What is the Forex Trade Entry and Why This is so Important?

Forex Trade Entry tells you that once you are in a potential trade area When to actually enter the trade.

At the end of this article you will know how to exaclty execute a trade at the right place with the right trade entry techniquess

Okay, Let’s dive in.

Trade Entry can differ from trading strategy to strategy.

Let’s Say, Now that you have decided on selling on a daily resistance area, Now you have to decide how to actually enter the trade.

Do you just blindly sell when the market trade near the resistance area? NO. Right? You have to wait for the right moment to execute the trade.

Let’s see whats happens when you blindly press the sell button on a resistance level. Have a look at the chart below.

Just like these forex trade in the above chart, your trading account will suffer consecutive losing trades, if you blindly trade support resistance or any forex trading methods out there.

But if you wait for profitable and quality forex trade entries, over a long period you will able to achieve consistently growing trading account.

You can get profitable trade setups If you combine trade entry and trade area correctly.

Below Picture Describe a profitable trade entry that took utilizing the daily resistance area.

Okay, Let’s learn about what are the highly profitable trading area to get better trade entries.

Find the Right Place to Get Better Forex Trade Entries.

Nothing work if you can’t understand what a good market is?

So before you find the best Forex Trade Entries you should focus on finding the right place to get execute your trade.

Make a habit of focusing more forex pairs instead of the same one or two forex pairs. The reason is Forex pairs don’t stay in the same market conditions, they go through different market phrases. (Range market, trending market)

By trading more forex pairs you can filter out Good Market and ignore whipsaw fore pairs.

Focus on More Market but be More Selective

There are some factors to consider when finding trade areas that have higher potentials for your trades.

Location

In my opinion, the trade location is the best forex trade entry filter so far.

Location means that you only take trades around key price levels such as Support and Resistance, Supply/Demands, Moving Averages, Swing points or Round Numbers.

There are two groups of forex traders when it comes to trade entry.

There are forex traders who execute the trade as soon as they spot a good trade entry but they don’t care about trade location.

There is another group of traders, who focus on both trade entry and trade location.

Over the long term, only taking trades that actually happen around these key levels can make a huge impact on your trading account mainly because you are taking only quality trade opportunities.

The right Breakout happened on the major support level in the daily timeframe we see on the left.

Know the Market Condition

This second point is something not many traders focus on.

There are lots of trading styles out there such as Trend trading, Range market trading and Reversal trading.

These trading styles required different market conditions to play out effectively.

So, in order to get better trade entries, you should focus on selecting the right market condition that your strategy works well.

If your forex strategy is based on trend then you should focus on trading in the trending market and vice versa.

Execute your trading strategy in the right market condition helps you to preserve your trading capital by unnecessary losing trades and also helps get profitable trade entries.

Study the chart below to understand the different market phrases.

Confluence Areas

If two or more trading confluences (Support and Resistance, Price Patterns and Candlestick patterns) align with the same area, we can call it a confluence area.

Also, Trading with more confluence factors can improve the quality of your forex trades.

When you are looking for trade entries always try to take your trade entries around these key confluence areas.

Also, keep in mind that confluence factors can be varied with your trading styles. So, try to find confluence-rich areas that support your trading idea.

Have a look at the sample trade below which executed at the confluence area.

so,

In a game where probability matters most, as a forex trader, you should prioritize increasing your trading odds.

By simply combining Location, Market condition and Confluence areas in the forex market you can find high probability areas to execute your trades.

But only finding high probability trade areas doesn’t mean that good forex trading opportunities going to happen in these areas.

As traders, we need extra confirmation to trade these levels successfully.

This is where forex trade entries come in.

Okay,

Enough of Hocus-Pocus,

Let’s talk about what you here to learn – 4 practical ways get higher profitable trade entries.

How to Get Profitable Forex Trade Entries

Have you ever feel like,

Am I entering too early? Or

Do I need to wait for another candle?

If you are new to the world of forex trading, then you have probably asked yourself these questions multiple times.

