Welcome back to another article on weekly market analysis and trade review.

Last week was a profitable week for us, with two profitable trades and one losing trade. Apart from that, we missed three profitable trades worth little more than 6R. Yeah! that’s true.

Here are the results of last week’s trade.

- GBPJPY short – +2.16R

- GBPUSD short – +0.78R

- EURNZD long – 0R (Breakeven trade)

- NZDUSD long – (-0.5R)

- EURAUD long- +2.26R

With that let’s move forward and review these trades.

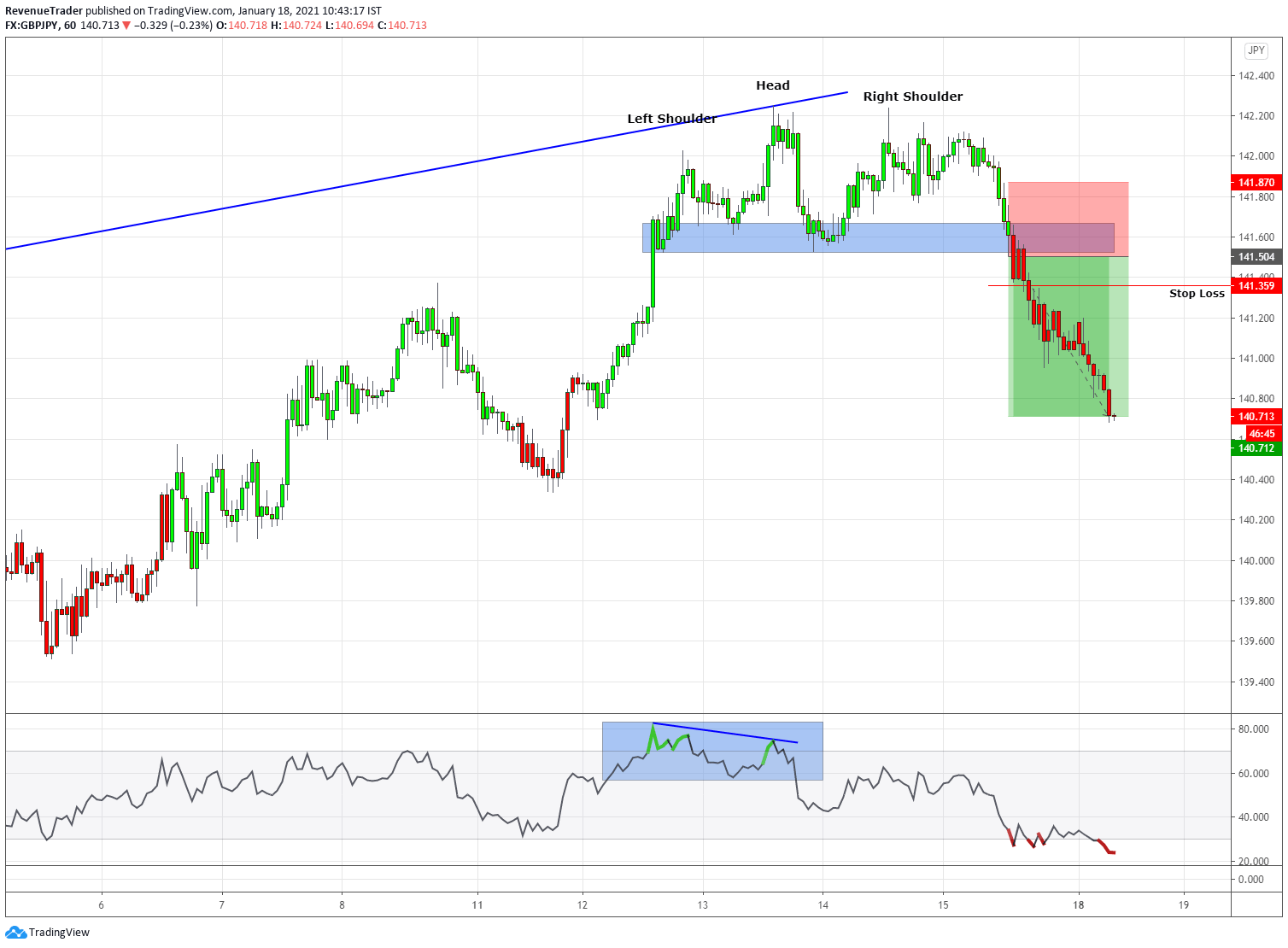

GBPJPY Short Trade

In the above chart, you can see that GBPJPY was in a strong uptrend before the price action met the channel top marked in the blue line. When the blue resistance level hit, the price action ended up forming a head and shoulders pattern indicating a lack of bullish moment and, at the same time, the RSI divergence also showed a lack of bullish momentum. And finally, just before the breakout of the local structure level, both the super trend indicator and the trend identifier confirmed the momentum shift, and these confluences together make the area near the channel top as a high probability area to go short based on my predefined trading rules.

Finally, as you guys can see, we ended up shorting upon the break of the local structure level and able to banked +2.16R from this trade.

