Let’s get to the point. After a few years of trading, many traders are not achieving what they expected, and for many of them, trading has become a maze with a large wall where they don’t know what to do or where to go. In essence, these traders are entrapped.

In this post, I’ll reveal 11 bitter truths about forex trading that everyone is keeping from you. This is not intended to discourage beginner traders, but rather to educate them on the realities of the market.

Once you understand these concepts, you will have a better understanding of how Forex trading works. You’ll have more realistic expectations and a clearer understanding.

Here is what we are going to talk about…

- Random Outcome, Consistent Result

- You Don’t Need To Know What Is Going To Happen Next To Make Money

- A Trading Edge Is Not About Win Rate Or Your Entry and Exits

- History Repeat Itself But, Every Moment In The Market Is Unique

- Anything Can Happen Anytime

- You Need Money To Make Money

- Trade When There Is Volatility In Place

- Learning To Trade Takes Time

- Trading System Won’t Make You A Profitable Trader

- Your Mindset Is Much More Important Than Your Trading System

- Detaching Yourself From Single Outcomes Can Help You Become A More Profitable

1. Random Outcome, Consistent Result

This is the only truth you need to get yourself out of that big wall maze. Read through two bold passages below.

A consistent, non-random outcome produce consistent results. And…

A random outcome produces random, inconsistent results.

This is how we were trained to think. But when to comes to trading where every possible outcome is totally random this become the opposite as we used to think.

In trading, it is all about Random Outcome But Consistent Results.

As an example think about a casino. They make money consistently even the gambling produce random outcome every day, right?

The same applies to trading as well. Trading also produces random outcomes for each trades. That is because we don’t have control over the market. As traders, all we do is execute our trading plan.

How do you get to this level of consistency where random outcome won’t mess with your trading?

It’s all comes down to the risk-reward ratio, expectancy, sample size and the odds in your favour.

Basically, what I need you to grasp is that: even those that have probable outcomes can produce consistent results if you can get the odds in your favour and there is a large enough sample size.

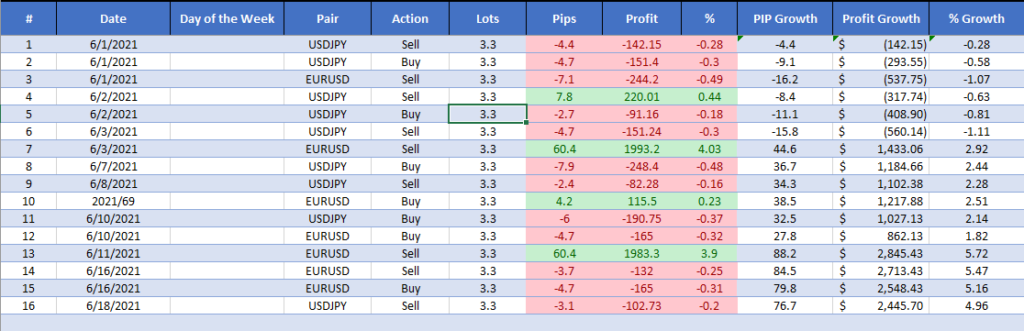

To clarify more about this have a look at the trades I took in the last month.

At a glance, you can see that there are lots of losing trades and few winning trades according to the above trade data. Or in another word, we can say that these results are totally randomized.

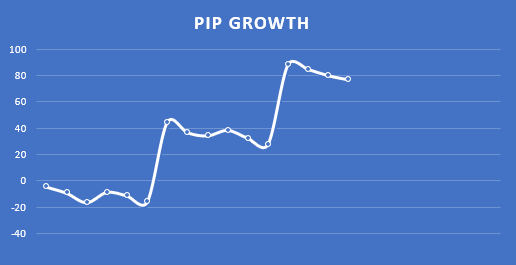

But do you believe me if I tell you that these random outcomes culminate in consistent results? Well, have a look at the equity chart for the above trades.

The above chart perfectly describes what it means by the Random Outcome but Consistent Result.

Now I hope you understand what I mean by the Random Outcome, Consistent Result.

With that let’s move into the second truth about forex trading.

