Welcome back to the weekly market review of Trade Revenue Pro. Today we’re going to talk about two trend reversal trading setups forming on GBPUSD and USDCHF. At the moment, both trading setups seem to be more obvious and the setup on USDCHF has already been completed and all we have to do is place orders.

But before that, let’s talk a little bit about last week.

How was your week? Is it rough or profitable? Let me know in the comment section.

For us, it was a highly profitable week. We were able to earn 7% from two profitable trades. Let’s briefly talk about these two trades.

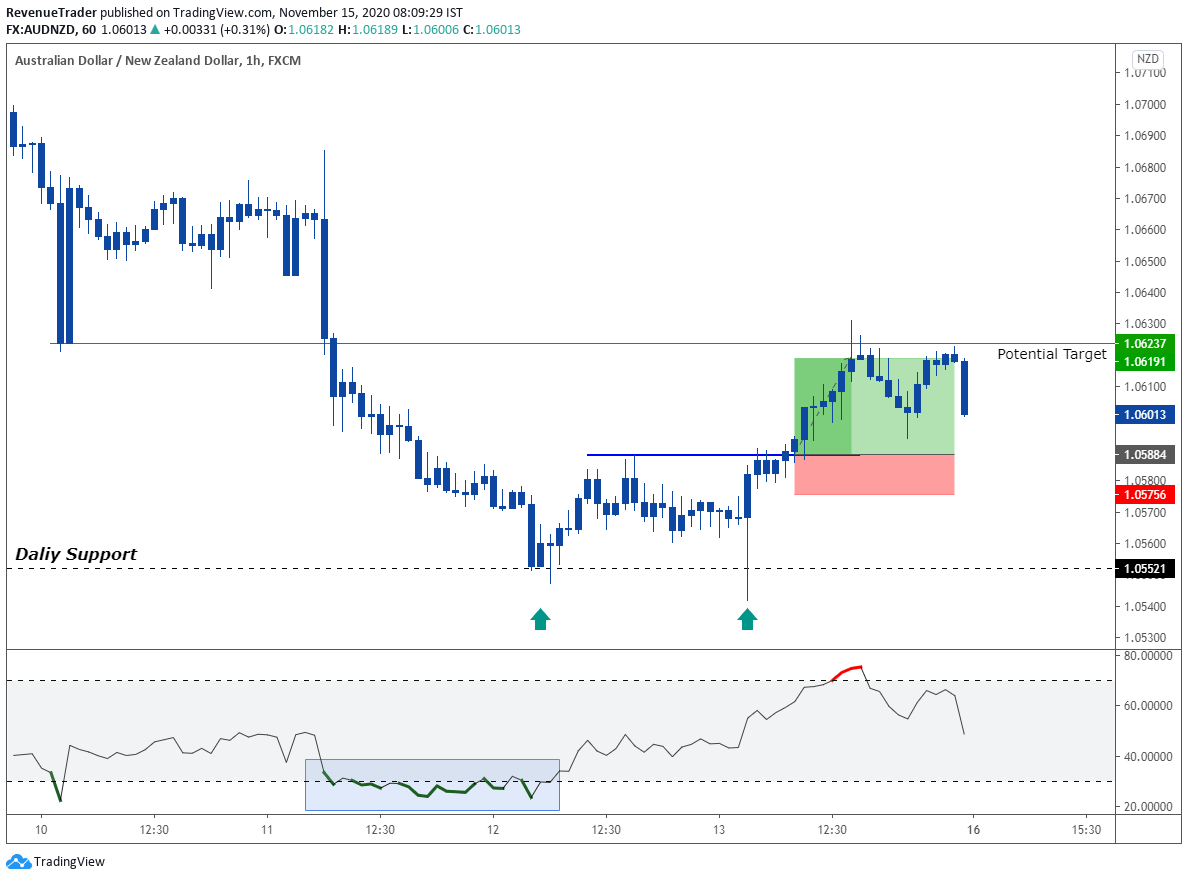

The first trade is on AUDNZD which help us to gain 2.4R which is equal to 1.5%. (our risk per trade is 1.5%).

Have a look at that trade below,

According to the above chart, you can see that price formed a double bottom at support level comes from the daily chart. Additional we had RSI over-bought and RSI divergence. After we identified all of these confluences we wait for a break above the local structure level to place our orders. As we expected price ended up breaking above the Local structure level and easily hit our target with no time.

