Finally, we’ve come to the end of 2020. For me, It’s been a capital preservation year so far. That’s how rough out there in the Forex market. Maybe it’s because of the pandemic situation going around the world.

How’s your trading year been so far? Did you achieve your end-of-year trading goals? If it is, fine. Just keep going.

If not, don’t worry, and don’t rush things out. Keep trading the way you’ve been trading so far. If you’re profitable for at least a few percentages, that’s a positive sign, and you can still grow slowly.

Remember that, Good Things Takes Times.

Before we talk about the trade ideas for the week ahead, let’s review three trades that we took in the last week. For us, it’s been a profitable week and we were able to gain around little over 4.5R.

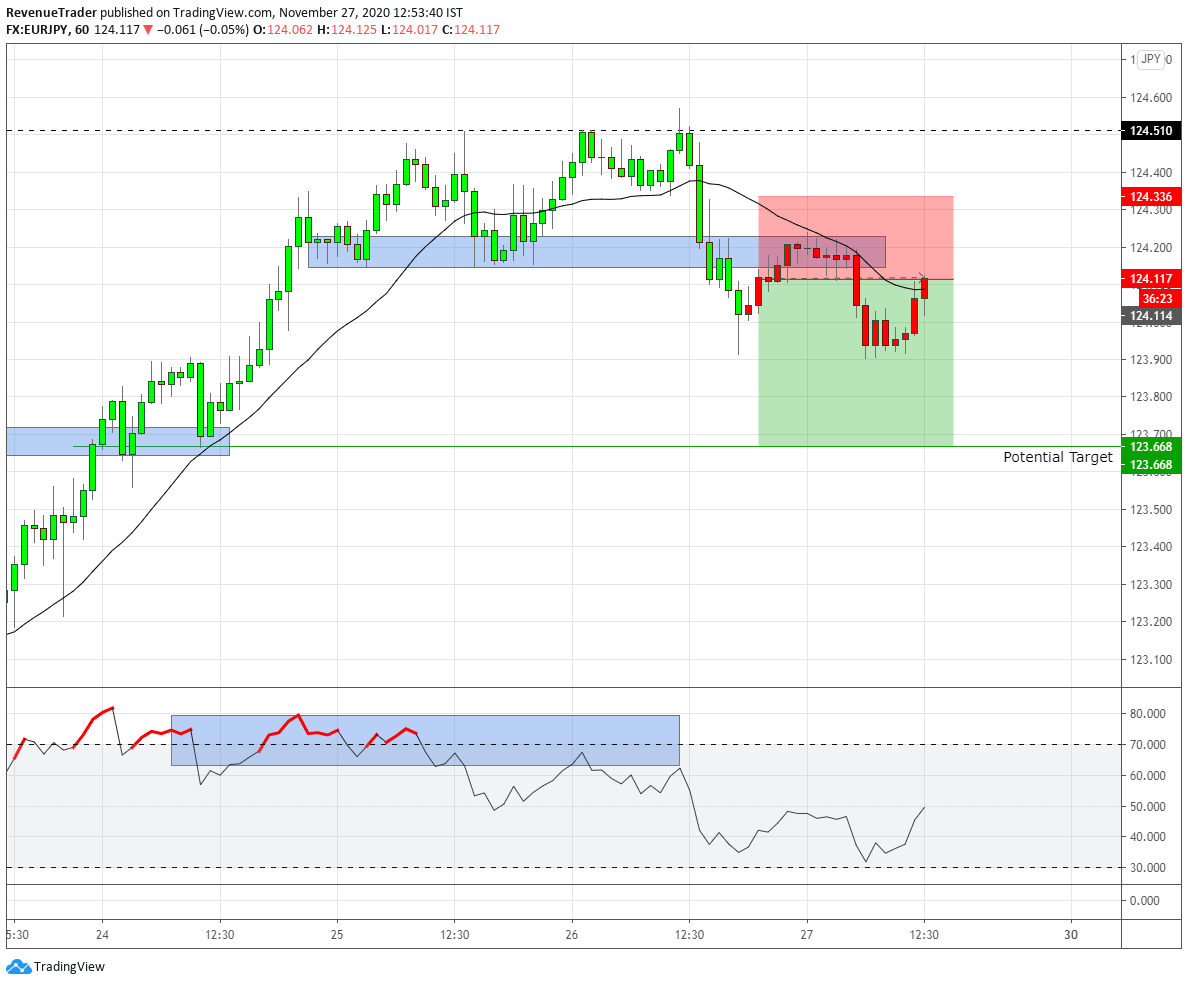

The very first trade took place in EURJPY.

