Trading the break and retest strategy can be a highly effective way to trade the markets, especially in trending markets. In this article, we will discuss what the break and retest strategy is and how to trade it.

What is the break and retest strategy?

The break and retest strategy is a trading strategy that involves identifying a key level of support or resistance and then waiting for the price to break through that level before entering a trade. This strategy is based on the idea that when the price breaks through a key level, it is likely to continue in that direction and potentially create a new trend.

How to trade the break and retest strategy

Step 1: Identify a key level of support or resistance

The first step in trading the break and retest strategy is to identify a key level of support or resistance. This can be a previous high or low, a trendline, or even a round number like $10,000 in the case of Bitcoin.

Step 2: Wait for the price to break through the key level

Once you have identified your key level, you will then wait for the price to break through that level. This is known as a breakout and it is often accompanied by increased volume, which can be a good sign that the breakout is genuine.

Step 3: Wait for the price to retest the key level

Once the price has broken through the key level, you will then wait for it to retest that level. This means that the price will come back down to the key level and test it to see if it still holds as support or resistance.

Step 4: Enter a trade in the direction of the breakout

If the price successfully retests the key level and holds, then it is a good sign that the breakout was genuine and you can enter a trade in the direction of the breakout. If the price fails to hold at the key level and breaks through again, then it is a good sign that the breakout was not genuine and you should avoid entering a trade.

Risk management

It’s important to note that the break and retest strategy is not a foolproof way to trade the markets and it is always important to use proper risk management techniques when trading. This includes setting stop-loss orders and only risking a small percentage of your account on each trade.

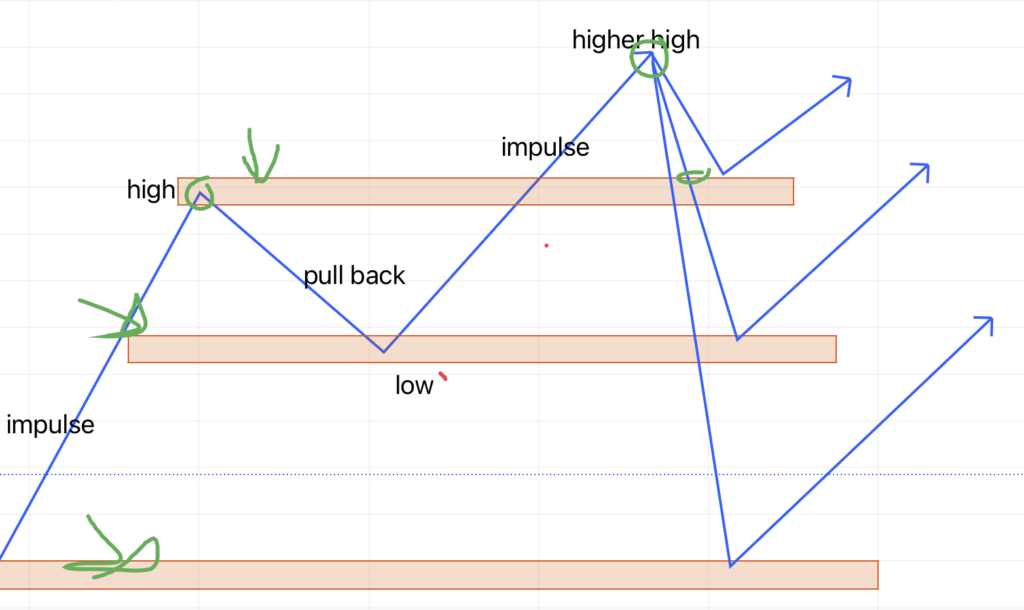

Now lets discuss this strategy furthermore using few diagrams

The break and retest strategy is a popular trading strategy that involves identifying a key level of support or resistance and then waiting for the price to break through that level before entering a trade. This strategy is based on the idea that when the price breaks through a key level, it is likely to continue in that direction and potentially create a new trend.