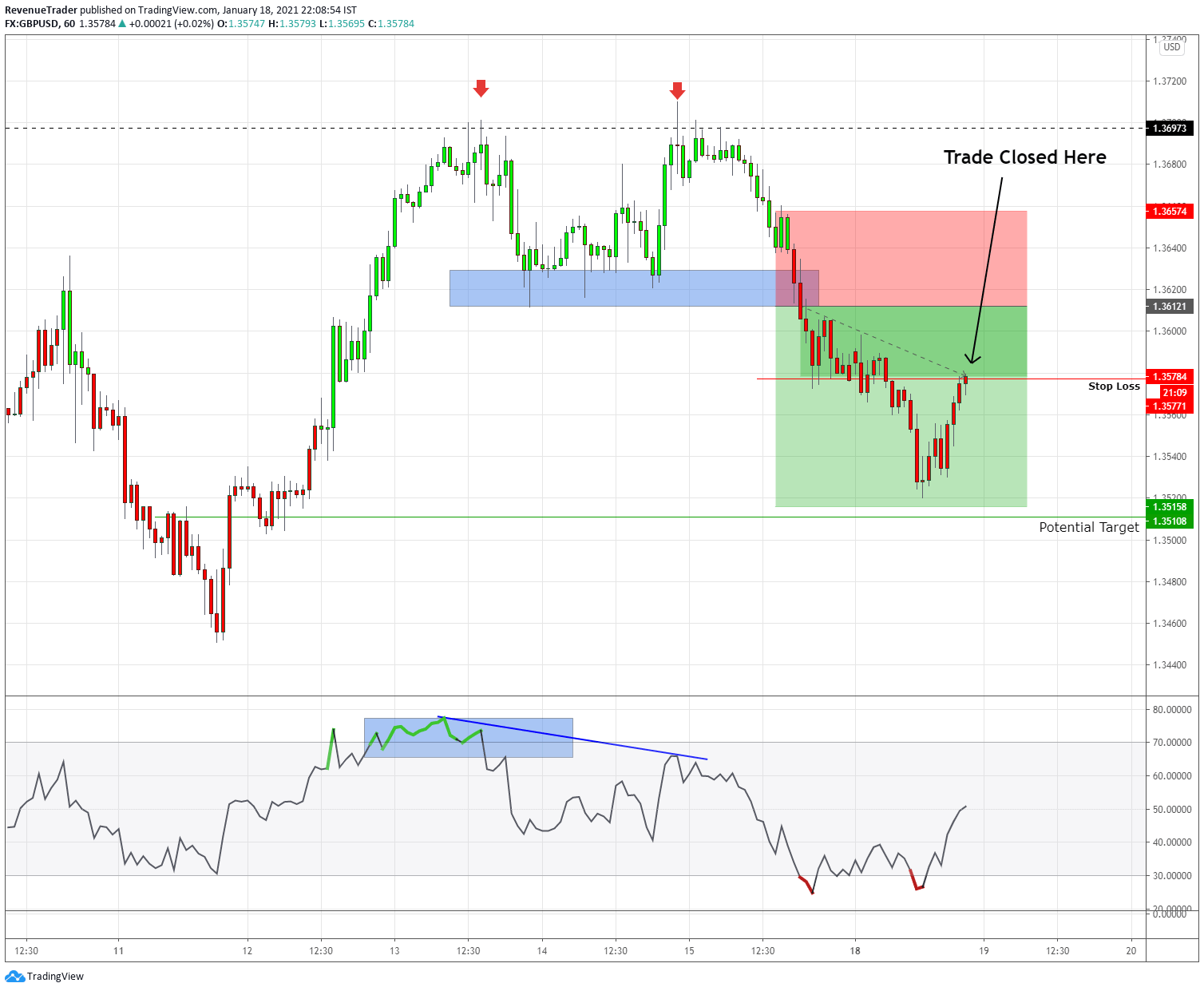

GBPUSD Short Trade

It is clear that in the above chart, price action rejected the resistance level twice which comes from the higher time frame and at the end, this price behaviour resulted in the double top pattern. At the same time, the RSI indicator showing clear divergence. When Double top and the RSI divergence aligned like this, more often than not it is a clear and higher probability indication of a trend reversal. Just like the previous trade on GBPJPY, we also went short here on GBPUSD with the break below the local structure level. Unfortunately, price turned without hitting our take profit and stop out after hitting the trailing stop loss. We earned +0.78R from this trade.

EURNZD Long Trade (Break-Even)

This is the third trade I closed in this week. As you guys can see, this is a breakeven trade. Let’s puts that aside and talk about why we went long here.

First of all, you can see that market was in a strong downtrend until the price action met with the support level marked in the chart. At the same time, RSI also indicates a massive divergence. In combine, these technical confluences indicate the lack of bearish momentum. When looking at the extension moves, they are getting smaller as the price action met with the support level marked in the chart and on the other hand retracement moves are getting deeper and deeper indicating aggressiveness of buyers. So with these confluences in mind, we place a long trade targeting the structure level comes from the higher time frame. But as the chart illustrated, the price ended up move against us after hitting 1R level.