EURJPY Short Trade on 1-Hour

According to the above chart, you can see that EURJPY was in a strong uptrend until price met with 124.510 Resistance level comes from the 4-Hour chart. Also at that point, RSI indicator started to form RSI divergence indicating a lack of buying pressure which is a plus point for our trade opportunity.

In price action perspective, we see that price formed a triple top at resistance and eventually price ended up breaking below the local structure level which is our entry trigger. We placed a short trade by targeting structure level and after price reached 1R, we moved stop-loss to breakeven (This is one of out capital preservation rule) and finally price turned back and ended up hitting our stop-loss for a break-even trade.

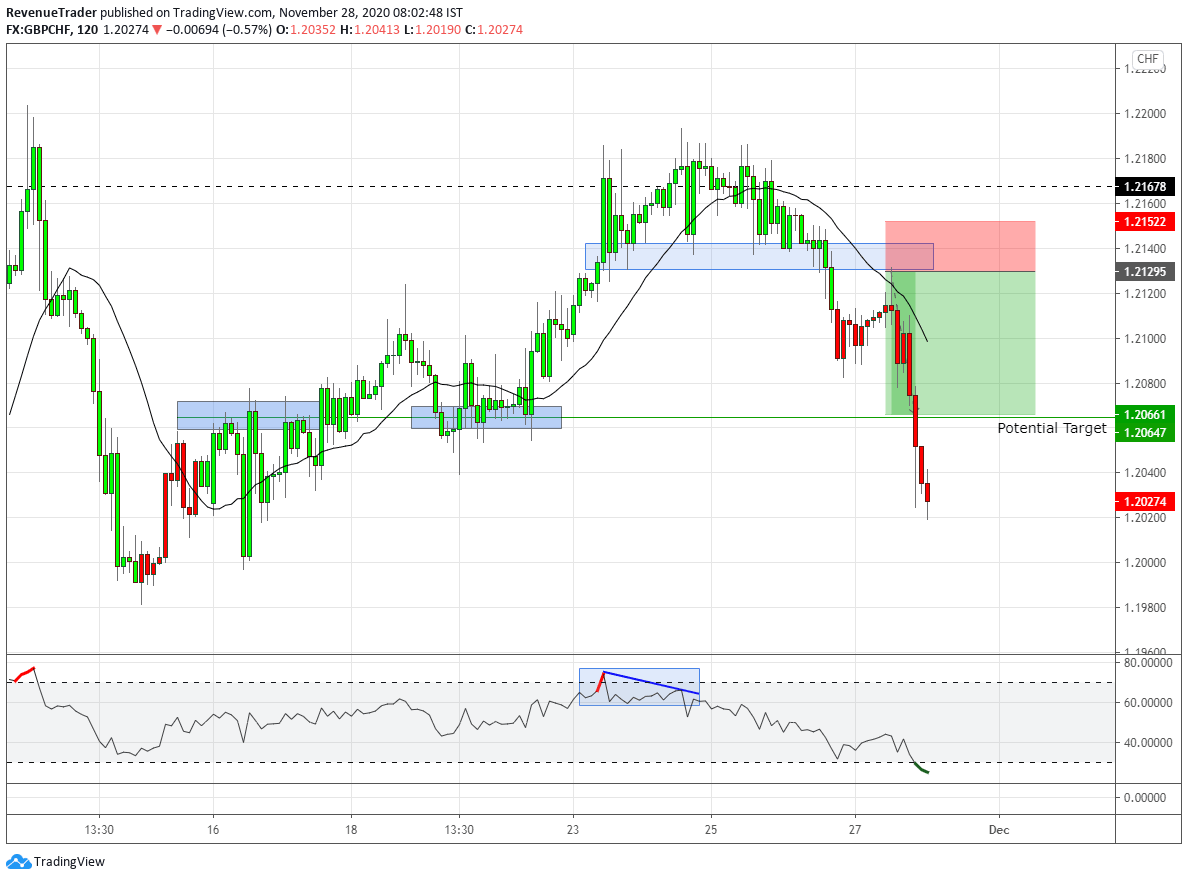

GBPCHF Long Trade on 2 Hour Timeframe

Study the chart above. First, we can see price started to consolidate around 1.2167 level which is a 4-hour resistance level. Just like the previous trade, we were planned to go short on a break below the local structure but the breakout was too big for us not be able to achieve our rules on Risk to Reward ratio. Therefore we placed a sell limit at the local structure level hoping that the price would pullback and retest before moving down. That actually happened and we ended up reaching our take profit with a profit of 2.7R.