Next…

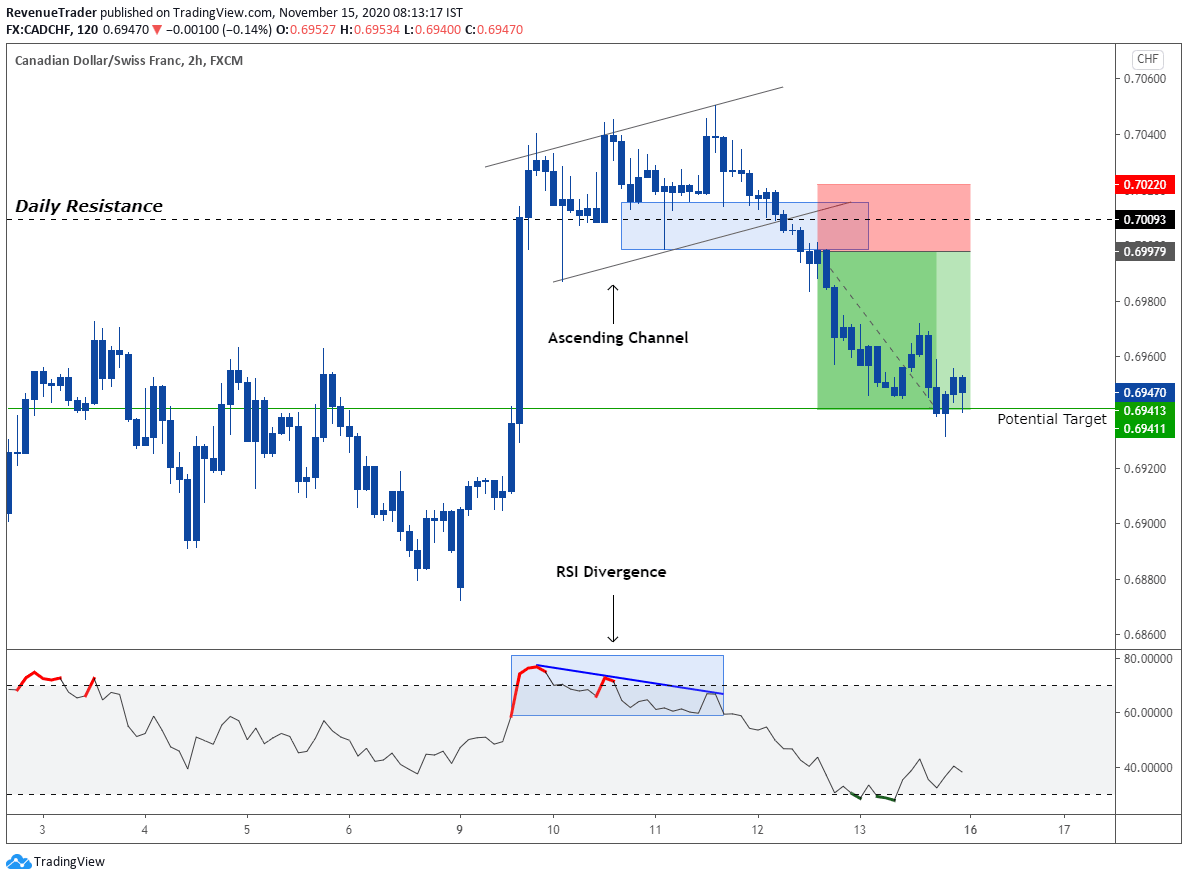

We had our second trade on CADCHF which also helped us earn 2.3R which is equal to 3.4%. (Again our risk per trade is 1.5%).

Have a look at that trade below,

Between these two trades, this is my favourite one. Because have a look at how technicals are aligned. I can call this a textbook trading setup.

Okay, have a look at the Ascending channel formed around daily resistance level. This indicates buyers are losing their control over the market with this we also had RSI divergence. Just like the previous trade, we placed our orders after price break below the local structure level and as the chart showed above, we ended having a quick profitable trade.

Okay, now let’s move on to this week market analysis and talk about GBPUSD and USDCHF.

Disclaimer: Trade Revenue Pro’s view on the Forex Charts is not advice or a recommendation to trade or invest, it is only for educational purposes. Don’t Blindly Buy or Sell any Asset, Do your own analysis and be Aware of the Risk.

Keep in mind, These are Just Market Predictions and not a Trade Signal or Trade Ideas, At Trade Revenue Pro We are Using Daily Time Frame to Identify Major Price Movements and Push Down 4-Hour Time Frame to Get Favourable Risk to Reward For Our Trades, Furthermore, We are Using Tight Risk Management Method to Preserve Our Trading capital.

