This is what everyone is looking for…👇

THE SECRET TO FOREX TRADING, Right?

Well, this is a common thing among beginner traders.

Beginner traders are always looking for the magic bullet, the easy way or the shortcut. And for some reason, they think successful traders have access to the best trading strategies AKA Holy-Grail trading system to get to success in forex trading.

But here is the truth, there is no such a thing called Forex Trading Secrets.

The only secret that differentiates successful traders from losing traders (traders who are always looking for trading secrets, shortcut and Get-Rich-Quick) is the way they act and managing their trading activities.

We observed and extracted 17 forex trading secrets from experienced traders while the newbie traders appear to disregard totally. Specifically, here is what we are going to talk.

- The First Forex Trading Secret is There is No Secret

- A Proven and Clean Trading Strategy is All You Need

- Emotions are Always There

- News Brings Noise

- A Well Organized Trading Journal is Your Best Friend

- Real Traders are Not Always Winning, So Learn to Lose Properly

- Every Trading Method Have Green and Red Months

- Money Management Play a Crucial Role

- Give Your Best to Control What You Can Control

- You Don’t Need Intense Knowledge in Financial or Economics to be a Successful Forex Trader

- This is Not a Game of Intelligence

- Follow the “Middle-Path”

- Set Your Trading Goals Right

- Real Trading is Boring – Not Exciting

- There are 4 Stages in the Market – Read Them Wisely

- Set Realistic Expectations

- Focus on Price Action, Not the Indicators

I hope these trading secrets could make a world of difference in your trading. Let’s dive in.

1. The First Forex Trading Secret is there is NO Such a Things Called Trading Secrets.

Yeah! Unfortunately, this is the reality, accept it. Faster you admit, it’s easier for you to find a profitable path.

Although you believe that there is no hidden secret to forex trading, you also need to figure out “why you used to think that there is a secret to forex trading that everyone is keeping from you.”

The main reason you used to think like this is the infinite resources you can find on the Internet.

Think about it for a moment, after failing in one trading strategy, what are you going to do? You’re going to find a new trading strategy from Google, right? (One of the biggest mistake new traders fall in).

Next, when you’re looking for a trading strategy on Google, you’re going to come across a lot of stuff about trading strategy and how to use it to make money.

In those articles, everybody shares their personalized trading strategy, the way they use it in their trading, and so on. Among these articles, you’re nitpicking a trading strategy and thinking, “This is going to be the (next) Holy Grail trading strategy, and in no time can I become a better trader.”

This process will be repeated until you find a secret trading system which prints unlimited money.

Are you guilty of this? Then now It’s time to correct this. But how?

Simple. Stop finding the secret to trading, instead, work on finding your trading edge and gradually build it into a killer trading strategy.

Next, I want you guys to stop following Instagram traders, particularly traders who share their glamorous lifestyle and screenshots of their massive profits.

These things are going to mess up with your mind. Particularly when you’re watching a trade that you’ve taken going deeper and deeper against you, even if it’s executed in compliance with your trade plan.

So just stop searching those shortcuts. There’s no shortcut to Forex trading, it’s a long-term game. So instead of increasing the time span of your learning curve, do your homework properly.

There is No Secret to Success. It is the Result of Preparation, Hard work, and Learning from Failure.

Let’s move into the second trading secrets.

2. A Proven and Clear Trading Strategy is All You Need

First of all, what’s a trading strategy?

A Trading Strategy is a well-defined document that helps traders make buying and selling decisions based on a predefined set of rules.

These rules need to be proven and clear. A trading strategy with a complicated set of rules can only make your trading more complex. Priority should therefore be given to developing a clear trading strategy with proven trading techniques.

Now, how do you know that your trading strategies have proven to be profitable? Well, this is where back-testing comes in handy.

Go through historical chart data and test whether or not your trading strategy is profitable. When you’re back-testing, make sure you come up with a rule-based trading strategy, not a discretionary trading strategy. Discretionary trading strategies make it difficult for a beginner trader to trade consistently, therefore while back-testing makes sure to add strict set rules to buy and sell.

Tradingview provides a fantastic back-testing solution called Market Replay. It’s simple and comfortable. I highly recommend back-test on Tradingview.