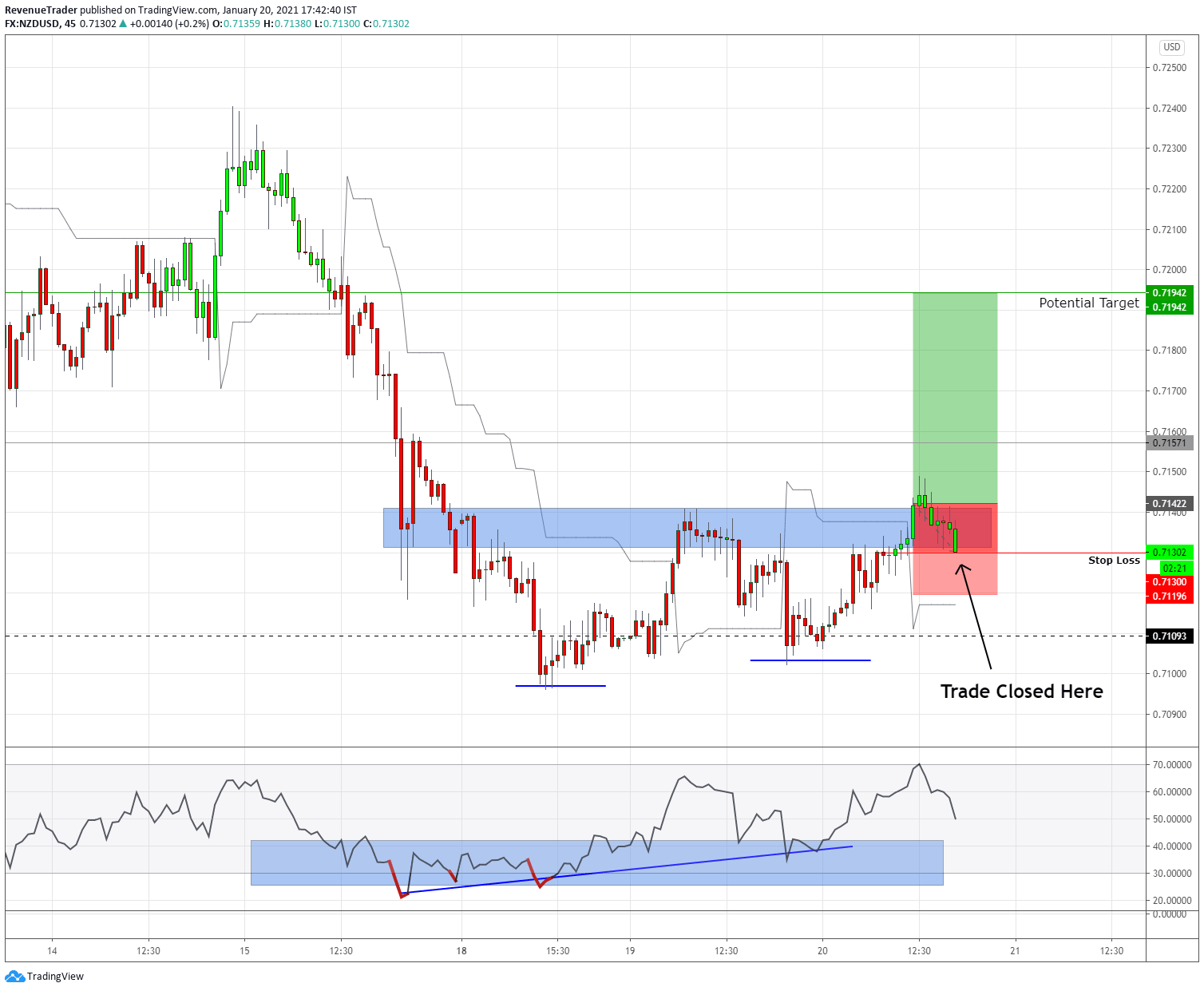

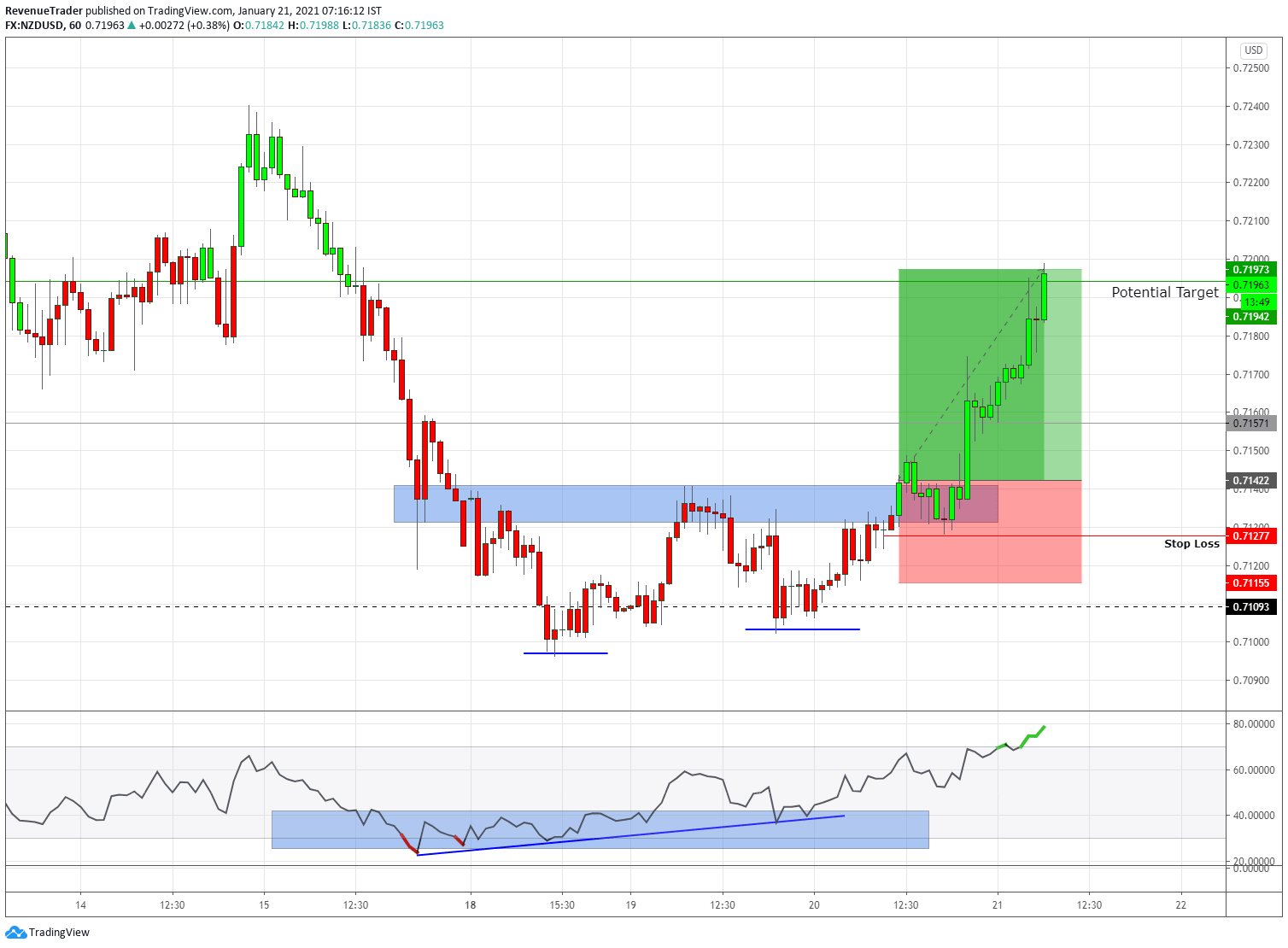

NZDUSD Long Trade

Let’s start by analysing the left side of the market. On there you can see that NZDUSD was in a strong downtrend with price making lower lows and lower highs. The extension move not telling much in this scenario, but the retracement move, specifically last retracement indicates the strong bullish momentum while RSI divergence indicating the lack of selling momentum. These two confluences together indicates the possibility of a trend reversal. Additionally, the price was also sitting at major support as well. As usual, we went long as price break above the local structure level but unfortunately, the price started to move again in favour and closed below the local structure. This is where we cut ours loses. This is one of our capital preservation rule.

The next day after reaching our trailing stop loss, NZDUSD moves up again and hits our profit target. In Forex trading, that’s normal. I’ve faced a lot of trading situations like this.

Someone would say that, if I were to keep my stop-loss where it had been put before, I would have made money on this trade. Yeah! Well, it’s true. But for me, it’s always RISK COME BEFORE REWARD.