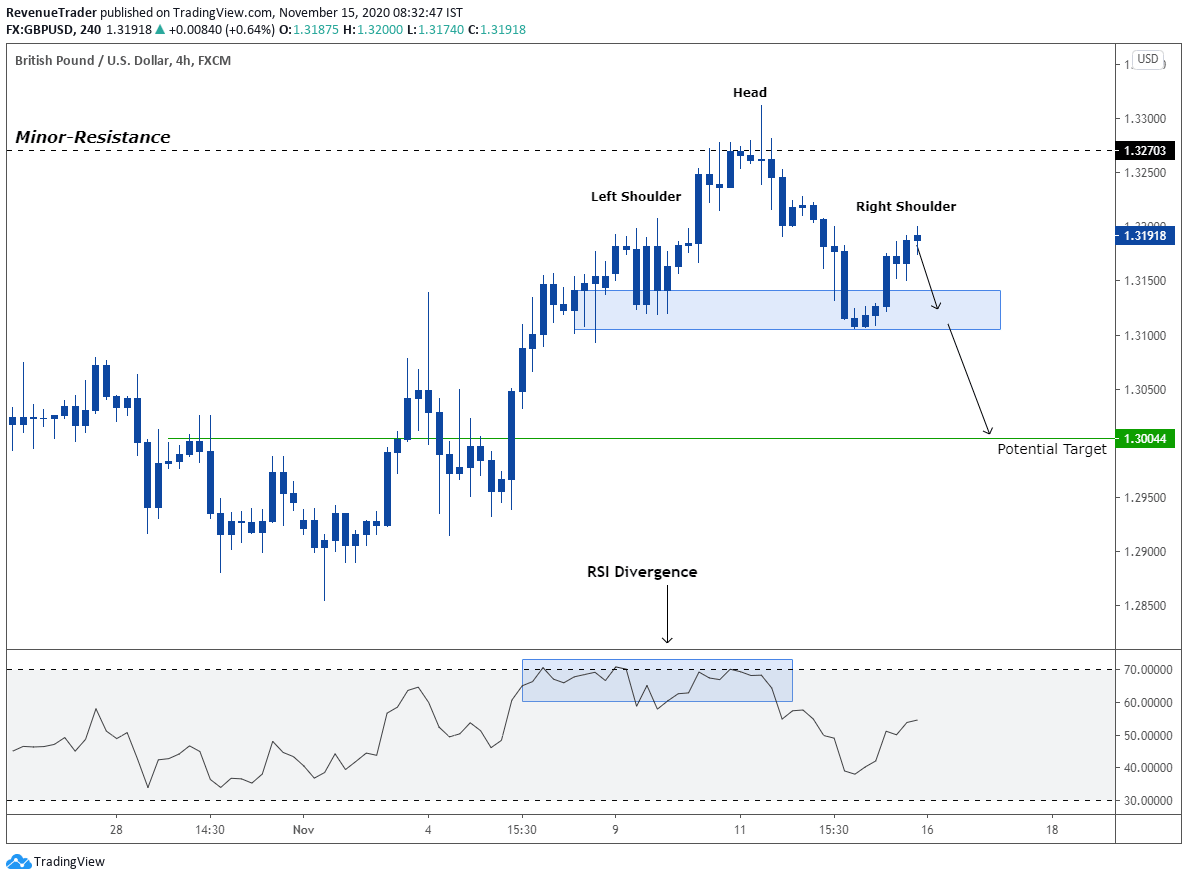

GBPUSD – Head and Shoulders Pattern at Resistance Level

Key Level – As the above chart showed price is rejected from a minor resistance level at 1.3270 which comes from the daily chart. Since this is a minor structure level, we need to careful when trading around this level.

Head and Shoulder Pattern – The head and shoulders pattern around the resistance level indicate the lack of buying pressure and have a look at how the head rejected from that resistance level. Also, keep in mind that the right shoulder is not finished until it hit local structure level again.

RSI Divergence – Divergence on RSI indicator also confirm the lack of buying pressure.

Market Forcast – At the moment the head and shoulders pattern is not finished yet we have wait for that. Until price trading above the local structure level, we have bullish bais. But in any case price break below the local structure level which is what we want, we can expect a trend reversal of the ongoing uptrend.

Trade Idea – If the price breaks below the local structure level, then we will consider placing sell orders after a successful retest of the local structure level. For take-profits we use 1.30044 marked area.