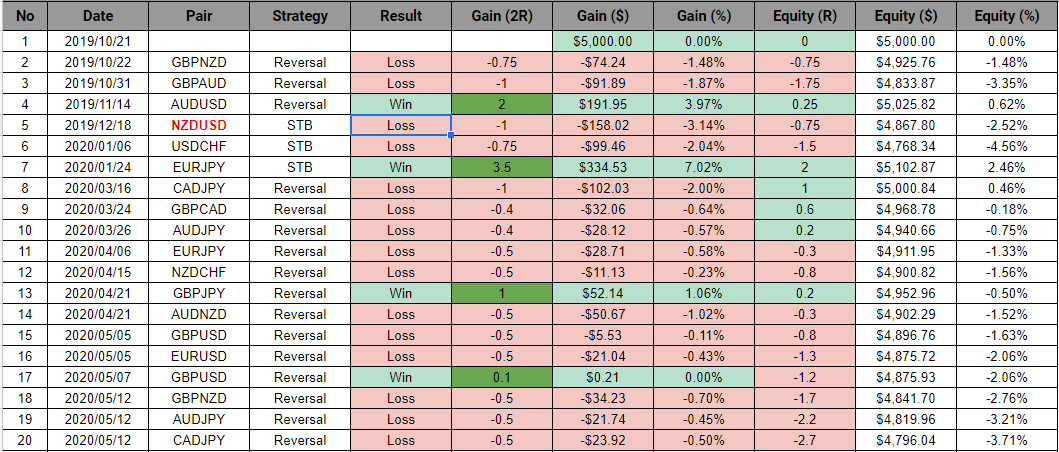

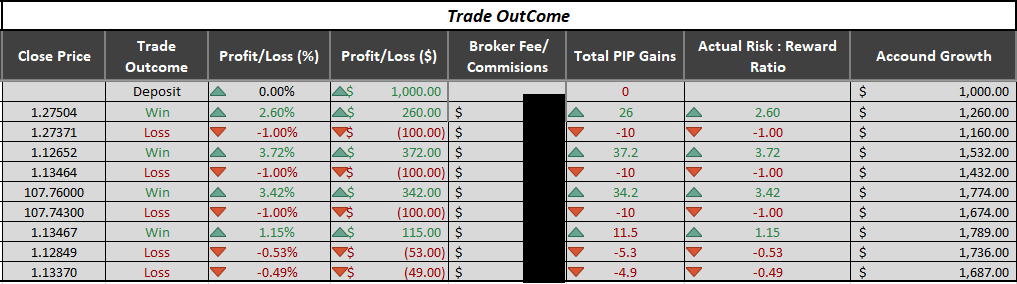

Also, make sure that you record every trade that you back-test on a spreadsheet. Have a look at our spreadsheet below.

Have you noticed something about the above data? Yup, that’s the number of losing trades. According to the test data listed above, we may conclude that this trading strategy has not proven to be profitable. As traders, what do we need to do in a situation like this?

Jump to a new trading strategy. NO!

Instead, fine-tune your trading plan, make a minor change, and back-test it again to see whether it’s different or not. This is the trading secret.

To be honest, we’ve never abandoned the above strategy, we fine-tuned it, made small adjustments to it, and eventually took it to the killer trading strategy, where it now allows us to consistently earn 2R to 5R every month.

Now assume that you have a killer trading strategy that is clear and proven to be profitable. Next, you need to write down your trading strategy in your trading plan while clearly describing your rules of engagement.

And finally, you have to trade it on a consistence basis, while managing your emotions.

In reality strategy is actually very straightforward. You pick a general direction and implement like hell.

3. Emotions Are Always Present…

Therefore, Instead of fighting against emotions, you should learn how to control emotion ups and down when trading forex.

Whether you’re planning a trade, executing a trade, taking profit or losing a trade, there’re a certain amount of emotions in it.

Now, where are these emotions coming from and messing up with your trading?

Withing Yourself, right?

What if you can observe and identify when these emotions are messing up with you, you can easily control them, and you can trade with emotional stability, right?

But, how to do this?

Simply put, you have to identify emotions at an early stage or in another perspective, I would tell that you have to identify and act before that emotion gets to a point where you have no control.

In fact, Vicki Botnick, a therapist in Tarzana, California, explain that any emotions – even elation, joy or others you’d typically view as positive – can intensify to a point where it becomes difficult to control.

With that here are the 5 ways to control your emotions in different situations.

- Select Situation – This is simple. You just have to avoid circumstances that trigger unwanted emotions. If you know that you are most likely to revenge trade after having a losing trade, then just stay away and focus on an entirely different activity for a few minutes and then come back.

- Modify the Situation – Perhaps the emotion you’re trying to control is a disappointment like losing a perfect trade which you had a lot of faith. In this kind of scenario, typical trading emotions like frustration, anxiety, and revenge trading are going to mess up with your decision-making, because what you eagerly expected didn’t happen. In a scenario like these, just simply adjust to the situation. As an example, modify the situation by thinking about all the profitable trades you executed so far and forget about this single trade.

- Shift Your Attentional Focus – Let’s say you are in a drawdown and having a considerable losing streak, and at the same time, you’re seeing other traders on social media are doing great with profit while you are in drawdown. It hurt, right? But in this kind of scenarios, stop worrying and compare your result with others. Just shift your focus on your past result and tell yourself – “Drawdowns are part of trading, and I will surely dig out of this drawdown”. Like that, instead of focusing on other traders result, focus on how you’re going to come out from drawdown. Not only for drawdowns, but this can also be applied to any problematic aspect you face in trading.

- Change Your Thoughts – This is simple, You just have changed your thought. You may not be able to change the situation but you can at least change the way you believe the situation is affecting you. For example, just after you placed a trade, you have to stay middle, thinking, this trade can be a winner or loser, whatever the outcome, I’m going to accept it. In the end, if it is a loser, instead of worrying about it, change your thought on how well you manage risk on that trade. That way at least you change the situation, right?

- Change Your Response – If anything else fails, and you can’t avoid, modify, shift your focus, or change your thoughts, and anyhow that emotion comes out, the final step in the emotions control is to get control of your response. Your heart could be beating out a constant of uncomfortable feeling when you’re made to be nervous or frustrated. Take a deep breath, maybe close your eyes or move out from your trading station to calm yourself down.

