Do you find it difficult to make consistent monthly profits from forex trading?

Then, this simple Profitable forex trading strategy is for you.

Before we get started, let me tell you something. If you follow the guidelines outlined in this article and implement the approach as instructed, I am assured that you will be able to make consistent profits month after month.

Now, what is this trading strategy?

This is a simple yet highly profitable forex trading strategy. The focus of this strategy is to cut our losses short and gain as much as possible. The main driver of this strategy is the Higher Returns and Small Losses.

Also, when developing this trading strategy we followed the popular term KEEP IT SIMPLE STUPID.

Hence, all the trading signals are generated by the trading system and all you have to do is to place your orders and manage them according to the rules of engagement.

Now don’t worry, you don’t have to purchase an indicator or an EA to trade this strategy.

With these things in mind, Let’s get started.

What is This Simple Profitable Forex Trading Strategy?

In this trading strategy, we use 50 simple periods moving average to determine the market trend and use bullish and bearish engulfing candlestick patterns to get into trades.

Basically, when trading this strategy, after determining the trend, we will ride that trend to gain as much as possible. Also if the trade is not going in our favour, then we immediately cut the losses.

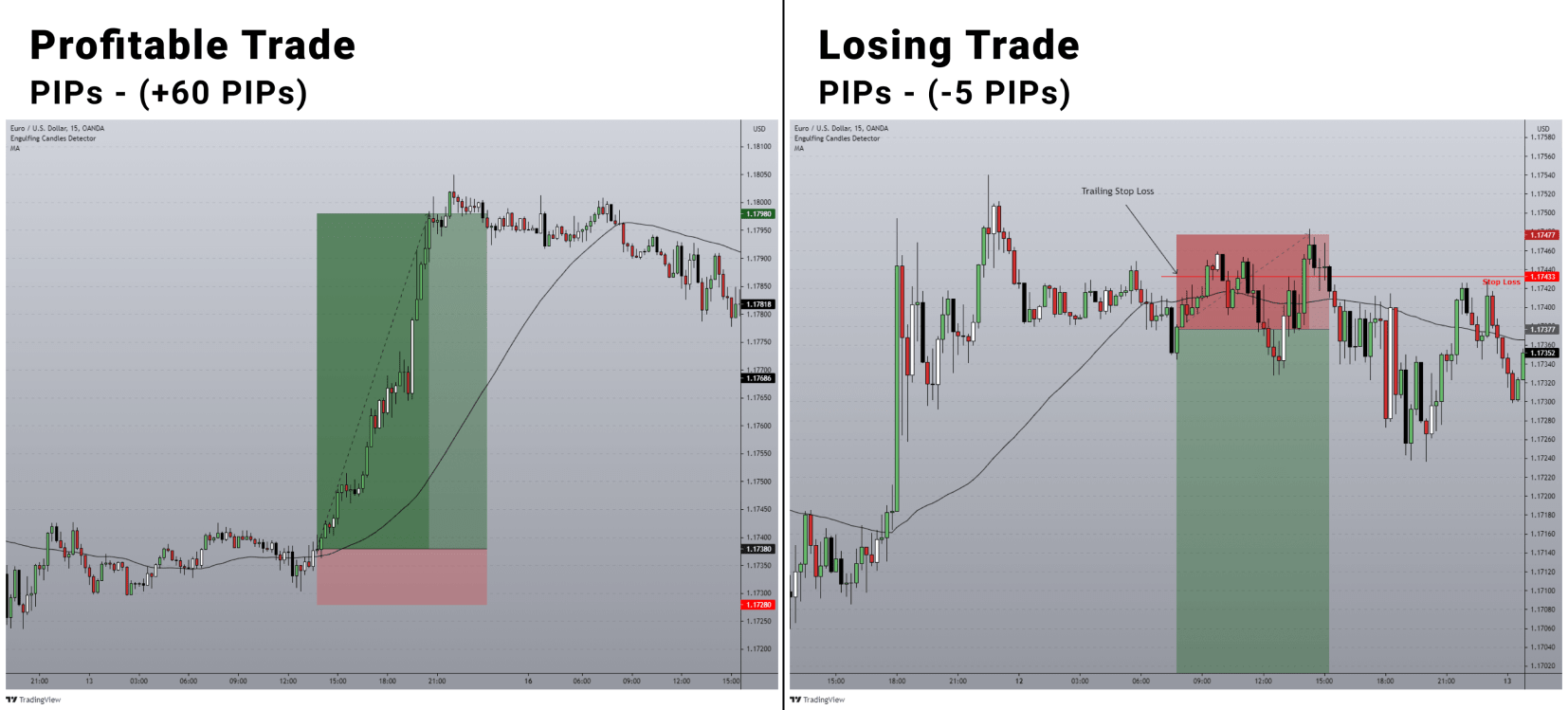

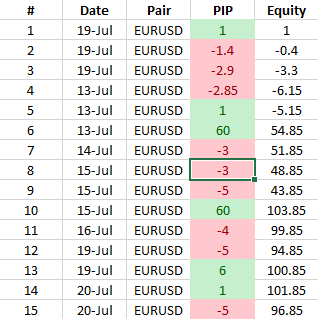

For example, have a look at the charts below. It represents how a profitable trade and a losing trade looks like.

+60 PIPs vs -5 PIPs. That is a huge return, right?