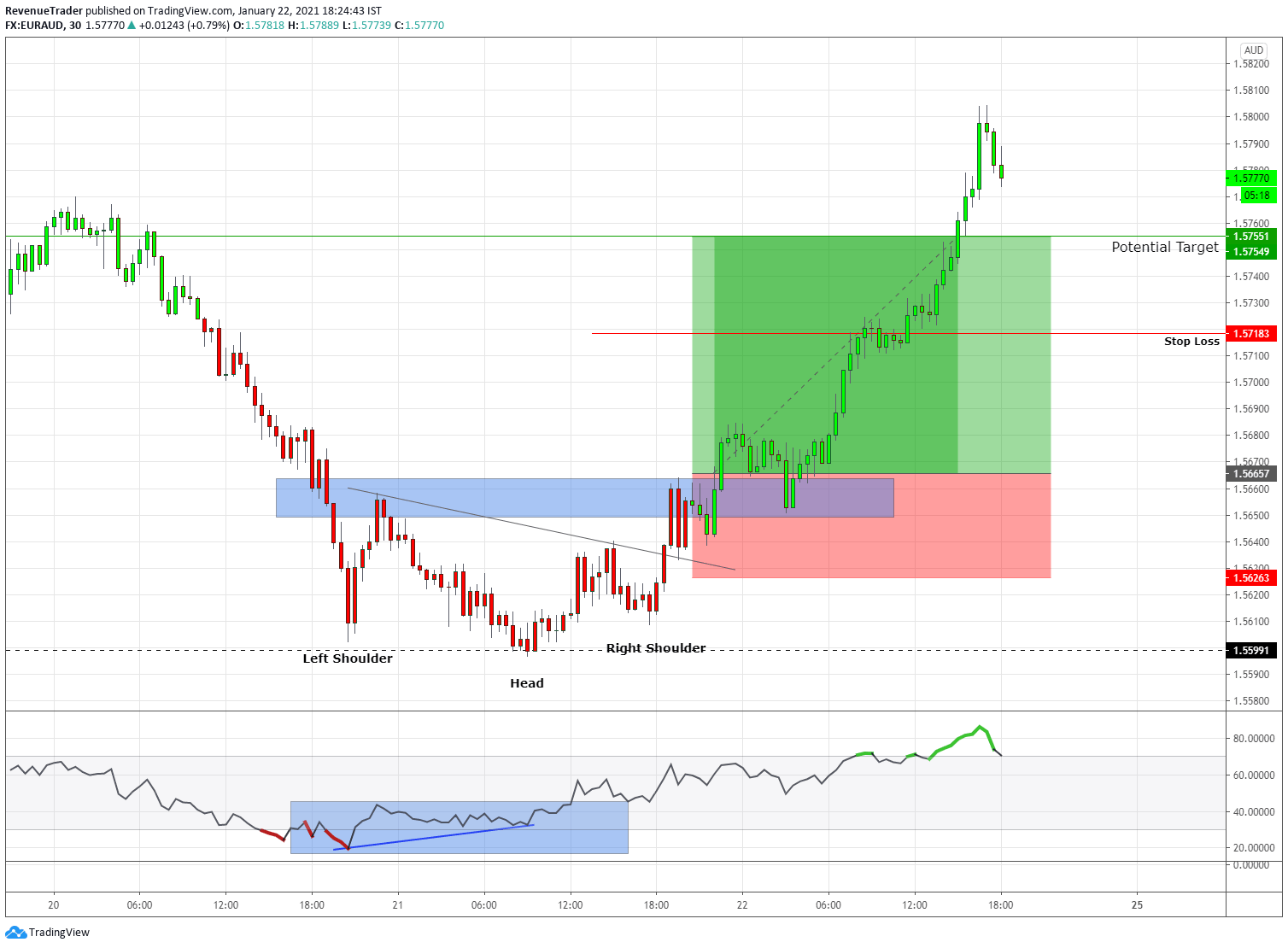

EURAUD Long Trade

A solid trade to end the week with +2.26R. First of all, you can see that the price has made a sharp bearish move all the way down to the marked support level. But at the time, the sellers were struggling to keep moving the price below this level, which resulted in an inverse head and shoulder pattern. At the same moment, RSI also displayed divergence, suggesting a lack of selling pressure. With these three confluences in hand, we waited for a shift in momentum and all the technical confluences were ideally aligned as the price broke above the local structure level. So we put a long trade targeting the previous high and eventually the market ended up hitting our take benefit for +2.16R.

In total, we earned 4.7R which is equivalent to 9.4%. (Risk per trade is 2%).

Now before we talk about the trade ideas for the upcoming week, let’s briefly review the trades we missed in the last week.

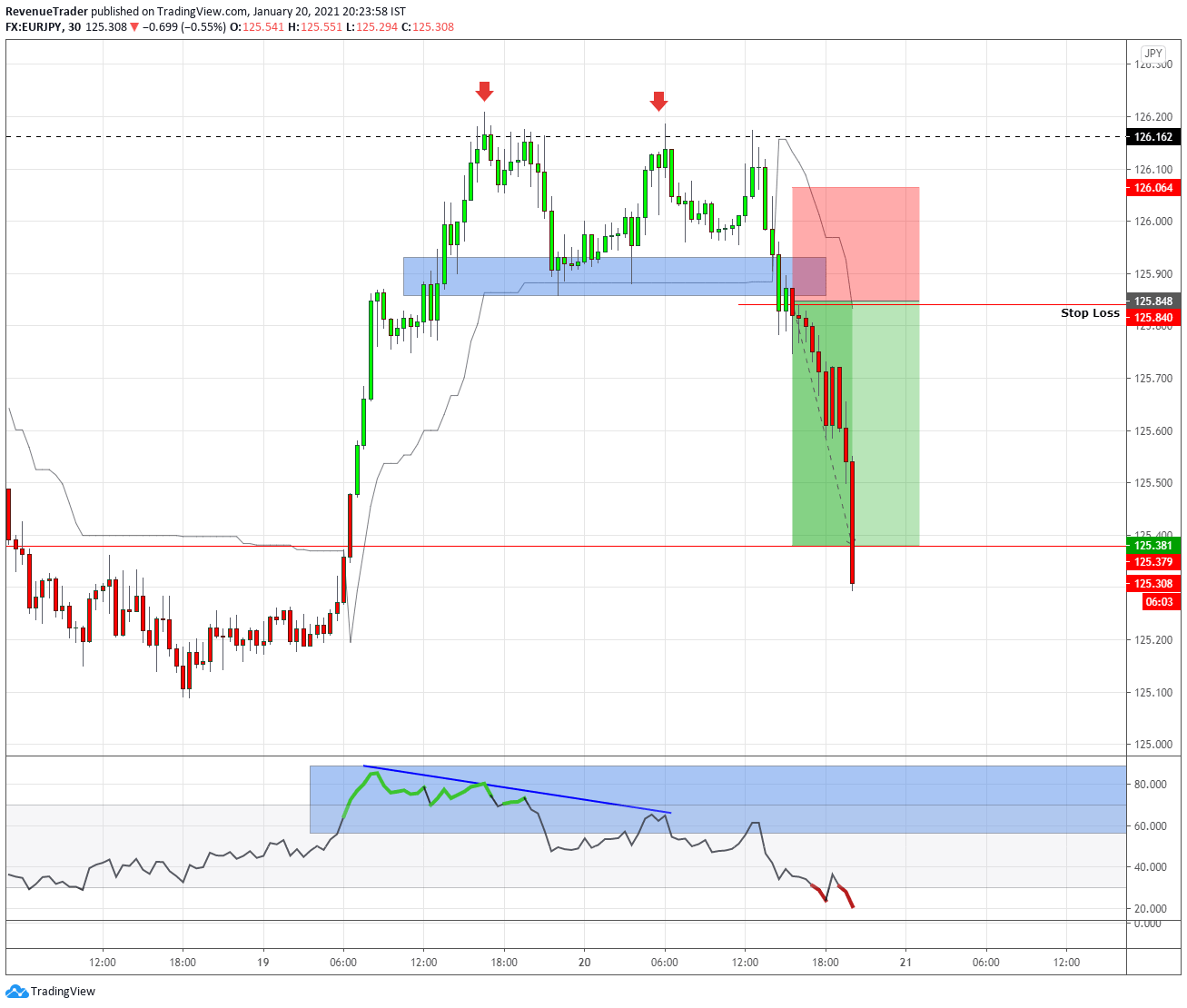

EURJPY Missed Trade — (+2.16)

