The risk and reward ratio – another term that we will heavily talk in the future.

Before we talk about the risk reward ratio, let’s first talk about the risk that we will come across when trading forex,

The Forex market is the world’s biggest financial market, with an average daily trading volume of $5.1 trillion and That is one of the major factors that enhances the attraction of the forex market.

Also, people from social media post photos like Trading from the beach, Trading in their Lamborgini with flashy Gucci outfit and show their million-dollar trades in their smartphone. I’m not saying they are lying. But what happens is lots of new traders get into Trading with totally different mindsets. What they are looking for is to own a Lamborghini within a few weeks. Or in other words they get into Forex trading with the mentality of Get-rich-quick scheme.

Due to the rise of the internet, forex brokers also offer few-click account registration and leverage trading that enable the small trader to trade with a small amount of capital. I’m not saying that is bad, I’m saying is that most of them get into Trading with a little bit of capital and hoping to make millions without even understanding that leverage trading also involved massive risk if it is not used correctly.

Please Keep in mind that,

Because it is easy to get in, it doesn’t mean that it is easy to trade.

According to the research, 90% of traders lose their money within first three months trying to make millions by trading forex. These amateur traders don’t even know about the risk that is involved in the forex.

How to Manage Risk in Forex Trading

Before we talk about Reward, Risk: Reward ratio or R-multiple, let’s first talk specifically about RISK that involved in trading Forex. When talking about the risk, we have to consider some factors where the risk is involved.

Losing a trade is not the only risk involved in forex trading. There is another one- Get-Rich-Quick scheme. Yeah! There is more risk that comes with trading forex, but for this lesson, we will only focus on this.

Get-Rich-Quick Scheme

This is the main reason that most people are attracted to Forex trading thanks to social media and showy ads. Then they open a trading account with a few minutes & start to trade like there is no tomorrow. In Forex dialect, we called it overtrading, which is one of the main emotional problems that cost lots of money.

What cause overtrade? The answer is simple. It is to get rich quick and own a Lamborghini. But what happens is these new traders losing more money by trying to trade every move and every currency pairs instead of waiting for higher probability setup.

So how to avoid this?

The first thing is, you have to understand that Forex trading is not a Get-Rich-Quick scheme method. It is an investment method. Secondly, don’t trade with your hard-earned money right away. Try Demo Trading. It is a secure way to understand market nature and practice your edge.

The Risk And Reward Ratio

In the beginning days of my trading, I used to say, “Wow, I made 50 PIPs from this trade.” Soon after I realised that telling my P&L (profits and losses) utilising PIPs only tells me a part of a story, then I switched to the R-multiple method which is a very effective way to calculate trading P&L.

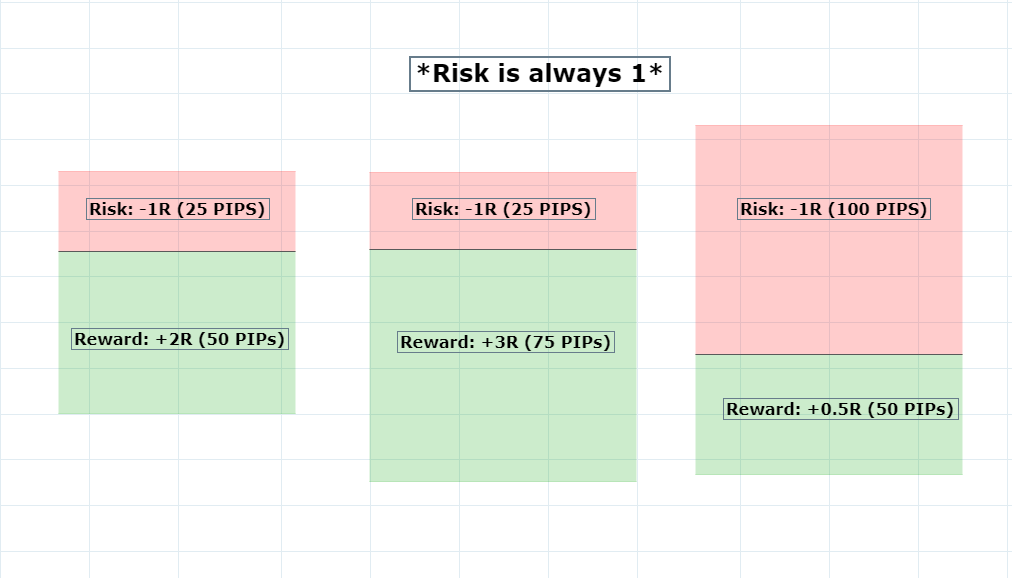

50 pips profit from a single trade is useful if the risk is 25pips mean that the reward is twice as a risk. But it is not helpful to risk 100 pips to make only 50 pips. Why risk more to earn the small right.