With these kinds of returns, achieving consistent monthly gain is simple. For extra clarification, have look at the excel screenshot of our trading journal. It represents how the profitable trades and losing trades are distributed.

Now according to the above trades, you can see that all the losing trades are below 5 PIPs and we got two massive profitable trades (two +60PIPs gains) which skyrocket our total profit.

In the above chart, we got a total of 15 trades. Among them, we only had two massive 60 PIP winners with some small winners and all others were losing trades.

Even though the number losing trade exceeded the number of profitable trade, we still ended with +96.85 PIPs in our hands. That is the beauty of this trading strategy.

Now I hope you got a brief idea about how this simple profitable forex trading strategy is going to work.

Next, let’s talk about what you need in order to trade this trading strategy.

Here are the things that you need:

- For charting you need Tradingview.com

- To determine trend directions you need 50 Simple Moving Average.

- Ability to spot bullish and bearish engulfing candlestick patterns to find the entry point.

- Ability to effectively manage your emotional ups and downs to let your profit run as well as to face lots of small bunch of losing trades.

Now with that said, let’s move forward and set up your trading environment.

Setting Up Your Forex Trading Workspace & Your Mindset

Personally, I am a huge believer in keeping things simple. That’s why I try to make my trade simple and rule-based. That way, I’ll be able to concentrate and follow my trading process more effortlessly.

So, in this chapter, we’ll discuss how to set up your trading environment in a more simple manner so that you can avoid complications and focus on your trading process.

Let’s get started.

First, head over to tradingview.com and open a free account. Then follow the below video to set up your tradingview chart.

Ok, Tradingview is now ready. But from which platform are you going to place the trades? It’s up to you.

Personally, I use Tradingview for charting purposes and Meta Trade 4 (MT4) for trading purposes.

The choice is yours.

Also, we are using a 15-Minutes timeframe for this strategy. So make sure that you are on the right timeframe.

Now your trading workspace is ready, right?

But…

Do you mentally ready for this trading strategy?

Let’s talk about it before we go into the trading technique like entry, take profit and placing stop loss.

Now, if you’re going to trade this strategy, here are the things that you’ll have to deal with mentally.

- You have to deal with losing trades.

- You will have 10 to 15 very small losing trades in a row. But it takes only one trades to wipe all of these losing trades.

- You will need emotional strength to execute a trade after losing one.

- The win rate of this trading strategy is fluctuating in between 35% to 45%.

What do you think? Do you have enough mental strength to deal with these?

If you want to make a consistent profit each and every month, you need to take control of your emotions.

Related: How to Control Emotions Ups and Down When Trading Forex – Trading Psychology

Since we have tremendous returns in this trading strategy, these small emotional problems will not be big deal.

With that let’s see why we are obsessed with bigger returns and smaller losses.

Why Obsessed With Higher Reward & Small Losses?

…Simply because of peace of mind.

Consider this: even if you have a poor win rate, you can still be profitable due to the higher risk to reward ratio. So you can be a calm trader since the win rate cannot bother you anymore.

That is one reason why I am obsessed with a higher risk to reward ratio.

When it comes to this trading strategy, the main objective is to decrease the size of losing trades while simultaneously exponentially increasing the gains of winning trades.

Think about for a moment, with a higher risk to reward ratio, to be profitable all you need is a trading strategy with a 20% to 25% win rate. Therefore, single losing trade or a series of losing trades doesn’t concern you since you know that one good trade will cover all of the losing trades.

When trading the forex market, Losing trades is one of the most common market events that can harm us, right?

But…

Due to the higher risk to reward ratio, losing trades cannot hurt you anymore because you have a gut in your exponential higher returns.

This means you’re removing (or effectively managing) one of the market events that appear to be causing you emotional pain. This is a significant step in the direction of becoming a successful trader.

As you can see, there are several reasons to be obsessed with a higher risk to reward ratio.

Related: A Complete Guild to Risk Reward Ratio & R-Multiple in Forex Trading

Now how do you go for such a high risk to reward ratio?

Let’s talk about that.

Trade Entry – How to Get Trade Entries with Higher RRR.

As you know, our trade entry is bullish and bearish engulfing candlestick patterns, and the best thing is, you have nothing to do. Every trade signal is generated by itself in the chart, so just relax and execute.

Now, let’s talk about the types of trade entries. We have three types of trade entries in this simple profitable forex trading strategy.

- Initial Breakout Entry.

- Breakout and Breath Entry.

- Pull Back Entry.

Let’s talk about these trade entries one by one.

Initial Breakout Entry.

This trade entry technique was developed to catch the trend early as possible or in another word, I can say that this is the first attempt to catch the trend.

Basically, we are waiting for bullish or bearish candlestick to break the 50 Simple moving average.