What a lovely trade to miss, isn’t it? But that’s how the trading work. You won’t be able to catch every move. Although I miss this trade, I would still call this trade a perfect one. Why? Have a look at how the technical aspects are aligned. Triple top at the resistance while RSI clearly shows divergence this clearly indicates a lack of buying momentum and with these two confluences, we had a strong break below the local structure level, but unfortunately, our trade entry was missed at a small PIP distance.

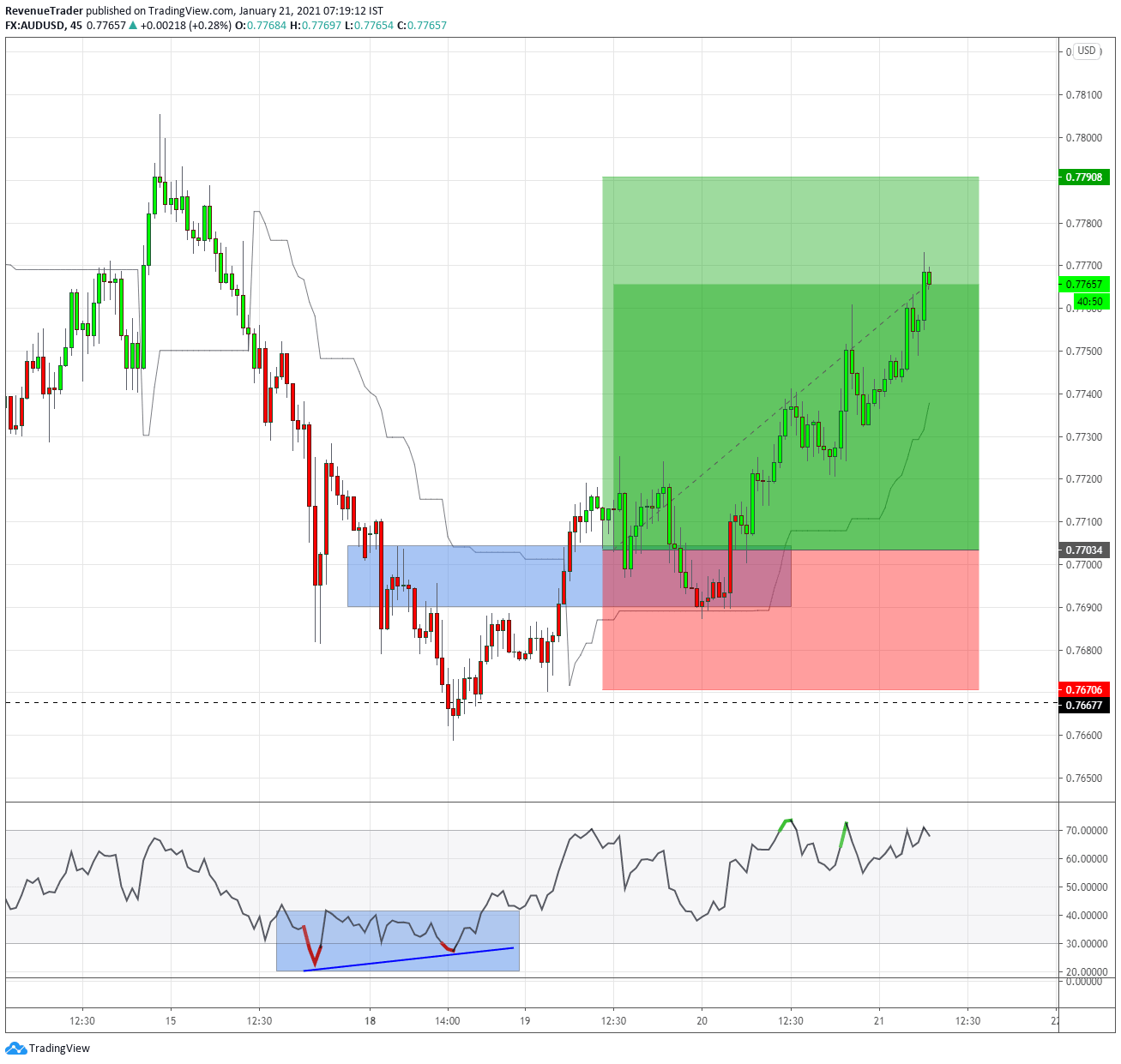

AUDUSD Missed Trade — (+2.66)

This is the second miss trade this week. Unfortunately, this is also a profitable trade with a whopping +2.66R profit potential. All the technical factors are ideally aligned in this trade. But I missed a huge profit potential due to the second-guessing of this trade.