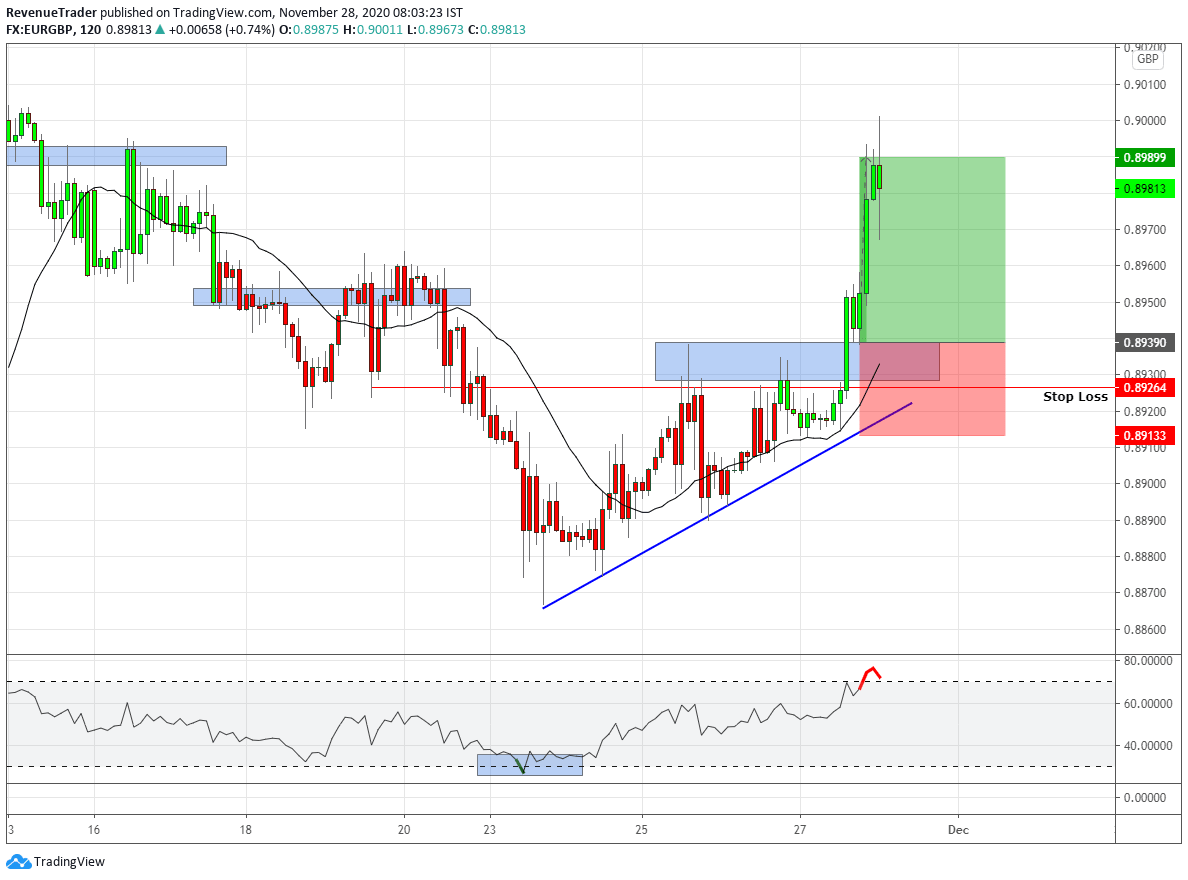

EURGBP Long Trade on 1-Hour Chart

Like the previous two trades, EURGBP is also in a clear downtrend until the price action ended up forming an upward triangle pattern signalling the buying pressure. We placed a buy limit order at the local structure to achieve favourable Risk to Reward Ratio for the trade and after the broke above the local structure level price did pullback to local structure level which filled our buy limit order and after the matter of two-hours price ended up hitting the take profit for a profit of 2R.

These are the trades we executed in the last week. In total, we were able to earn 4.7R, which is equivalent to 9.4% (if the risk per transaction is2%) in our trading account.

Okay. Next, Let’s have a look at the AUDJPY and GBPUSD trade idea for this week.

Disclaimer: Trade Revenue Pro’s view on the Forex Charts is not advice or a recommendation to trade or invest, it is only for educational purposes. Don’t Blindly Buy or Sell any Asset, Do your own analysis and be Aware of the Risk.

Keep in mind, These are Just Market Predictions and not a Trade Signal or Trade Ideas, At Trade Revenue Pro We are Using Daily Time Frame to Identify Major Price Movements and Push Down 4-Hour Time Frame to Get Favourable Risk to Reward For Our Trades, Furthermore, We are Using Tight Risk Management Method to Preserve Our Trading capital.