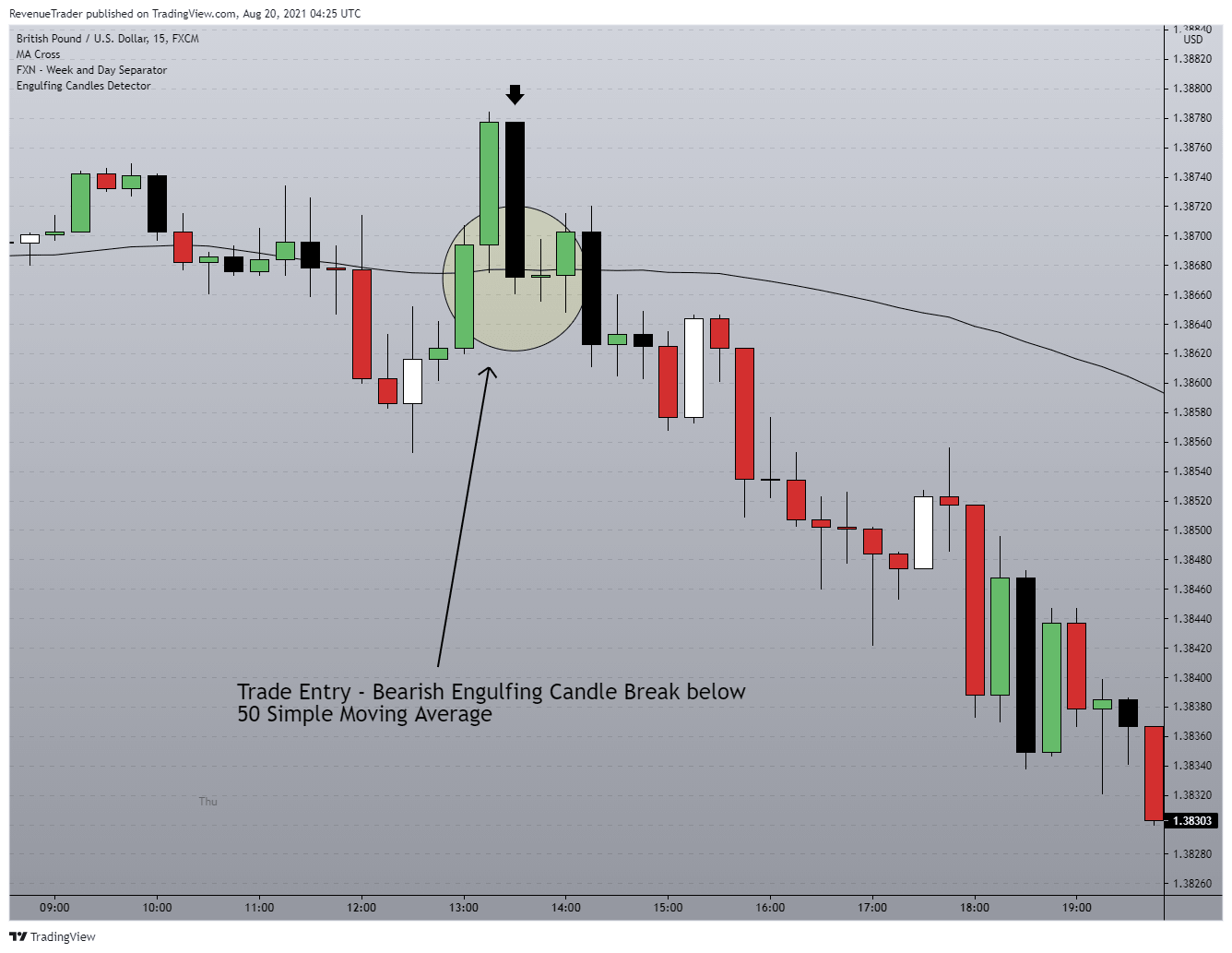

Have a look at the chart below,

Have a look at the marked area in the above chart (yellow circle). On there we can see that a strong bearish candle closed below the 50 Simple Moving Average.

This is what I call initial breakout entry and this is a bearish trade signal.

In the next chapter, we are going to talk about how to manage risk (Setting stop-loss and cutting losses). Therefore don’t worry about placing a stop-loss at the moment.