Lessons I’ve learnt from this trade – Never spare time in perfecting, judging or second-guessing on trades as long as it’s a trade setup compliance with my trade plan and my rules of engagements.

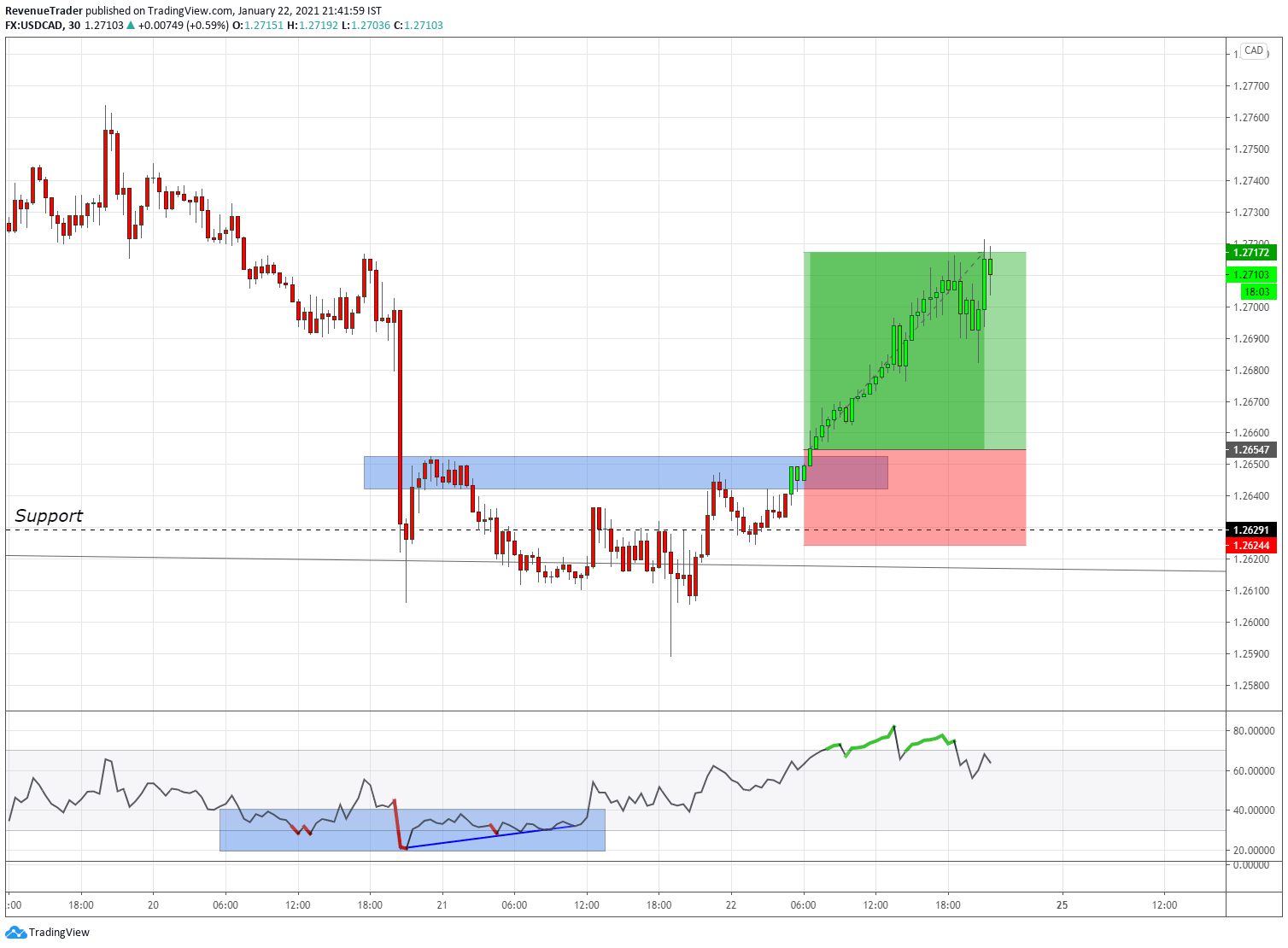

USDCAD Missed Trade — (+2.06)

Third missed trade this week, as well as profitable trade. This trade took place while I was away from my PC. Let’s break this trade down. On the left, we can see that the market was in a deep downtrend, and the last extension was very sharp and finished in a single candle. But the big bearish candle closed after rejecting the support level shown in the chart. If we analyze this level closely, we can see that the price has rejected this level twice, which raises the value of this area. With that, we’ve been waiting for the momentum shift and the break above the local structure level as a trigger to go long. That’s exactly what we got, and if I’ve been there to do the trade, I would get another 2R banked for this week.

With that let’s talk about the trade ideas for the upcoming week.

Disclaimer: Trade Revenue Pro’s view on the Forex Charts is not advice or a recommendation to trade or invest, it is only for educational purposes. Don’t Blindly Buy or Sell any Asset, Do your own analysis and be Aware of the Risk.

Keep in mind, These are Just Market Predictions and not a Trade Signal or Trade Ideas, At Trade Revenue Pro We are Using Daily Time Frame to Identify Major Price Movements and Push Down 4-Hour Time Frame to Get Favourable Risk to Reward For Our Trades, Furthermore, We are Using Tight Risk Management Method to Preserve Our Trading capital.