There you have it, this 5 step approach is one that any trader can apply to the most trading situation that causes trouble. Knowing the emotional trigger will help you stop the problem first. Being able to change your thoughts and emotions can create your confidence in your ability to cope.

Win, loss whatever emerges in the short-term, place and manage your next trades untouched, unattached… always keeping your eyes on the long-term picture.

4. News Bring Noice

For me, trading news is like rolling the dice and its pure gambling.

In the early stage of my trading career, I did try news trading in many different ways, in many different timeframes.

Eventually, I ended up failing and but I learned two valuable lessons.

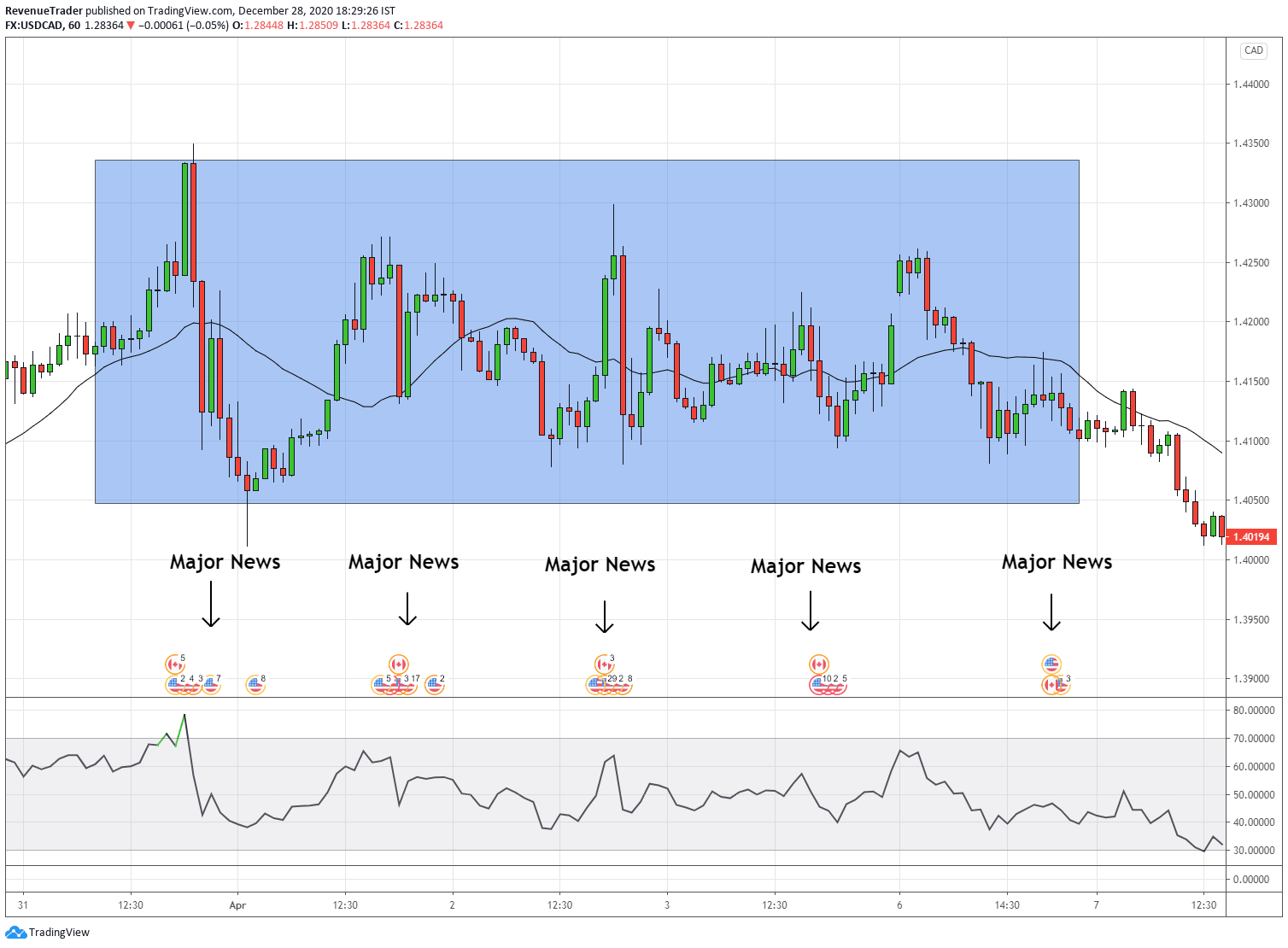

First one is news bring noice to chart. News can turn readable chart into an unreadable chart. Have a look at the chart below,

Have look at the highlighted period and news releases. 5 Major news announce release at that period and this lead to flat and unreadable price action on the chart.

So be careful when trading with news announcements.

The second lesson I learned is that Market news mess up with your decision-making process.

Since news events create higher volatility price action behaviour, we as traders need to make a trading decision within a snap of a finger. Not only that, but we also need to actively manage the trade as well. Sometimes news event never leaves a time to manage a trade.

The best thing you can do as a trader is to stay away from the news.