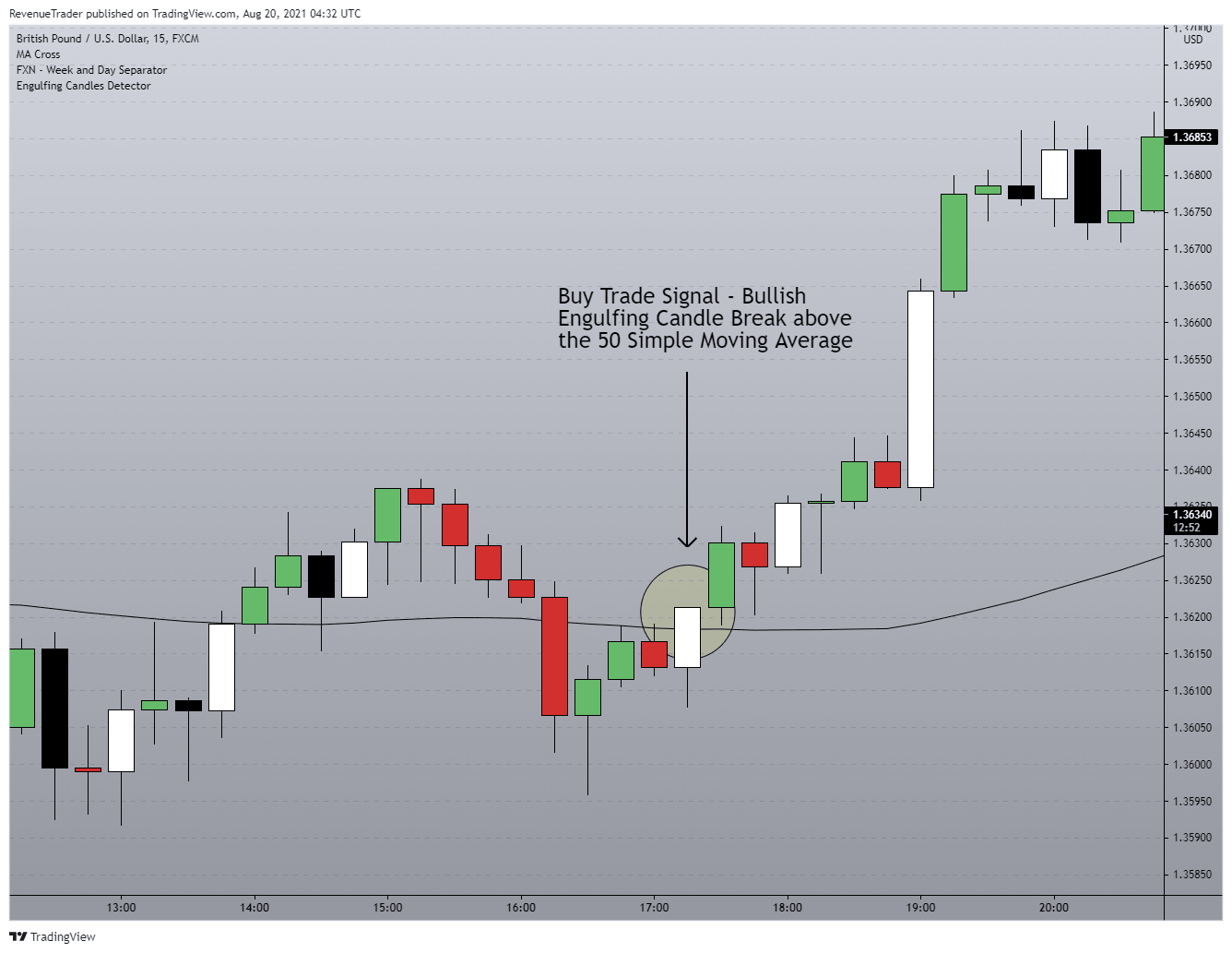

With that let’s talk about another example. Have a look at the chart below.

This time it is a long trade signal. Observe the above chart carefully.

On the marked area in the above chart, you can see a bullish engulfing candlestick pattern break and closed above the 50 Simple moving average. This is our buy trade signal.

Now, what happens if we do not get bullish or bearish engulfing candles when the price break the moving average? What happens if it is just a regular candle?

In that case, you simply don’t have any trade and if this kind of scenario occurred, you can go for the second trade entry technique. Which is…

Breakout and Breath Entry.

I use this trade entry technique if I were unable to get into the trade on the initial break of the moving average.

In here I wait for the market to slow things down after the initial break of the moving average, then like the previous example, I use bullish or bearish engulfing candlestick patterns to execute the trade.

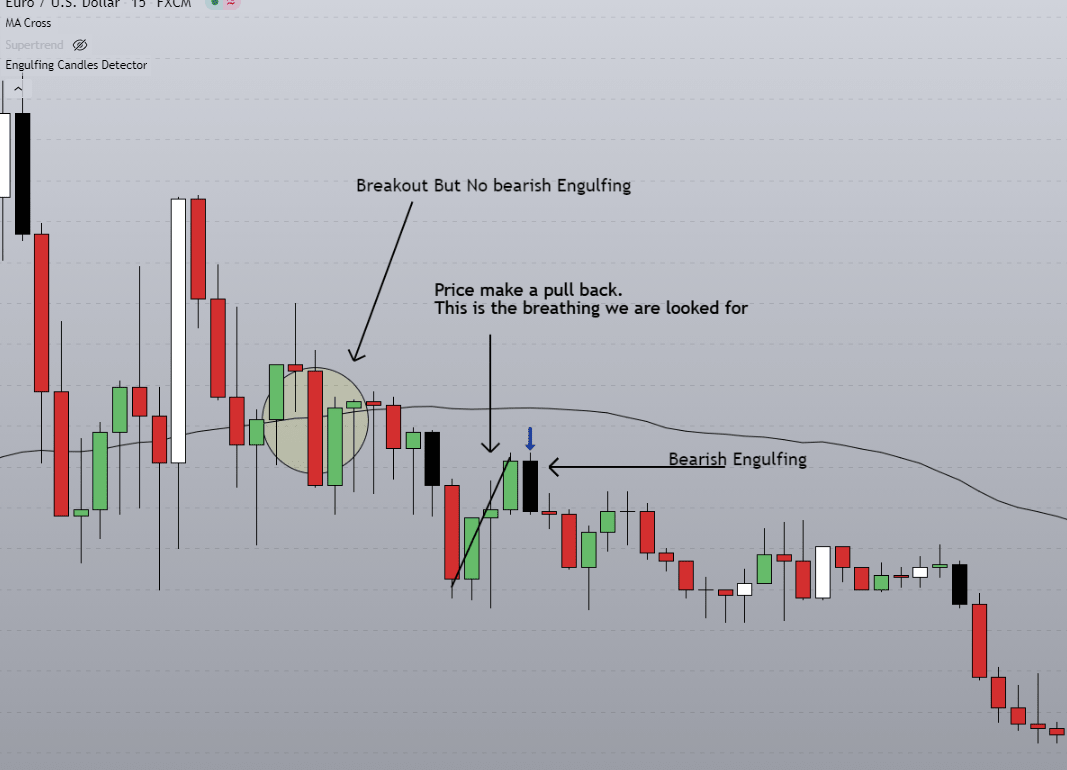

Now have a look at the chart below,

According to the above chart, you can see that we didn’t get any bearish engulfing candlestick at the initial breakout. But we did get a bearish engulfing candlestick after the break and pullback AKA after the breathing stage,

Now here we consider the marked pullback as the breathing stage. In the breathing stage, any bearish engulfing candlestick pattern is qualified to place a sell trade.