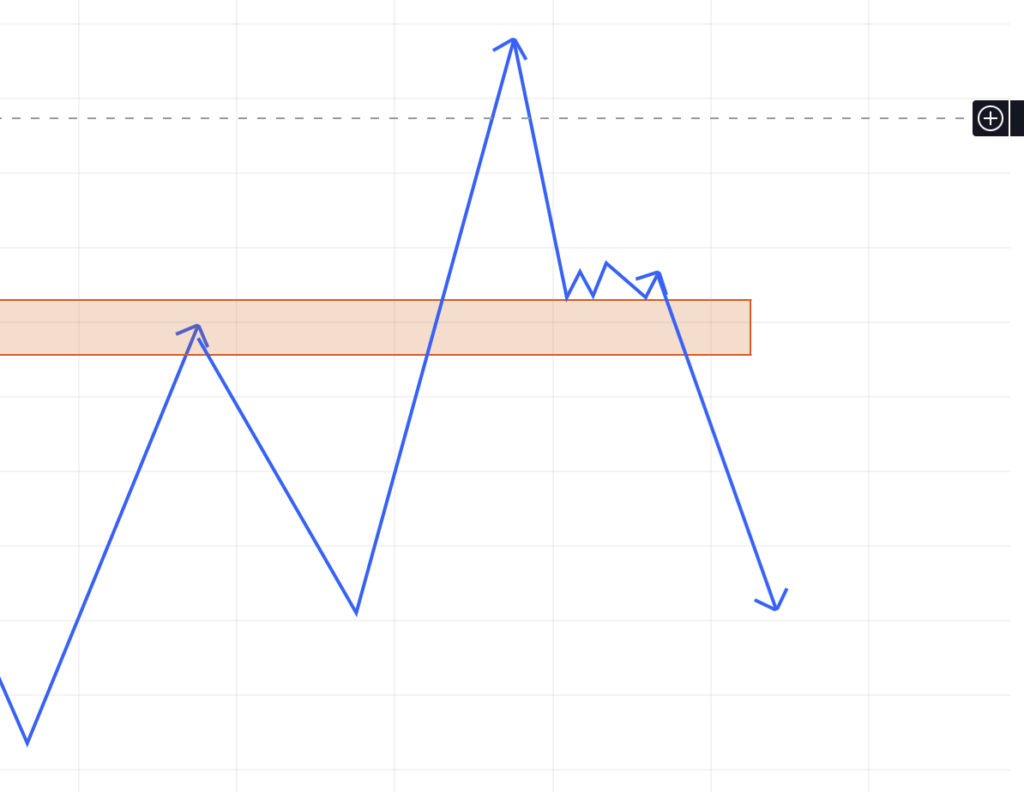

Here is an example of how the break and retest strategy works:

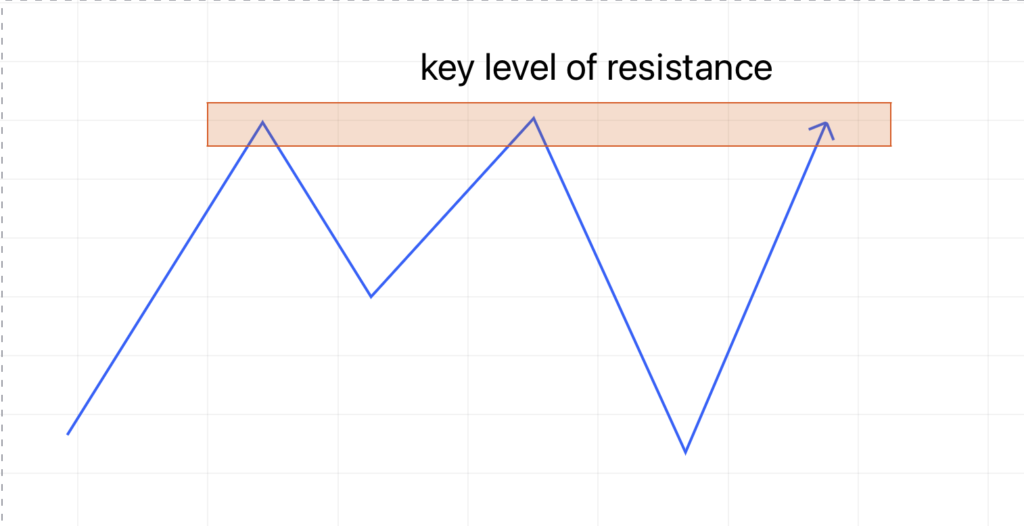

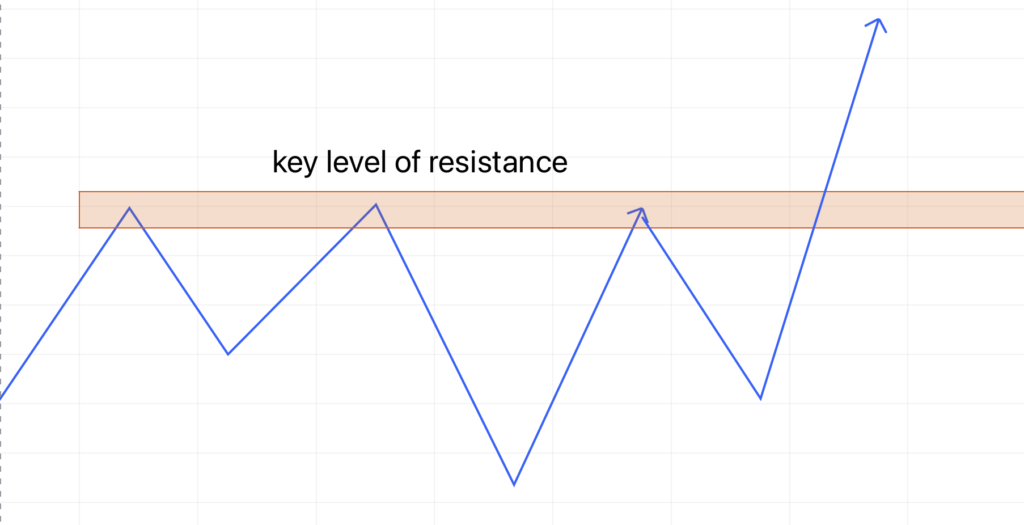

In this example, we can see that the price has been struggling to break through a key level of resistance. This level of resistance has been tested multiple times, but the price has been unable to break through it.

However, eventually, the price breaks through the key level of resistance and moves higher. This is known as a breakout and it is often accompanied by increased volume, which can be a good sign that the breakout is genuine.