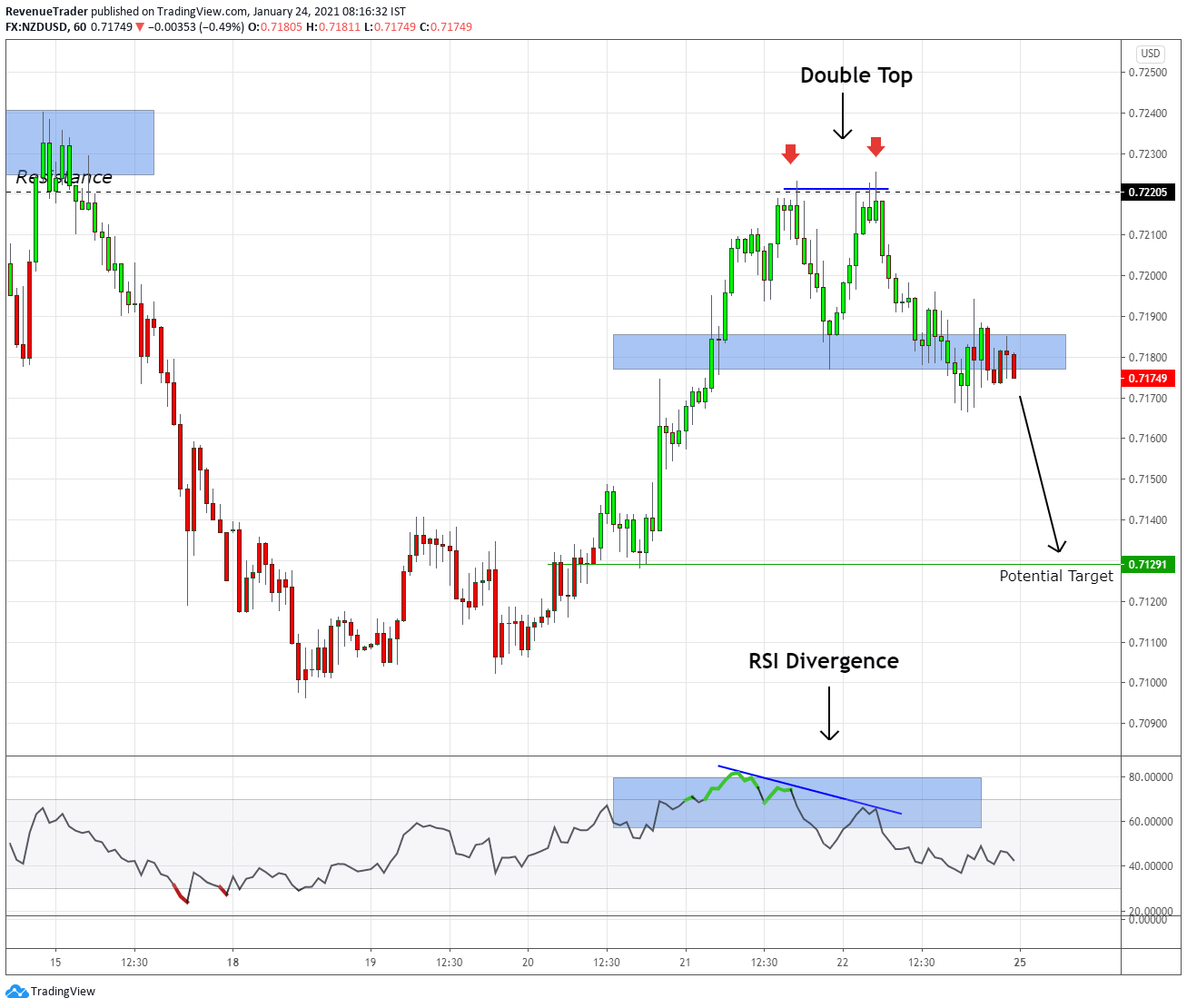

NZDUSD – Double Top Pattern at the Resistance

Key Level – Last week NZDUSD rejected the resistance at 0.72205 which comes from the daily chart.

Double Top Pattern – Due to the twice rejection of the resistance level at 0.72205, the price action developed a double top, suggesting an inability to drive the price further. This indicates a lack of buying pressure.

RSI Divergence – When the double top is formed, the RSI also shows the divergence that indicates the lack of a bullish momentum at the resistance level.

Local Structure Area – At the moment the price is at the level of the local structure. In reality, the price even broke below that level. This confirms the reversal that we have been waiting so far.

Market Forecast – The price is now split below the level of local structure, which reinforces and raises the probability of a market reversal. Trend Identifier also transforms into red, which also confirms the idea of a market reversal.

Trade Idea – if the price remains below the local structure level, I’ll be looking for going short targeting 0.71291 level and, If any case price broke above the local structure level I’ll immediately cut my losses.

At the moment, this is the only trade idea I’ve got on my radar. If you have some other trade idea beside NZDUSD, please let us know in the comment section. With that, I’m going to make sure that I update this article if I’m going to be able to discover another trade idea during the trading week.

Head over to Trade Revenue Pro Trading Blog to learn more about how to trade forex with Proven Trading Techniques and Strategies.

Want more Trade Ideas – Head over to Trade Idea Page.

That is all for this week and If you want constant trade updates – consider following Trade Revenue Por on Tradingview.

Also, consider following us on social media and Pinterest, Instagram and Facebook.

One Response

Great !