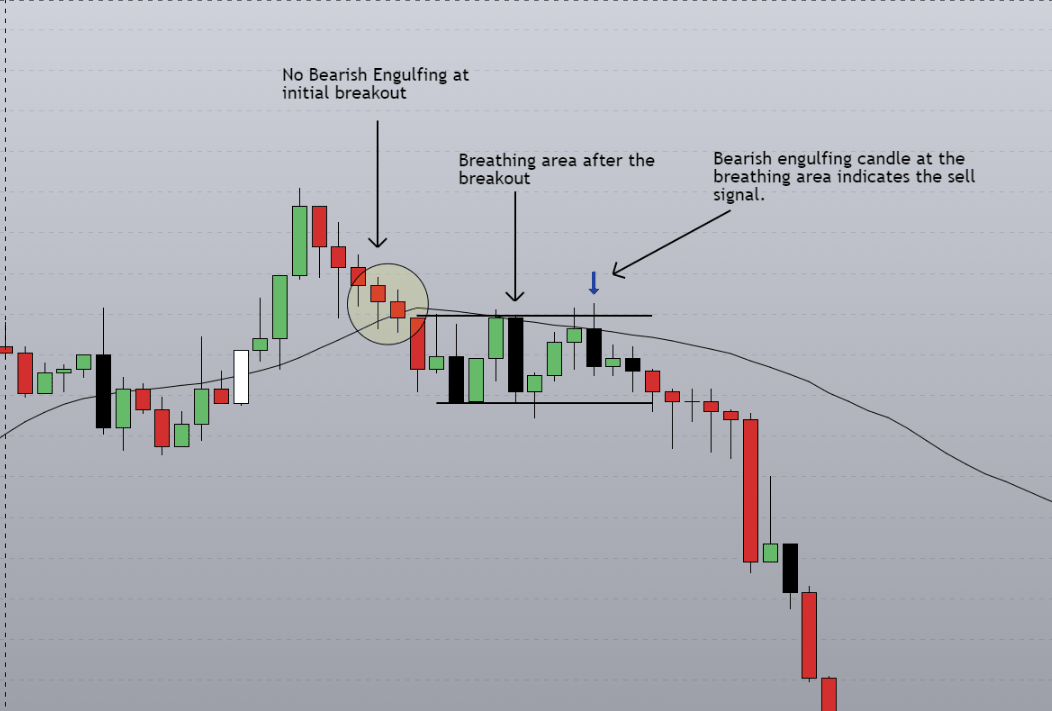

Let’s see another example.

Have a look at the above chart. Just like the previous example, we did not get bearish engulfing candlestick at the initial breakout. But inside the breathing area, we got multiple bearish engulfing. All of these candlesticks inside the breathing area are qualified to go short.

Also in this chart, we can get the small consolidation area as a breathing area.

Now assume that you missed both of these entry techniques. Now what?

This is where the last entry technique comes into play. Which is…

Pullback Entry.

I will use this trade entry technique when I miss both the initial entry and the breakout/breath entry.

When using this trade entry technique, most of the time we get into the trade in the middle of the trend.

Now, how does this trade entry technique work?

Simple. We wait for price action to pull back and touch the 50 MA and then wait for a bearish engulfing candlestick to place trade.