So,

How to actually find out when to pull the trigger?

Pricking a good entry point will increase your chances of having a winning trade on your hand.

Let’s say you’re trading reversals and what happens if you entered too early? You may be caught up on a retracement of the ongoing trend and ended up having a losing trade.

On the other hand, if you are entering too late, you are missing a good portion of the move and ended up having a trade with the worst risk to reward ratio.

Learning how to pick a good entry cannot be done by reading a book or watching a youtube video. It’s something that is learned with experience.

Below I listed 5 profitable ways to get more accurate trade entries. Let’s see what these techniques are?

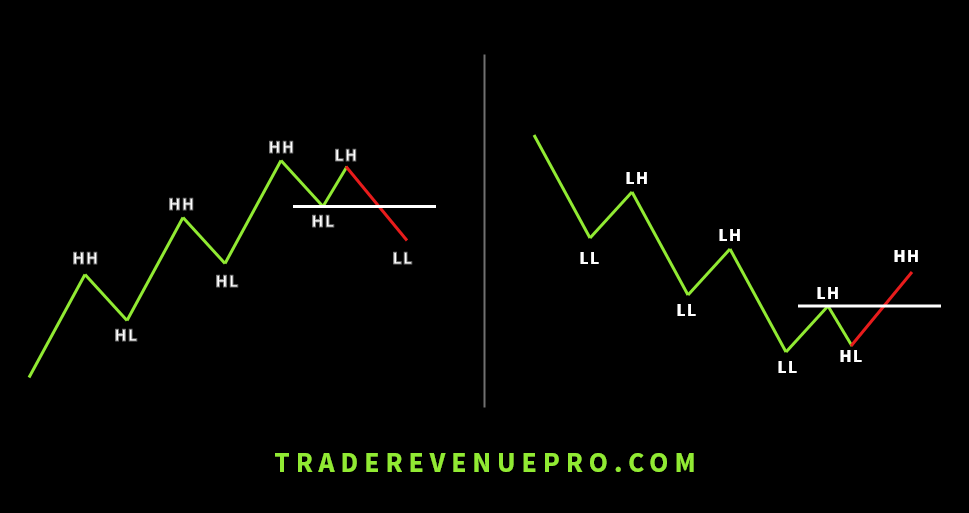

Change of the Trend Structure

The first forex trade entry technique involved classic trend structure analysis.

In an uptrend, the market creates higher highs and higher lows. What happens if the market creates lower lows (LL) in an uptrend.

It is a sign of a reversal. Right?

The same goes for the opposite way in a downtrend.