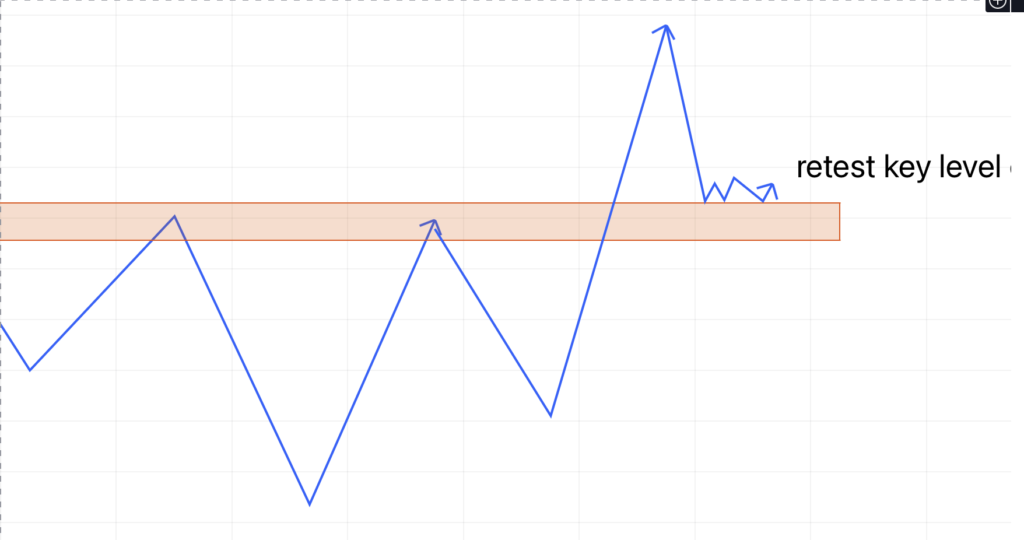

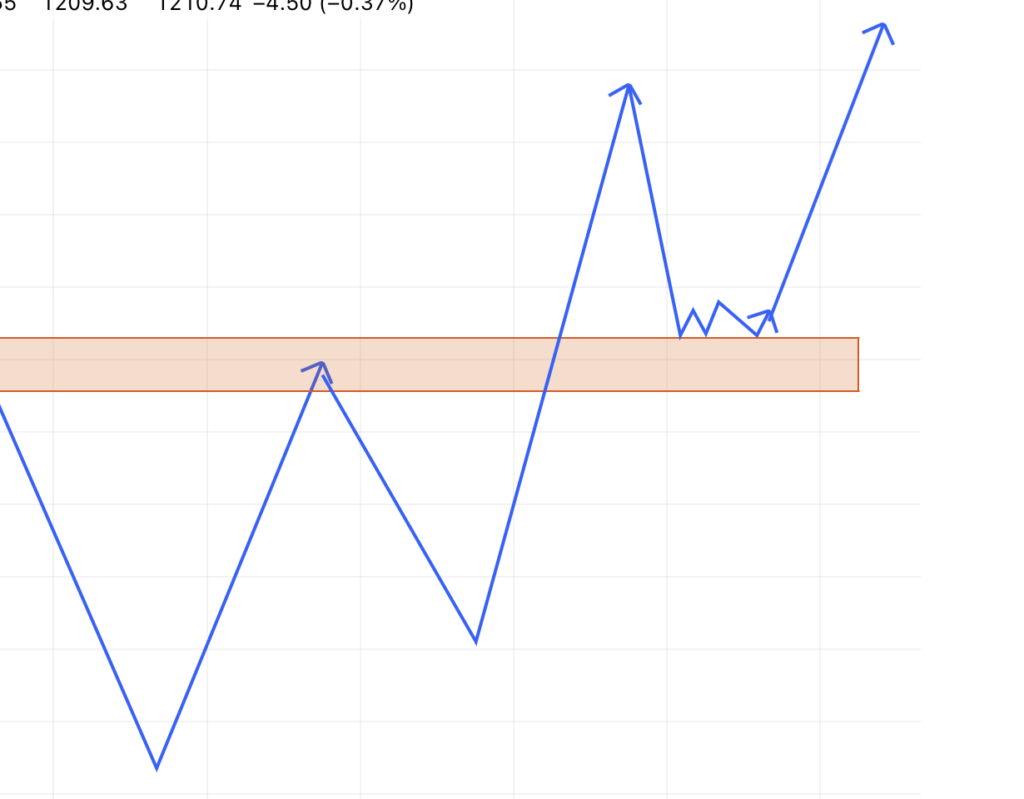

After the breakout, the price will often retest the key level to see if it still holds as resistance. This is known as a retest and it gives traders the opportunity to enter a trade in the direction of the breakout.

If the price successfully retests the key level and holds, then it is a good sign that the breakout was genuine and the uptrend is likely to continue. Traders can then enter a trade in the direction of the breakout and potentially capture significant profits.

On the other hand, if the price fails to hold at the key level and breaks through again, then it is a good sign that the breakout was not genuine and the uptrend is likely to reverse. In this case, traders should avoid entering a trade or consider closing any existing trades in order to limit potential losses.

I hope these charts are helpful in illustrating the concept of the break and retest strategy. Just be sure to keep in mind that the break and retest strategy is not a foolproof way to trade the markets and it is always important to use proper risk management techniques when trading. This includes setting stop-loss orders and only risking a small percentage of your account on each trade.

Conclusion

The break and retest strategy can be a highly effective way to trade the markets, especially in trending markets. By identifying a key level of support or resistance, waiting for the price to break through that level, and then entering a trade in the direction of the breakout, traders can potentially capture significant profits. Just be sure to use proper risk management techniques and always be aware of the potential for losses.

One Response

sense it