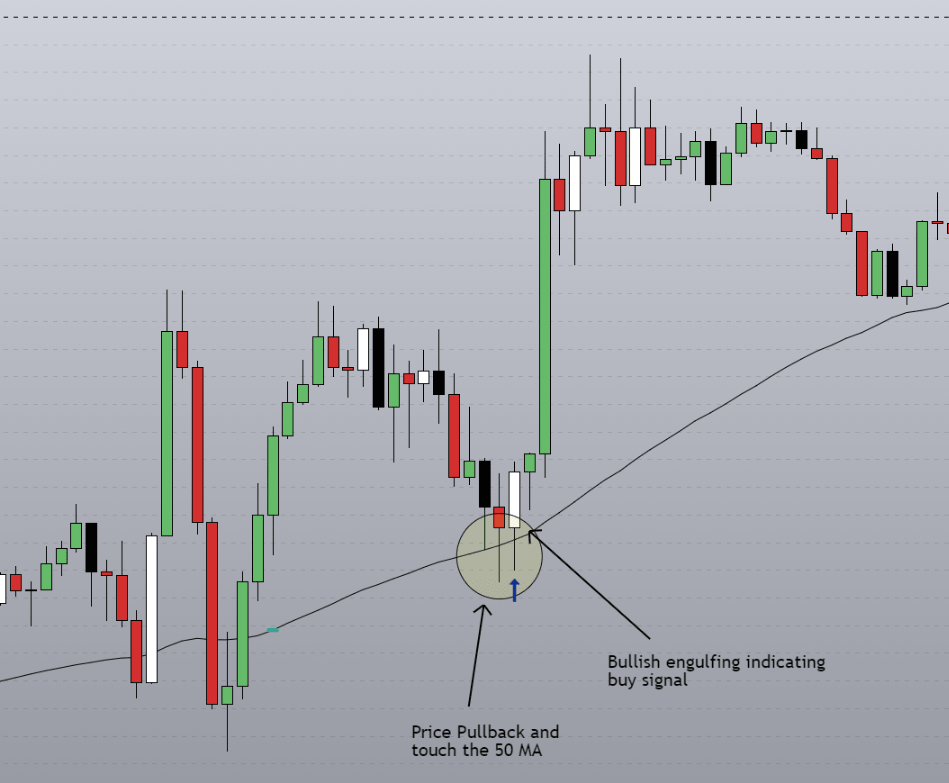

For an example have a look at the chart below.

According to the above, you can see that price pullback to the 50MA and touched it. This is a valid pullback. Now, all we need is a bullish engulfing candlestick to go long. As expected we got a bullish engulfing pattern and after that price shoot like a rocket.

Now I hope you got the idea behind these three trade entry techniques.

Next, let’s move forward and talk about how to Manage Risk.

How to Manage Risk?

As you already know this simple forex trading strategy is highly based on the small risk and higher reward.

Therefore managing risk should be our top priority.

Here I use 2 methods to managing risk when trading with this strategy.

- By Setting Default Stop-loss

- By Using Cutting Losses Methods.

With that let’s talk about these two methods.

How to Set Stop-Loss

Assume you had a bullish engulfing candle and you should place your entry at the closed on that candle.

Next, measure the size of that bullish engulfing candle in PIPs and place your stop-loss twice that distance. For example, if the size of a bullish engulfing candle is 7 PIPs, then your stop-loss should be 14 PIPs.

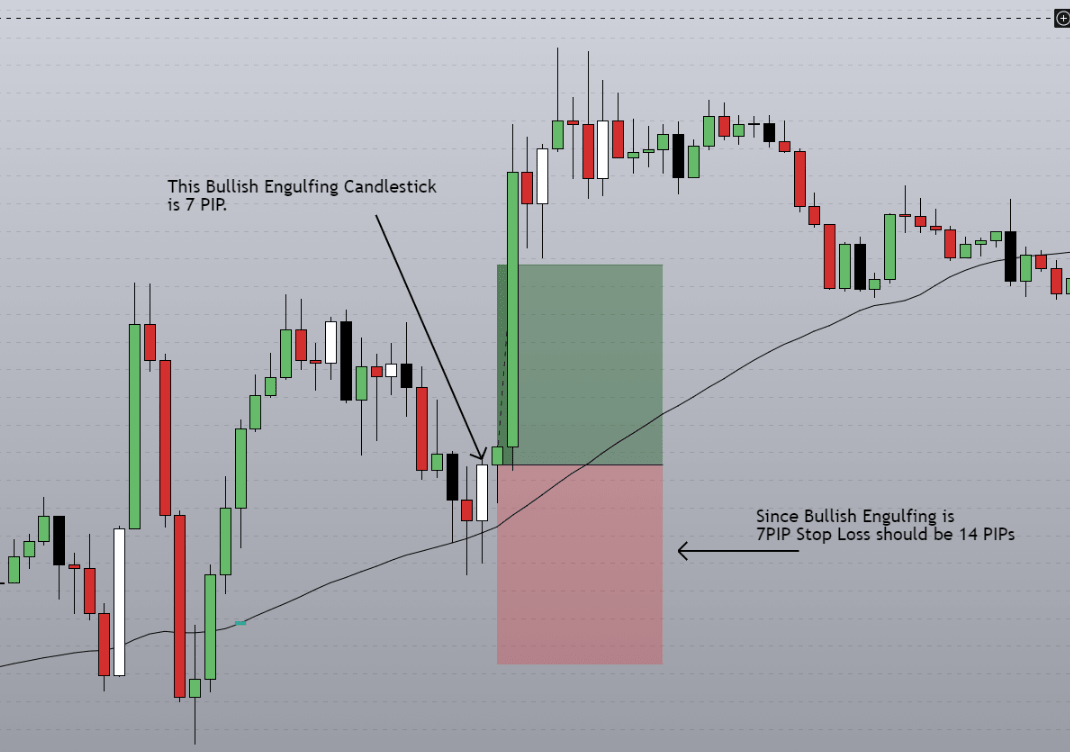

Study the chart below.

According to the above chart, you can see that we got pullback trade entry as the marked bullish engulfing candle is closed. So our trade entry should be there.

Now, the size of that candlestick is 7 PIPs, therefore Stop-loss should be 14 pips which is twice that candle.

This is how you place the stop loss when trading with this simple profitable forex trading strategy.

With that let’s see how to cut losses when trading with this trading strategy.

How to Cut Losses, So That You Can Keep Your Losses Small

The core objective of this trading strategy is to reduce our losses as much as possible so that small losses don’t affect us and we can keep growing our equity as traders. We can also avoid larger drawdowns by cutting losses.

With that, we use 4 step process to cut losses after executing a trade.

- If the Price Breaks below or above the Engulfing candle (entry candle), we should close our trade manually.

- We wait for 4 candles to closed upon the trade entry, then cut 50% of the loss.