Trading effectively is about assessing probabilities, not certainties.

5. A Well Organized Trading Journal is Your Best Friend

After getting a series of trade losses or a drawdown, Trading Journal lets you view your trading in an analytical manner that eventually helps you make sound and rational trading decisions by clearing your cloudy thinking.

The main goal of keeping a well-organized and clear trading journal is to prevent you from taking impulsive trading action, which will ultimately result in saving you in unnecessary losses and drawdowns.

Now, what is the best way to keep a trade log?

Using a spreadsheet. This is the best way to do it. One of the key benefits of using a spreadsheet is that it helps you to make different reports that offer a lot of useful details about your trading performance.

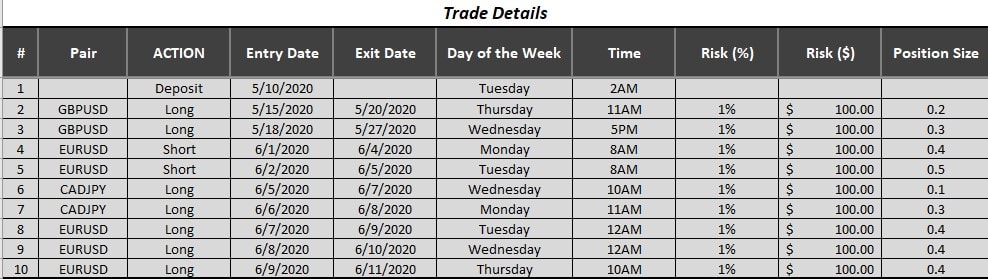

We separated each section in our trade journal for easy readability.

With that here is the Trade Details section where we enter all the data just after placing a trade.

And next, here is where we stored trade entry and exit details.

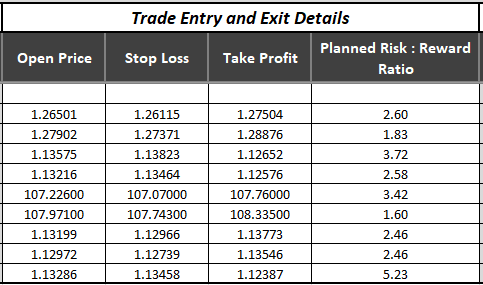

Finally, this is where all the outcome of the trades are stored,

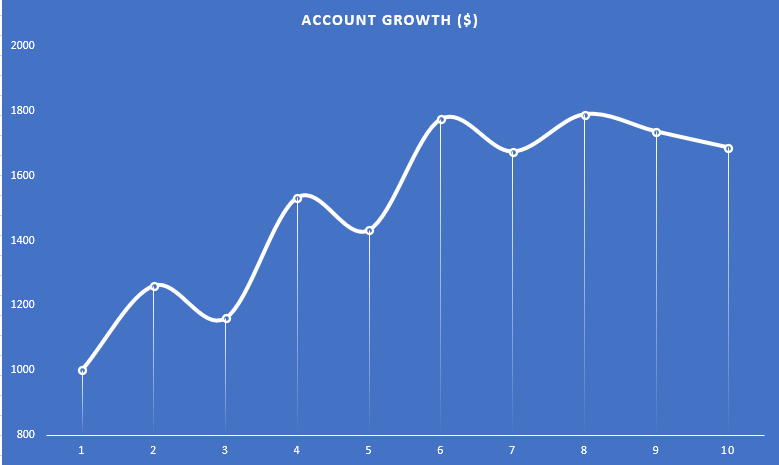

Through storing trade data in this way, you can easily review your past trades without putting a lot of Hussle into it.

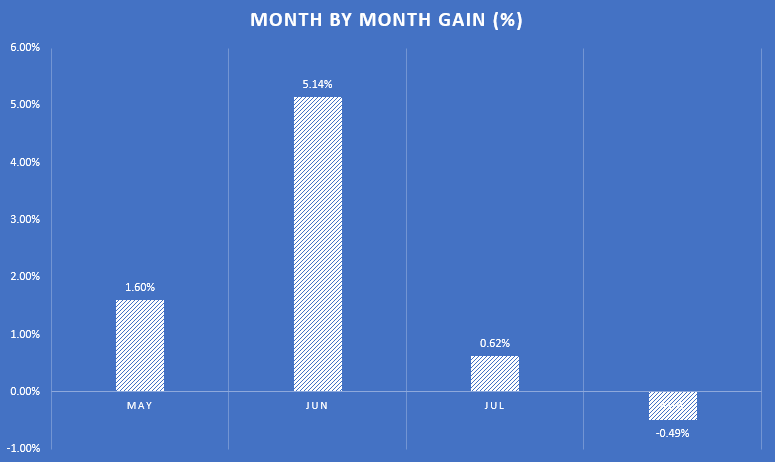

Another advantage is that you can visually display your trading results using various chart metrics.

Like using a Line chart to display your equity curve.

… and column chart to view month by month profit,

I think now you have the idea why a trading journal is such a valuable tool for any trader who wants to improve themselves as forex traders.

So, do you have a trading journal? Let me know in the comment section. Maybe I can help you to create a one.

Next…

6. Real Traders are Not Always Winning, So Learn to Lose Properly

You already know that loses are inevitable in forex trading.

