading results.

All we used is simple price action analysis and some form of support and resistance as technical analysis tools and based on that analysis we used corresponding trade entry technique to get a favourable risk to reward ratio.

The point here is – Keep Your Trading Simple.

There is No Such Thing Called Holy grail.

Why a lot of new forex traders fail to make money from forex market?

The number one reason is that they are chasing perfection and they are constantly looking for 100% winning trading strategy or system or in another word, they are looking for a holy grail trading system that helps them to get rich overnight.

But the truth is, every trading strategy is suffering from losses as the market conditions change whether it is price action trading strategy that we talked above or any other trading strategy.

So rather than wasting your time on finding holy grail trading strategy, invest your time in one good trading strategy like price action trading strategy and focus on mastering that trading strategy.

Final Word

in this article, we talked about two price action entry techniques that help us get favourable reward to risk ratio for our trades.

These entry techniques can be used in any currency pair in the daily timeframe but if you planning to implement these techniques to your trade plan,

- First, learn more about price actions from basic. click here.

- Then. backtest these trade techniques in your own to check whether this price action trading strategy work or not.

- Then implement this trading technique to your trade plan.

Just like this don’t follow any trading strategy you find from internet blindly. Do your research and be aware of the risk.

Finally, if you have any question feel free to comment in the comment section.

5 Responses

I would love to learn more about this strategy, its awesome and great for making profits compared to what I have seen on the internet.

Glad you found it helpful. Yeah, Price action trading strategy is one of core trading strategies we’ve used here and I will make sure to write more articles related price action trading.

God bless u I was researching websites to improve my price action strategy (i am a novice on trading ) and i think i am in the right place. I found the content very helpful. thanks so much.

Very helpful website. other sites would charge u more than 1000$ for the same

Glad you found our website helpful.