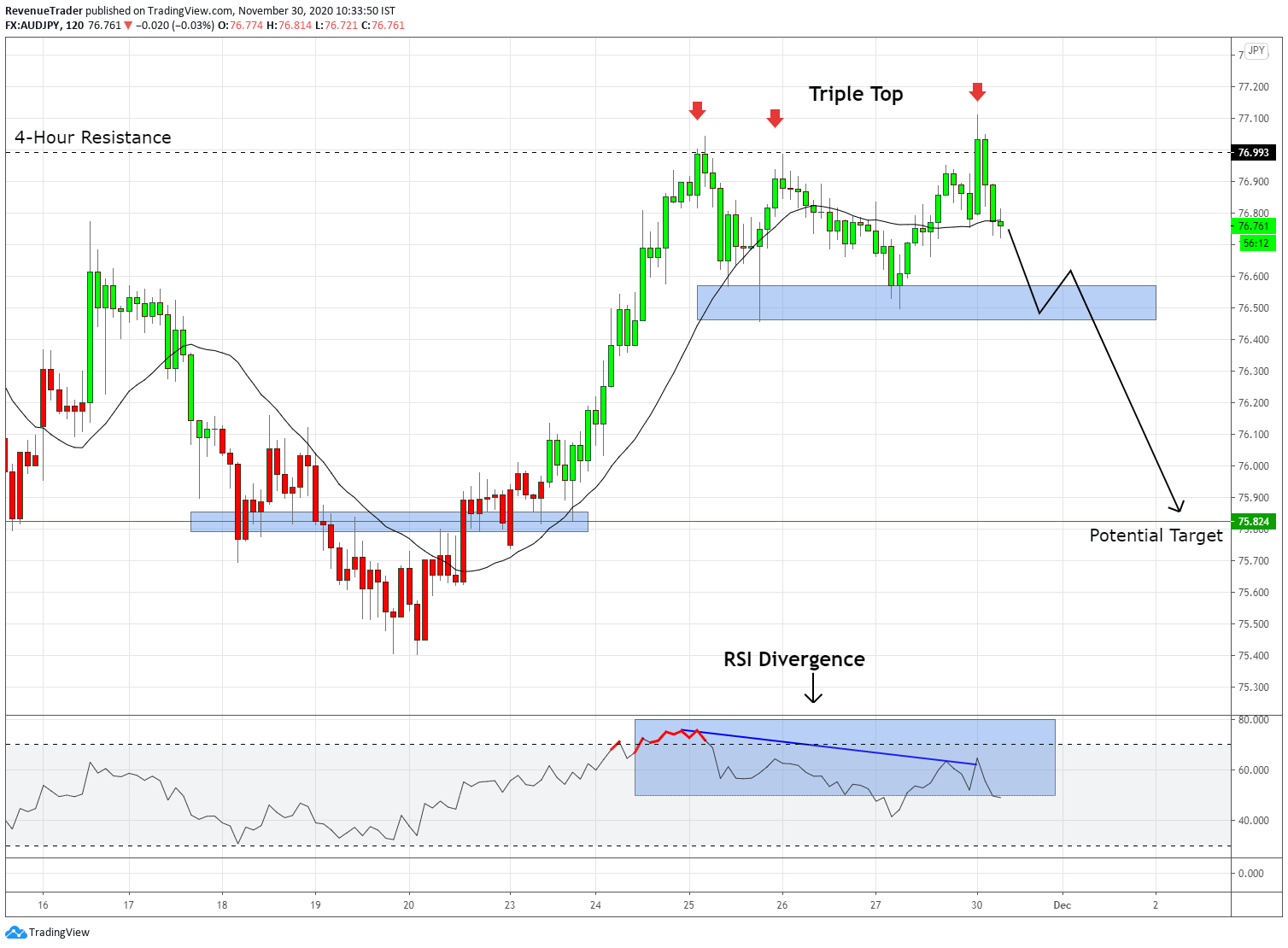

AUDJPY Triple Top Pattern at 4-Hour Resistance Level

Key Level – As above chart showed, at the moment AUDJPY is trading around 76.933 Resistance level which comes from the 4-Hour chart and ongoing downtrend is now showing lack of bullish momentum around this level.

Triple Top Pattern – This pattern indicating the real struggle that buyers face at the resistance level. Keep in mind that the triple top pattern is not confirmed yet for that price need to break below the local structure level.

RSI Divergence – A Massive and clear RSI divergence indicate the lack of bullish momentum at the resistance level

Market Forecast – Bullish trend is still in place until we have confirmed the triple top pattern for that price need to break and closed below the local structure level. If that happened we can expect a bearish trend or jus bearish move to the downside. But if the price keeps on trading above the local structure level, the continuation of the uptrend highly possible.

Trade Idea – If price break below the local structure level, we will consider going short on AUDJPY by targeting 75.824 which is the previous structure level.