The truth is, you’re not going to be happy to have a losing trade, right?

But, if we dig deeper, you should understand and, should be happy to get out of the market when the trade is no longer represent to be a profitable opportunity.

In forex trading, this is called “The Art of Cutting Losses and Letting Winner Run”.

Related – The Art of Cutting Your Losses Short – Forex Risk Management

Sadly, most traders, especially newbie forex traders, disregard the fact that how important it is to treat losers just like we treat profitable ones.

However, on the other hand, successful traders, instead of ignoring losing trades (like most traders do), they confront the possibility of being wrong, and therefore they know how to take a loss without hesitation on right time.

If you can adjust what these losses mean to you and acknowledge that getting out of losing trade as soon as you define it as such, you’ll be able to get rid of the stress that those losing trades are likely to trigger you right now. This is why it is so important to learn to love taking a loss. It sets you in an even better position to take on winning trades.

When you genuinely accept the risks, you will be at peace with any outcome.

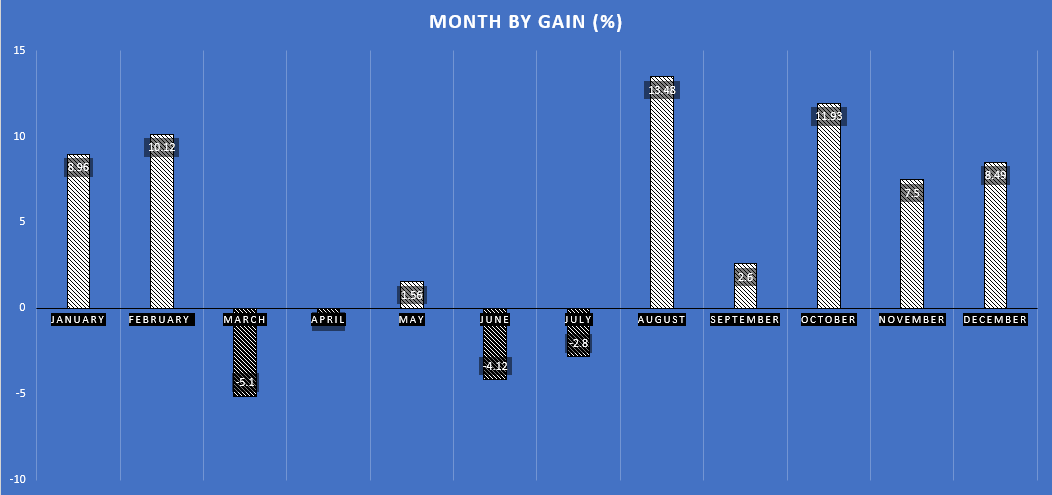

7. Every Trading Method Have Green and Red Months

Here is the thing:

Due to the high volatility, the Forex market is always changing. There are some months with strong and precise price actions while there some months where the price actions move sideways leaving unreadable price actions.

So as Forex traders, we cannot filter out which month is going to be profitable, all we can do is go through every month as normal and executing trading opportunities when it present according to the trade plan while prioritize on managing risk.

Therefore stop getting frustrated after having a negative month. As long as you profitably complete the trading year, you can always compound your trading result and can grow your trading account into a big one.

With that here is the percentage of the month by month graph in our trading account 2018.

Money is just something you need in case you do not die tomorrow. Let this is a reminder for you not to obsess over profits and losses. In whatever you do, strive for enjoyment, focus, contentment, humility, openness… Paradoxically (and as an unintended consequence) your trading performance will improve significantly.

8. Money Management Play a Crucial Role

What is Money Management in General?

Money management refers to the method of monitoring and planning the use of capital by an individual or a group. In personal and corporate finance, money management typically entails budgeting, spending, saving, and investing.

Next, What is money management in forex trading?

In trading, Money management is a strategy for increasing or decreasing the position size to limit risk while achieving the greatest growth possible from a trading account.

Note how both definitions focus on the growth of the capital not the downside of the capital. To protect your trading capital you can use the risk management, and money management is for geometrically growing your trading account.

Therefore don’t think Risk and Money management are just one thing. There totally different as the earth and the moon.

The main object of good money management is to focus on one thing alone, and that is account performances.

With that, here is a brief review of different Money Management techniques:

- The 2% Rule – The Money Management strategy of beginner traders. In here trader uses a percentage of his/her trading account for each trade. Growth is slow and risk is low.

- Fixed Fractional – Trade 1 contract for every X amount of dollar. If X amount is large, the growth is slow and risk is low. If X amount is small, Growth is geometric, and risk is high.

- Fixed Ratio – Use a metric called Delta, and use to determine when to increase and decrease the position size. Growth is geometric, and the risk is low. The best all-rounder among these 5 techniques.

- Optimal F – Use the optimum version of the fixed fraction from a set of trades. Growth is geometric, and the risk is high.

- Secure F – A more secure version of optimal F. Grow is slow, and the risk is low.

Now among these 5 money management techniques, what is the best one?

We recommend the fixed ratio money management method. One of the core benefits of this method is that it gives you more control in drawdowns.

With that, if you didn’t use any money management strategy till now, I highly recommend you to implement a one.

Even a poor trading system could make money with good money management.