2. You Don’t Need To Know What Is Going To Happen Next To Make Money

As we already talked about, in trading there is a random distribution of winners and losses for any given period.

Or, to put it another way, based on the previous success of your trading edge, you may know that 60 of the next 100 trades will be winners and 40 will be losses.

But, what you don’t know is the sequence of wins and losses or how much money the market is going to make available on the winning trades. This truth makes trading a probability or number game.

Now, if you think that everything is possible and that you don’t need to know what will happen next to make money, you will always be correct.

Your anticipation will always be in sync with the market’s perception of the situation, effectively removing your possibility for emotional pain.

Therefore, whenever you execute trades, don’t anticipate the outcome to be anything certain, such as “this one is going to be a winner for sure.” These types of expectations will result in emotional pain in the end.

Instead of having unrealistic expectations, as a trader, do your research by backtesting your trading strategy, defining the market condition you should be in, and, most importantly, understand the statistics behind your trading edge. These will help you trust your trading process.

3. A Trading Edge Is Not About Win Rate Or Your Entry and Exits

Then what is it?

A Trading EDGE is Nothing More Than an Indication of a Higher Probability of One Thing Happening Over Another.

To develop a consistent mentality in trading, you must first accept that trading is not about hoping, wondering, or accumulating evidence one way or the other to decide if the next trade will succeed.

The only confluence you need to gather is whether the technical tools you use to define an edge are present at any given moment.

If your trading edge has a positive expectancy, this is all you need. You don’t need other technical confluences outside the parameter of your trading edge to decide whether you’ll take the trade or not.

So believe in your trading strategy and let it play.

4. History Repeat Itself But, Every Moment In The Market Is Unique

History Repeat Itself – we all heard this at some point in our trading career, right?

While I completely agree with this, I also believe that the market uniquely repeats itself each time.

For example, let take a support level. We have seen the price action bounce from support level from time to time. Basically, this is a repetitive event. But the price movement isn’t performing the same way around the support level, is it? Sometimes the price will reach the support level and shoot like a rocket, and other times the price may hold the support level for a while before shooting off.

Consider the true meaning of “uniqueness” for a moment. The term “unique” refers to being unlike anything else that exists or has ever been.

When it comes to the practical version of ourselves, our minds don’t deal with it very well, even though we understand what the term “unique” means.

In trading, if we want to take the advantage of repetitive moments, we must truly understand how uniqueness work in trading and how to adapt ourselves for that.

So the question is, how to do that? To be honest, you cannot do anything here. All you can do is execute your trade plan and let your edge play out. Don’t get panic by trying to understand every movement in the market. If the trade move in your favour, give it some time to play out. If it is not moving in your favour, just cut the losses.

Keep in mind that, the stronger you believe in the uniqueness of each price movement, the lower your potential for each trading outcome. The lower your potential for each trading outcome, the more open your mind will be to perceive what the market is offering you from its perspective.

5. Anything Can Happen Anytime

Why? Because there are always unknown participants working in every market at all times, it only takes one large institution or bank in the globe to negate the positive outcome of your trade.

Regardless of how much time, effort, or money you have put into your analysis, the market has no expectations for this reality. Any expectations you have will be a source of tension and may drive you to view market information as dangerous.

With that let’s move into the next truth about forex trading

6. You Need Money to Make Money

Opening a trading account and getting started in forex is simple since access is quick and convenient. Most of the brokers even allow retail forex traders to start trading with deposits as low as $50.

But, Is it worth it?

No. Rather than trading on a $50 real trading account, it is preferable to trade on a $10,000 demo trading account since the trades on this account will at the very least motivate you.

Therefore you should work on your trading capital first before thinking about the money you will make from the trading.

Now how much can I earn from forex trading?

Once again this boils down to the account size you have. Assume you invest $10,000 and you will make 2% monthly. Well, that brings around $200 per month.

On the other hand, if you invest $100,000 or grow your account to $100,000 you will earn around $2000 per month.

So, if you don’t have enough money, start working on it first. And good starting capital would be around $10,000.

7. Trade When There Is Volatility In Place

The currency market is available 24 hours a day, five days a week. This provides greater flexibility for traders, as they can trade at any time and from any location.