- When the price move 1R in our favour, we cut 75% of the loss on that trade.

- When the price move 1.5R in our favour, we move the stop loss to breakeven.

If you can follow the above rules without letting your emotions affect your trading decision, you can become a profitable trader and a professional risk manager in no time.

With that in mind, let’s go over each of those steps one by one.

Step 1 – If Price Break Above or Below the Engulfing Candle, We Should Close the Trade Manually.

As you already knew, our trade entry is bullish and bearish engulfing a candlestick pattern.

Next…

Assume you saw a bullish engulfing candlestick pattern and decided to take a long position. After that, the price break below the trade entry and closed below the bullish engulfing candle.

When this occurs, the bullish engulfing is no longer valid, and there is no reason to keep the trade open. Therefore, we should cut our losses as soon as possible by manually closing the trade. This way we can stop a trade turn into a bigger loss.

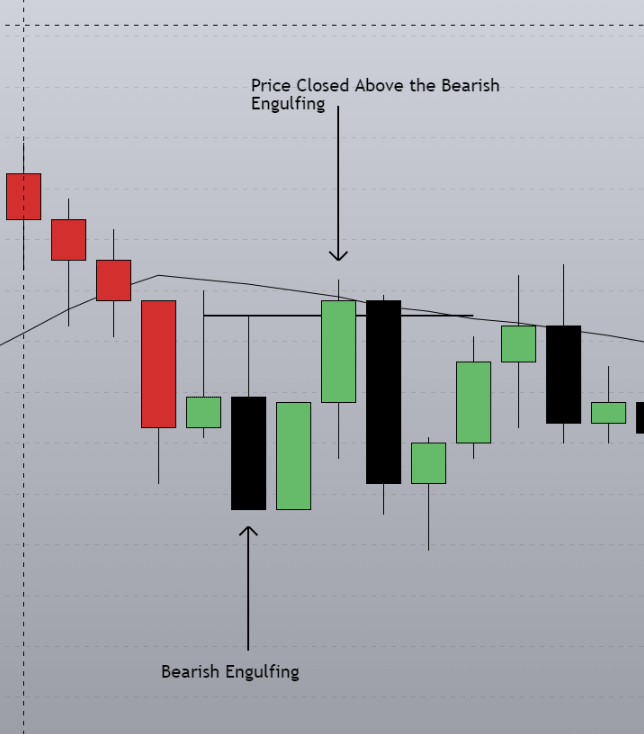

Have a look at the chart example below,

First, we can see that there is a bearish engulfing candlestick pattern that occurred after price break below the 50 SMA and this is a valid trade entry as well.

Assume that we went short here.

What happened after we went short? Within two candles price went up and closed above the bearish engulfing candlestick. Which mean our trade entry got invalidated.

Now What? Simple, as a trader and as a Risk Manager, you should cut your losses because our trade entry got invalidated and there is no reason to keep hoping that this trade will turn in our direction.

This is the first step. Let’s move into the second step.

Step 2 – We wait for 4 candles to closed upon the trade entry, then cut 50% of the loss.

In this step, we are giving some time period to see how the trade plays out. If the trade has the momentum to move in our favour within that time period we gave, there is no problem.

BUT…

If price action still stalking around the entry point after that period, we are going to cut 50% of the loss of that trade. Simply because the momentum is not in our favour.

Now, How much time period are we going to give?

Since we are trading in the 15-Minutes timeframe, we going to give 1-Hour which mean we are waiting for a closed of 4-candles before cutting 50% of the loss.

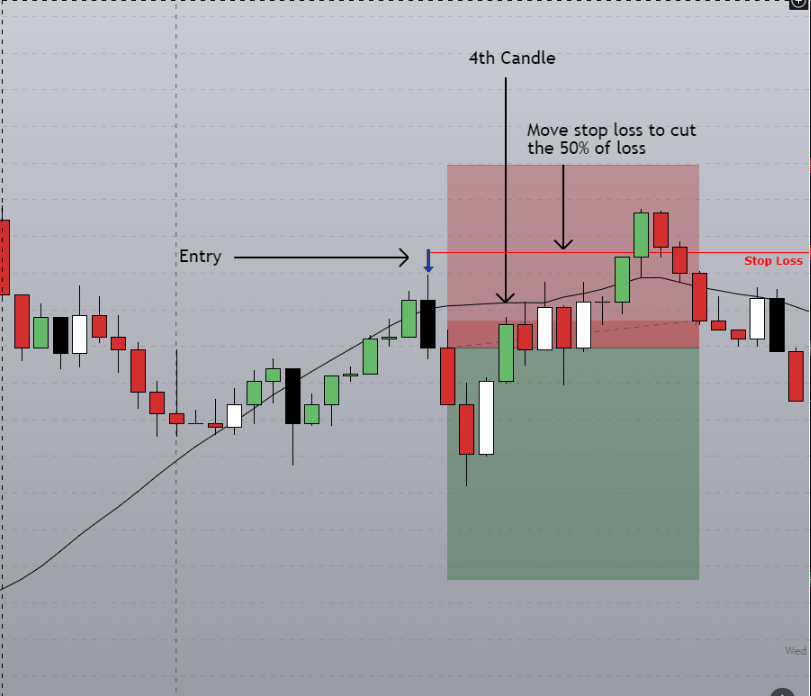

Have a look at the chart below,

According to the above chart, we got a breakout entry with a strong bearish engulfing candle. This is our trade entry and we can place a short trade here.