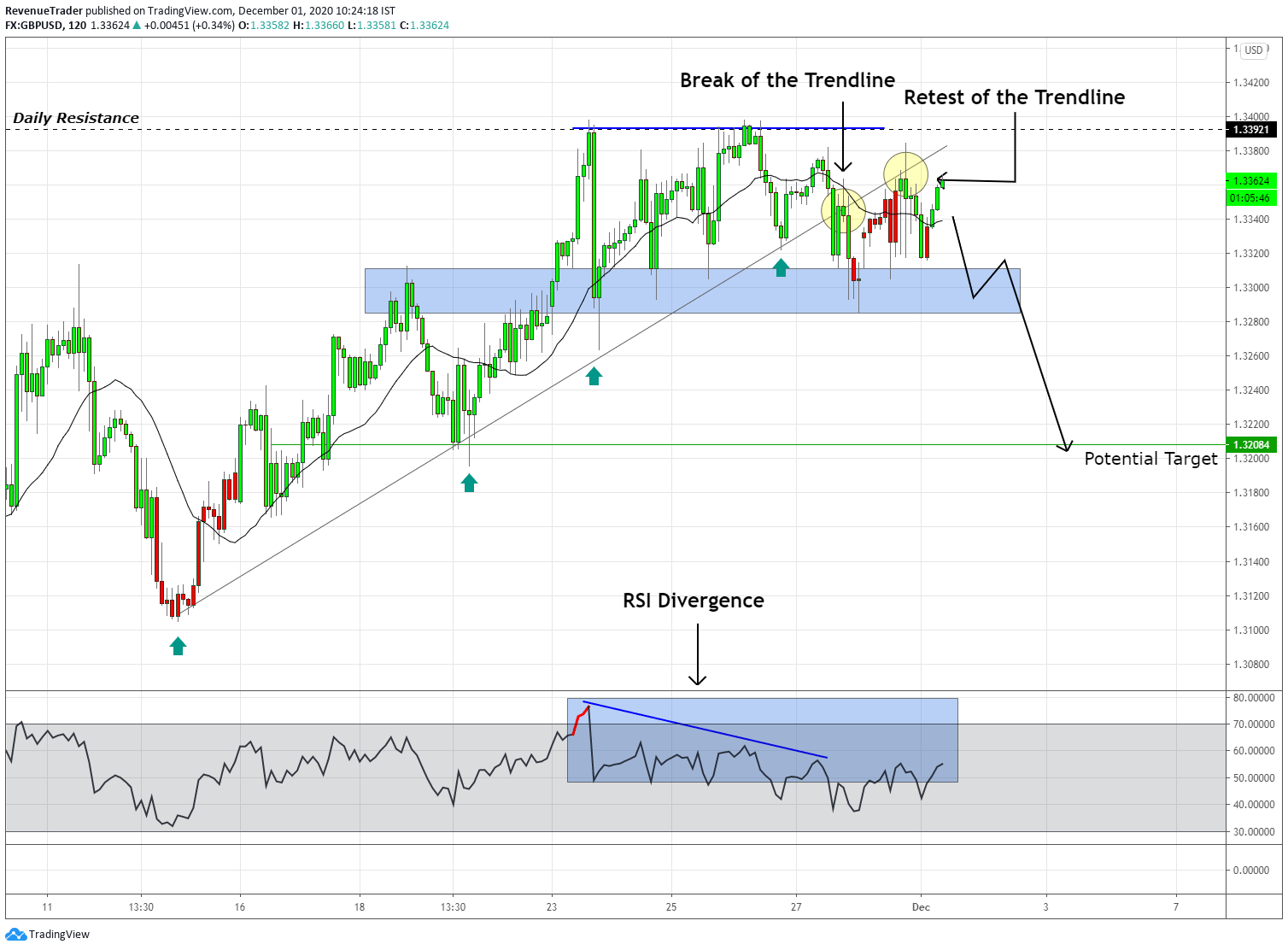

GBPUSD Price Action Move into a Range at Daily Resistance Level

Key Level – At the moment GBPUSD is trading around at 1.33921 level which comes from the daily chart. This is an important resistance level as price tested and made a huge movement around this level in the past.

Consolidation – Price actions started to consolidate at the daily resistance level this indicates the closing of a long trades and as a result of that buyers ended up losing their control over the market.

Trend Line Broke and Retest – Bullish trendline is already broken and this confirms the lack of bullish momentum in the ongoing uptrend.

RSI Divergence – RSI divergence in massive in GBPUSD. Just the previous trading confluences, Divergence is also indicating the lack of bullish momentum.

Market Forecast – At the moment all the three trading confluences are aligned nicely with the resistance level comes from the daily chart. If buyers continue to move price higher, then the price will remain above the local structure level and if any case price break and closed below the local structure level (That’s what we are looking), there is higher chance price will move down.

Trade Idea – We will consider going short if price break below the local structure level targeting 1.32084 level.

Head over to Trade Revenue Pro Trading Blog to learn more about how to trade forex with Proven Trading Techniques and Strategies.

Want more Trade Ideas – Head over to Trade Idea Page.

That is all for this week and If you want constant trade updates – consider following Trade Revenue Por on Tradingview.

Also, consider following us on social media and Pinterest, Instagram and Facebook.