However, there are times in the market when volatility is relatively low, like the Asian session. However, volatility is significantly higher in the New York and London sessions, which provides us with numerous new trading opportunities.

So be wise when comes to choosing the right period for your trading.

8. Learning To Trade Takes Time

The fact is that becoming a forex trader takes time. For some, it may be three months, while for others, it may be a year or two. However, even after a year of trading, another set of traders has still been trying to become profitable traders.

This is why it is critical to establish a solid foundation of knowledge. This is a simple step. To learn the fundamentals of trading, visit Babypips.com or our trading blog. This basic knowledge is readily obtained by reading a few articles or viewing a few YouTube videos.

After you’ve gathered the fundamentals, the next stage is to get out there and trade what you’ve learnt. This is where the truth about forex trading truly sinks in, and it’s also where you learn to trade. Or, to put it another way, the only way to learn about trading is to participate in the market.

Participate in the market create engagement, these engagements not only make you a more seasoned trader, but they also give you the confidence to remain cool under volatile market situations.

The idea here is that in order to be a consistent and profitable trader, you must apply what you have learned to real-world market situations. The demo trading account is quite useful in this situation.

Before we move to the next point…

Let the market be your trading mentor, and keep in mind that in order to acquire skills as a trader, you must maintain constant interaction with the market, which will ultimately build the skill set you require, which takes time.

9. Trading System Won’t Make You A Profitable Trader

To be a profitable trader, all you need is a trading system/strategy with a higher win rate.

This is absolutely incorrect.

This is what a lot of new traders believe. They are always seeking for that magical system, or in trading jargon, a “HOLY GRAIL” trading strategy, to skyrocket their trading profit.

Some of these traders believe that the world’s finest traders have access to the best trading system. This is, once again, absolutely incorrect.

So, what is that secret recipe that enables the best trader to generate continuous profits?

It’s all about their mindset. These traders have a distinct mindset that allows them to view the market from a different angle than novice traders. They think like risk managers and always trade according to a set of rules.

For these traders, a trading system/strategy is just a tool that allows them to acquire market information and consistently bet on higher probability trading areas.

10. Your Mindset Is Much More Important Than Your Trading System

In trading, emotions are constantly there. Whether you’re trading, taking profits, or losing money.

It makes no difference whether your trading technique has an 80% or higher win record, you will have to battle with your emotions at some time in your trade. It is not about developing better plans or conducting more comprehensive analyses, but about cultivating a winning attitude.

Mark Douglas clearly states in his book Trading in the Zone that the attitude of traders separates successful traders from losers.

Successful traders see the market differently than others, they understand that trading is a probability game or a number game, and they always accept and move on from random results of their trades.

One area that successful traders excel at that inexperienced traders sometimes overlook is trading psychology. Consistent traders understand how to control their emotional ups and downs, and you should do the same if you want to be a successful trader.

“Trading doesn’t just reveal your character, it also builds it if you stay in the game long enough.” – Yvan Byeajee

Related: How to Control Emotions Ups and Down When Trading Forex – Trading Psychology

With that let’s move into the last truth about forex trading.

11. Detaching Yourself From Single Outcomes Can Help You Become A More Profitable

As previously stated, the market always presents random distributions of winners and losers. We never know how a single trade will turn out until it is completed.

We have no influence over the market, therefore all we can do is execute trades in accordance with our trading strategy while prioritizing risk management. We have no influence over the result of trades as well. We must accept the outcome of our trades without hesitation, whether it is a winner or a loss.

We should detach ourselves from the trades since we have no influence over a single outcome. Having an attachment to something over which we have no control is a sure way to bring a lot of emotional pain.

Therefore, whenever you execute a trade, separate yourself from it and concentrate on what you can manage.

There you have it: 11 truth about forex trading nobody willing to tell you. Yeah, I know some of these things are bitter, But this is the reality. At some point in our trading, we have to face these truths and it is better to know about these things in advance, right?

Now keep in mind that, the faster you accept the truth, the quicker you can become a profitable trader.

With that, I hope you learned something valuable from this post. If so, give us small support by sharing this with your friends.

Happy Trading!