9. Give Your Best to Control What You Can Control

In the market, Forex or Stock, No one has control over it, right?

As traders all we can do is, participating in the movements while controlling what we can control. Here are things what we can control,

- When To Trade And When Not To Trade

- In Which Market Condition, You Put Your Trading Strategy Trade Or Not

- Risk Management

- Money Management

- Your Psychology Side Of Things

- Your Trading Routine

- Risk Reward Ratio

With that here are the things that you don’t have control over,

- The Market Itself

- A Trade After It Placed

- Momentum

- News Events

Therefore, put your best focus to control what you can control. If you do that, You can easily control and overcome the problem of your psychology side your trading.

Take the Control of Your Trading, Not the Market

10. You Don’t Need Intense Knowledge in Financial or Economics to be a Successful Forex Trader

Let me ask you a question, How do you define a consistently profitable trader? Let me know in the comment section.

For me, it is someone who talented at placing and managing their trades. It doesn’t matter if he/she has in-depth knowledge about the economy or financial.

At the end of the day, a trader who handles their trade precisely would certainly over-perform the so-called “Trading Expert or Technical/Investment Analyst.” Most of these guys are just good with historical chart data, most of them are struggling like hell in real-time.

Also keep in mind that, as traders, our first job is capital preservation. So make a habit to think like a Risk Manager.

In fact in his book Trading in the Zone, Mark Douglas also defined traders as Risk Managers.

So instead of following trading signals from others, Be engage with the market and get experience, and through that be an expert in manage your trade precisely.

Don’t blindly follow someone, follow market and try to hear what it is telling you

11. This is Not a Game of Intelligence

“Most of the trading industry failures are also some of society’s brightest and most accomplished people. The largest group of consistence losers is composed primarily of doctors, lawyers, engineers, scientists, CEOs, wealthy retirees, and entrepreneurs.”

Above phrase is a copy from a Trading in The Zone by Mark Douglas. According to the above phrase, he clearly defined trading in not a game of intelligence.

This is the truth, No matter how smart you are, You cannot outsmart the market.

Now you are probably thinking if smart guys even fail, How do I become a successful trader, Is it even possible?

Yeah! It is 100% possible.

It is all about having a mindset, a unique set of attitudes, that allow you to remain disciplined, focus, and, above all, confident in spit of the adverse condition.

A great start point is to start with general trading knowledge. Read everything thing you can read for free. Then instead of open a trading account and trade it right away (like most beginner traders do), start reading trading books related to trading psychology, these books put you in a better position to face any adverse condition you will face in the market.

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money

12. Follow the “Middle-Path”

The “Middle-Path” is a term that comes from Buddhism. If we can understand and practically bring it into trading, you’ll find yourself in a calm position regardless of the outcome of your trading.

Okay, let me start from a story of Lord Buddha…

The Buddha started his first teaching by asking his listeners to choose the Middle Way, the middle way between intense asceticism on the one side and sensual indulgence on the other. This exhortation to moderation underlies a great deal of Buddhist philosophy over the ages.

The time of the Buddha was a time of great religious upheaval and experimentation. Roaming renunciates of diverse religions, finding divine fulfilment and liberation from the misery of life, became a familiar sight of the Gangetic Plain

Before he was known as the Buddha or Awakened One, he was Siddhartha Gautama, a prosperous nobleman living a life of luxury.

Later, however, he fled his family, disavowed the lifestyle, and adopted the other extreme, becoming an ascetic practising mortifying austerity.

Statues representing this time of Buddha’s life portray an emaciated figure with all his ribs evident as he sits meditating. It is said that he survived a few grains of rice a day.

At the end of the day, the Buddha understood that both indulgence and deprivation were similarly futile, even counterproductive to his objective of awakening. Legend states that the day before his enlightenment, this moment of consciousness happened.

Close to death, the Buddha abandoned his austere principles and ascetic principles, and soon after he met a young woman called Sujata, who gave him a meal of rice and milk to restore his energy.

Having found fault in both extremes, the Buddha took the middle way.

The Middle Path influences a lot of Buddhist thought, including its more complex ideas.

For example, whenever the Buddha was asked whether or not the self exists, he stayed silent.

Afterwards, he talked to the student that if he had replied yes, he would have supported the idea of externalism; if he had answered no, he would have promoted annihilationism or nihilism. In the middle, in his silence, was the middle path.

Just like that, as traders, the “Middle Path” is such a vital principle that any trader must stick to.

In Forex trading…

Traders always get excited after having one or two profitable trades. Because of this enthusiasm, they ended up trading bigger position sizes, and this behaviour ultimately leads to the loss of all the money they’ve made.

And, on the other hand, after one or two trades have been lost, the majority of traders are worrying and have begun to overthink that particular trade – this results in revenge trading and over-trading, which eventually leads to bigger and needless drawdowns.

But…

If we remain in the Middle Path and treat all winners and losers the same, neither of these emotional issues will arise, and, simply following the middle path allows us to detach ourselves from the single outcome of a trade which helps us to concentrate on the overall trading process.

“The Middle Path is the way to wisdom” – Rumi

The Middle Path is the way to wisdom

13. Set Your Trading Goals Right

It is important to set a goal in our lives, whether it is business-related, health-related or trading-related. Goals provide guidance, something that aims while trading on the forex market and offers a sense of achievement every time a target is achieved.