Have a look at the sketch below,

Okay, now look at the real chart example below,

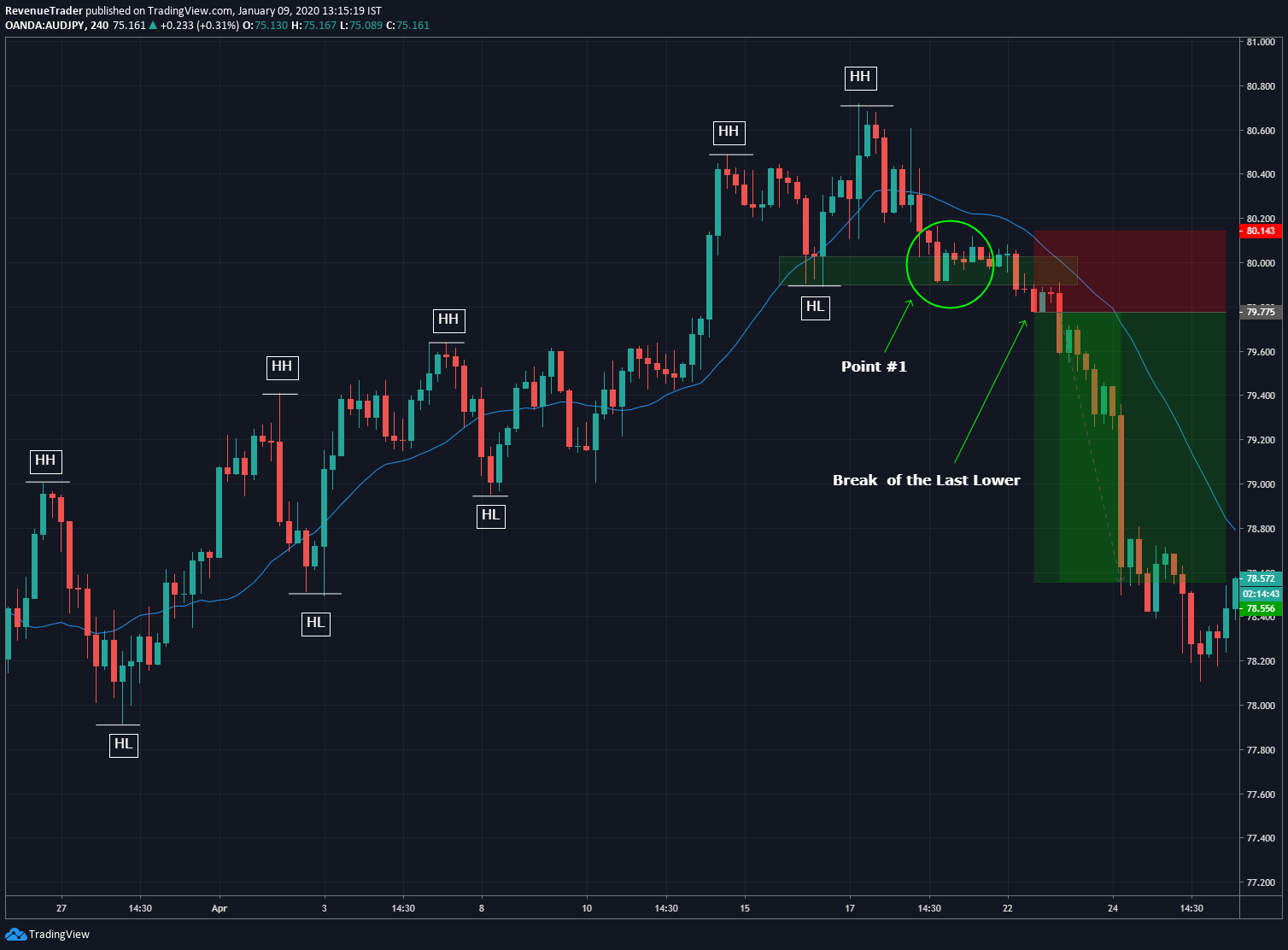

According to the chart, We have a healthy uptrend with a series of higher highs (HH) and higher lows (HL).

At point #1, price retrace all the way down to the previous Higher low (HL) and never bounce from that level until finally, we get a lower low (LL) by breaking previous Higher low (HL).

Going short at this point would have been a good trade entry and a great way to get a favourable risk to reward ratio trade work in your favour.

of course, the same principals can apply to long trade but in the opposite way.

Have a look at the forex chart below.

We have a downtrend with a series of lower lows (LL) and lower highs (LH) and have a look at point #1,

What happened there? Price tried to create another lower low by breaking the previous lower low (LL) but ended up failing.

Finally, the price broke above the previous lower high and made a new higher high (HH) which is an indication of a trend reversal and as a result price ended up creating massive bullish movement.

As you can see, the classical trend structure analysis can help you spot profitable forex trade entries.

Okay,

Let’s move into the second method

Break of the Structure Levels

We are now going to look at how we can trade the break of a structure level.

We can take support and resistance, supply and demands and round numbers as structure levels.

But, to get the full potential, try to aim for the levels which have been tested in both above and below.

As a forex trader, naturally, we tend to trade bounces off these levels.

But we can use the break of these levels as an effective trade entry technique.