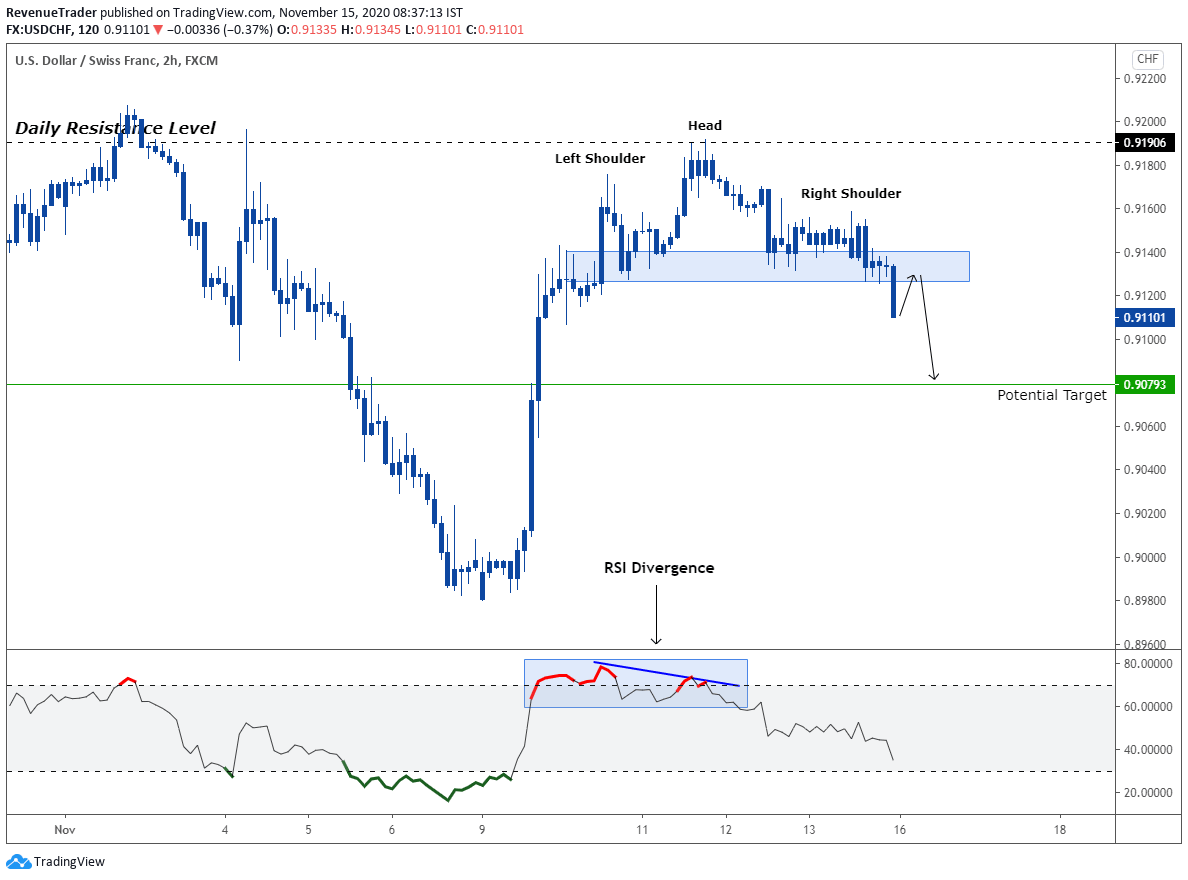

USDCHF – Wating for a Retest of the Local Structure Level

Key Level – Unlike the trade idea on GBPUSD, USDCHF is trading around higher probability resistance level at 0.9190 which comes from the daily chart. Additionally, we also have 0.9200 round number align at that same level.

Head and Shoulder Pattern – The head and shoulders pattern on GBPUSD (previous trade idea) is not yet complete but here on USDCHF, the story is totally different. The head and shoulders pattern here is completed and already break below the neckline as well.

RSI Divergence – RSI showed massive divergence and this is an indication of lack of buying pressure.

Market Forecast – Since price already broke below the local structure level, we can expect a bearish movement to the marked target area and there is a possibility that price could move all the way down to the previous swing low around 0.8980.

Trade Idea – Break below the local structure level is completed. Now we are looking for a retest of the local structure to place orders. As for take-profit, we use 0.9079 level and also try to maintain 2R risk to reward ratio for this trade.

Head over to our Trading Blog to learn more about how to trade forex with Proven Trading Techniques and Strategies.

Want more Trade Ideas – Head over to Trade Idea Page.

That is all for this week and If you want constant trade updates – consider following us on Tradingview.

Also, consider following us on social media and Pinterest, Instagram and Facebook.