In general, when setting a goal, we need to set SMART goals. Have a look at the image below.

Now, when in the forex trading, what kind of goals should we set?

Here are a few areas to keep in mind when setting goals for forex trading.

You Must Set Goals to Control Your Risk:

One way to reduce risk and set a robust risk control goal may be to set a percentage of your account balance on a given day or week, For instance – drawdown for a single trading day can never reach 5%.

You Must Set Goals to Maintain Good Risk to Reward Ratio

While managing your downside, it also important to maintain favourable risk-reward ratio for each trade, that way you can easily overcome from drawdown and also help you have small drawdown.

You Must Set Realistic Profit Goals

Not daily, Weekly or Monthly profit target. That is far more beyond the realistic Expectation. Therefore set annual profit goals. One of the main benefits of setting an annual trading goal is that time is on your side. Because of that, you do not need to rush things out to achieve your trading goals.

A man without a goal is like a ship without a rudder.

14. Real Trading is Boring – Not Exciting

Of course, it’s boring,

But,

The time is in our favour. That means you’ve got a lot of time on your side to think and plan the trade.

Becoming a consistently profitable trader is not about discovering the most exciting and fastest trading system out there. If you’re into such an excitement, look for a casino.

Becoming comfortable with boredom while also being able to maintain the focus on it is perhaps the toughest part of all this. But, that’s how it goes if your trading isn’t boring, then there’s something wrong with your trading.

If your aim is to become a consistently profitable trader, try to understand that Real Trading is Boring and Slow and that’s a good thing.

Here is an article about from forex4noobs on Dealing with Boredom in Forex.

If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring

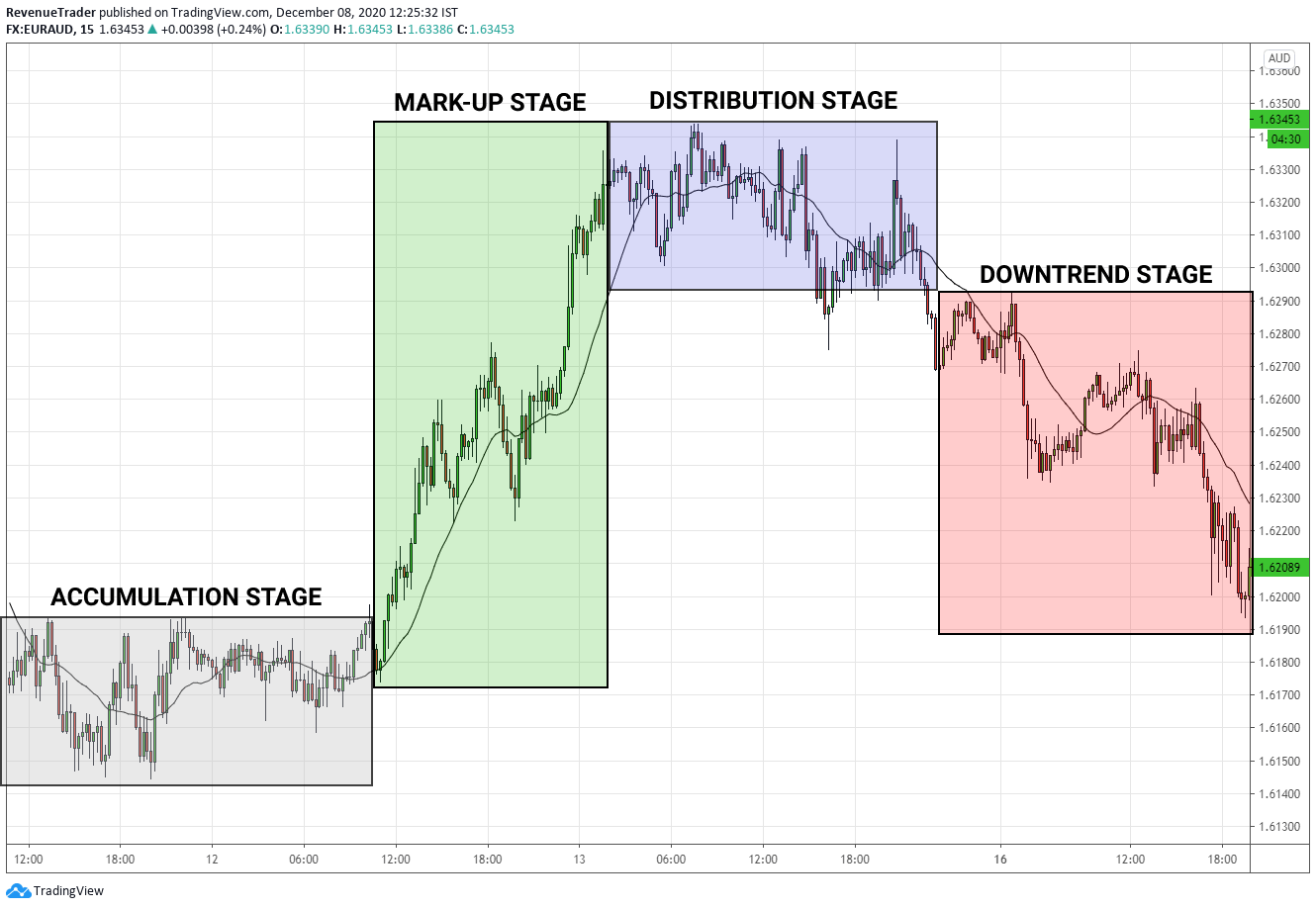

15. There are 4 Stages in the Market – Read Them Wisely

In forex trading, the market typically cycles through four phases. As traders, particularly as reversal traders, it is important to understand what these four stages mean to us.