Have a look at the EURAUD 4-hour chart below, First, price found support at green arrow marked in the chart. After the break of that support, the same level starts to act as resistance multiple times. (Red arrow marked in the chart).

Now we can consider the green zone as a local structure level and the break of this structure level is very crucial.

So, as expected price broke the level and made a huge bullish movement.

Have a look at the next chart below,

We can see that the structure level (Green zone marked in the chart) is tested three times as support. But eventually, get broken and this would be a good trade entry for a short trade.

Break and Retest

Break and Retest is one of the conservative forex trade entry methods out there.

In here,

Sometimes the price makes sudden reversals after the price broke the local structure level.

But, sometimes the price makes a pullback to the broken structure level and retests it before price reverse. So we can take this phenomenon as a very profitable forex trade entry method.

Have a look at the chart below.

As you guys can see price initially uses the structure level (Green zone marked in the chart) as support. When it was eventually breakthrough, it doesn’t immediately move further down.

But instead, the price retest that same level, only after that, the price starts to move further down.

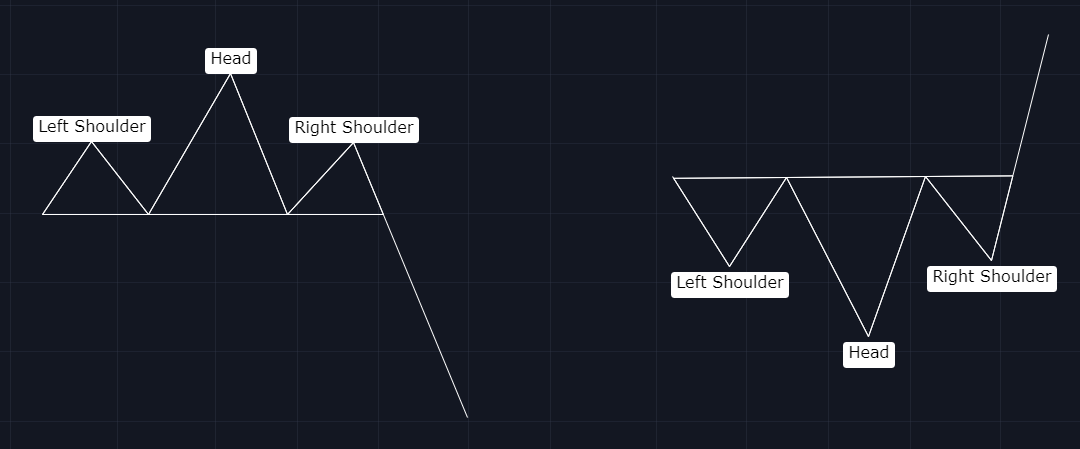

Head & Shoulder Pattern Trade Entry

Head and Shoulder pattern is a chart figure which has reversal character also head and shoulder pattern is the king when it comes to reliability and quality.

Also, this pattern has two forms with different variations.

Okay, Let’s see how we can use head and shoulder patterns as a trade entry technique.

Have a look at the head and shoulder pattern that occurs during an uptrend. Here Price respect to the neckline two times but after the right shoulder price broke the neckline strongly and made a huge reversal.

As a forex trader, we can execute a sell trade after the price broke the neckline.

Next, have a look at the long trade example below,

Just like the previous example above we executed a buy trade after the break of the neckline to the upside. the only difference is, here we are trading inverse head and shoulder pattern.

Finally

The above forex trade entry techniques will help you to get execute reversal trades, also these entry techniques can be applied to trade bounce off support and resistance as well.

There are more trade entry methods out there, but these entry methods combined with other tips we talked in this article will at least give you some inspiration to start looking for trade setups that reflect the quality and profitability.

When talking about quality,

You can execute very strong trades if can combine multiples of these techniques. for example break of the head and shoulder pattern with break and retest entry technique will often give you highly profitable trade entries.

Head over to article: How to Effectively Trade Daily Chart in Forex– If you want to learn about how take quality trades whenever you trade.