Look at the image below. In the first picture, profit is twice as much as your risk. Therefore Risk: Reward Ratio is 1:2. In the second example, however, the risk is twice as a reward. Therefore Risk: Reward Ratio is 1:0.5, which is terrible unless you have a trading system with a win rate of over 80%.

To further understand have a look at the sketch below.

While there are many different ways to trade, we can agree that a trading system with negative Risk Reward Ratio can also make money if it has a win of 80% or above. But in Forex, it is hard hit since there is no certainty in the market. As a trader, all we need is a trading system with good win-rate (40% – 50%) and a positive Risk Reward ratio.

So, Let’s take a look at how we can use Risk: Reward ratio with a series of trades.

R-Multiple

Have a look at the EURUSD 12Hour chart below. Let’s say you execute a buy order with one mini lot – which is $1 for each PIP- and put 100 pip stop loss. Unfortunately, price move against you and lose a 1R which is equivalent to $100 ($1 X 100pips).

Let’s take the same scenario and this time you moved your stop-loss from 100pips to 50pips as the price pushed higher in order to cut some loses. And this time also price moved down and hit your stop loss, but instead of losing 1R (100pips) you reduced it to 0.5R(50pips). See, All the P&L can be expressed in multiple of the initial risk (R’s).

Let’s take another scenario with a profitable trade. Below is an NZDUSD 12Hour chart. We have 100 PIP (-1R) stop and 200PIP (+2R) target, which is equal to 1:2 Risk and Reward ratio. See, price moves in our favour and hit our 200PIP profit target, which is equivalent to +2R. Or in other words we made twice as we risked.

Here is the formula to calculate R-Multiple,

R-Multiple = P&L / Initial Risk

According to the above Trade Example,

R-Multiple = 200PIP / 100PIP = 2R

Relationship Between R-Multiple & Position Sizing

Consider the following trades,

Trade A: a $50 stop loss and $100 profit target

Trade B: a $100 stop loss and $200 profit target

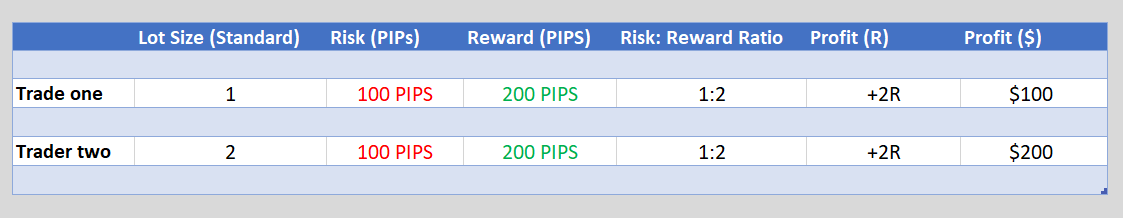

See, according to the above trades, Both trades have the same 1:2 Risk Reward ratio. When we assume that both are winners, we can say that both trades made 2R profit, Yet one trade made $100 profit while the other trade made a $200 profit. Why is that?

The reason is Position Sizing – No of units buy/sell based on the trader’s risk appetite.

Have a look at the table below. Both Traders use the same Risk Reward ratio with -100PIP stop and +200PIP profit target. But the only difference is that Trader one bought 1 Standard lot while the Trader two bought 2 Standard lots & this makes $100 to the Trader one, while the Trader two is making $200 even they had same 2R profit.

By using position size, We can change how much we risk per trade in percentage or Dollar when we are executing trades.

Usually, Position size can differ based on the strategy that trader use. Example: A trader with Fixed fractional money management use percentages, while another trader is use fixed dollar for the position size.

Conclusion

In today’s lesson, I have shown you how to use R and R-Multiple to measure your trading performance with risk in mind. Hopefully, after reading today’s lesson, you now know how important it is, to use positive Risk, Reward ratio for your trades.

If you follow our Instagram account (@trade_rev) you guys can see that I use a minimum of 1:2 risk, reward ratio for every trade. Like that, Consistently managing positive Risk & Reward ratio helps me to maintain a steadily rising equity curve each & every year.

Now, if you are using the Risk-Reward ratio in your trading, Nice, if not please add Risk-Reward ratio to your trade plan, otherwise it is harder to maintain a steadily rising equity curve.

Do you still have questions on how this works? Let me know in the comment section or Send a message to our Instagram account (@trade_rev).

2 Responses

Do you mean we should always enter a trade if the next support/resistance level is at least twice farther away than the previous one?

Yeah, you can use support and resistance level for planning your take profit level. What I mean here is that as traders we should always look for a favourable Risk: Reward for every trades while minimizing the risk as much as we can.