But why is that?

Since these 4 stages warn you that the market conditions will change-allowing you to plan your trading decisions in advance.

- Accumulation Stage – This stage looks like a downtrend range market. This stage also advises traders about the lack of selling pressure in the present downtrend.

- Mark-up Stage – This is where the previous downtrend is heading in the opposite direction. Basically, the mark-up stage is an uptrend with highs and higher lows.

- Distribution Stage – This stage looks like a range market in an uptrend that indicates that buyers are losing momentum in the market.

- Downtrend Stage – This stage is basically a downtrend of lower lows and a lower high of prices.

With that here is how 4 market cycle looks in the real market condition.

Related – Reversal Trading: The Definitive Guide

Charts really are the ‘footprint of money.

16. Set Realistic Expectations

Traders often focus on indicators, technical tools, trade entries and some of them even wasting their time of finding the “holy grail” of trading.

However, when considering the longer-term profitability, these factors alone won’t make you a profitable forex trader. There are lots of sides you need a master in orders achieves trading success.

One of that overlooked factor is the Realist Expectation.

There is no doubt about it, lots of traders have unrealistic expectations, that is why failure rate of so high in trading.

Therefore, traders must have a realistic expectation about their potential returns.

Here is the thing, you cannot live from trading right away, right?

Therefore when you ready to trade in the live market, you must set realistic expectations in the right way and throw away all the unrealistic expectations which are beyond your ability to achieve as a trader.

So, stop setting those unrealistic trading goals like…

- Earning x% in a single day, week or month.

- Earning 50PIPs per day

- Doubling the trading account in every week

…instead, focus on realistic annual ROI like 40%- 60%. Not only these type of goals are realistic, but also gives you more breathing room to achieve.

40% – 60% ROI, is that enough?

You already know that trading is a longer-term game, and if you compound your trading account with 50% ROI, You can make lots of money.

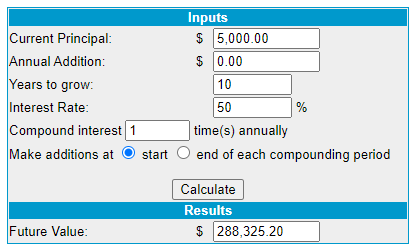

Not sure, Let’s clarify by using an example.

Assume that you have a trading account with $5K and you have the ability to complete each year with 50% ROI which is realistic, right?

Now if you take the profit of the first trading year, it is $2.5K. Not much, right? (50% from $5K trading account is $2.5K).

Next, let’s compound the result over 10 years. Have look at the compound interest calculator below. (We use money chimp compound interest calculator here).

See, this is where the magic happened? Over course of ten years, and, with 50% ROI, you can flip $5K trading account into $288K which is phenomenal gain, right?

See that is why setting realistic expectation is such an important in trading. I think you got the idea here.

I’ve learned that the long-game is the shortcut.

with that let’s move into the last trading secret.

Related Reading: How to Find More Balance in Your Life as a Trader – (10 Simple Ways)

17. Focus on Price Action, Not the Indicators

Be mindful that price behaviour is the King when it comes to quality and simplicity.

Also, price action is the key predictor of all else. If you use some other indicators, such as stochastic, EMAs and RSI, note that they all follow the price action and not the other way around.

Unfortunately, though, a lot of beginner forex traders are working on complicated trading strategies or systems with a belief in complexity that is going to rock the market and ended up not having the results they expected.

But successful forex traders know that simplicity is much more effective than complexity, particularly when it comes to trading on the forex market, and almost every successful trader that is consistent on the forex market uses at least some kind of price action strategies to improve their trading efficiency.

The argument here is that you should assign priority to price action. Why?

Since the price action reflects the actions of other market players (Bank, Hedge Fund and retail traders) and thus filters out the whipsaw price movements in lower timeframes, and allows you to make straightforward, objective and efficient trading decisions.

Related – Forex Price Action Trading Strategy – Price Action Entry Technique With Trade Example

The Market Speak its own language, That language is Price Action.

Now I’d Like to Hear From You

There you have it: 17 forex trading secrets.

Now I’d like to hear what you’ve got to say about trading secrets.

Have you learned any new trading secrets or strategy to upgrade your trading career to the next level?

Or maybe you’re aware of trading secrets or strategy I haven’t mentioned here.

Either way. Let me know by leaving a short comment below.

3 Responses

Really detailed article. Thanks for this. Could you please help me creating a trading journal.

Thank you for your comment; I sent you an email with an Excel Trading Journal attached. Please check your inbox.

The truth is not very attractive.

But reality helps us to reach our destination.

Thanks Dude.