Now in this scenario price never tried to close above the entry candle. Therefore we don’t have to worry about the validity of the entry candle.

But upon the trade entry, we got a little bit of momentum in our favour, but that didn’t last long and eventually, we got closed of 4th candle. On there we cut the 50% of losses.

Now, what happened there?

Price moves against us and hits the stop loss for -0.5R which is better than losing -1R.

This is how you take control of your losses and keep your losses short, so that when you hit winning streaks and bigger winners you asymmetrically compound your gains.

With that let’s move into the third step on how to cut losses.

Step 3 – When the price move 1R in our favour, we cut 75% of the loss on that trade.

This is simple, when the price move 1R in our favour, we just have to cut the 75% of the loss.

For example, if your stop-loss is 10 PIP, then you wait for the price to move 10 pips in your favour, then take 75% risk out of the table.

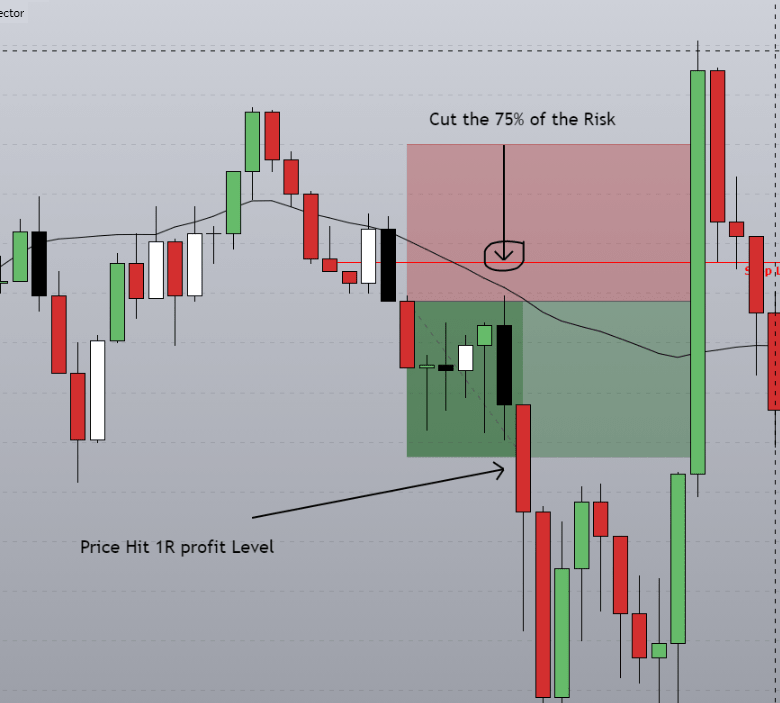

Have a look at the chart example below,

According to the above chart, we got a strong bearish engulfing entry signal following the break of the 50 SMA.

We can place a short trade there. Right after we executed a short trade, momentum began to kick in and price began to move in our favour, eventually reaching our 1R profit target. We reduced the risk by 75% there. Have a look at the red stop loss line.

This is the third step on how to cut losses. At this point, there is little to no risk on our trade. We dramatically reduce the risk of our trade using these simple trading techniques

With that let’s move into the last step.

Step 4- When the price move 1.5R in our favour, we move the stop loss to breakeven.

This is where we turn our risky trade into risk-free trade by moving the stop loss to breakeven after the price reached 1.5R in profit.

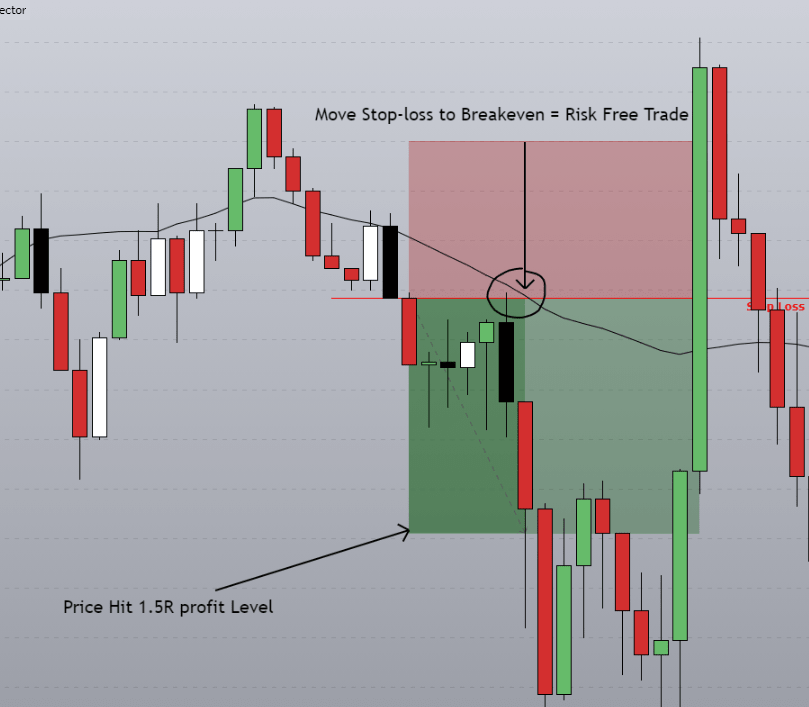

Have a look at the chart below.

Just like the previous example, in here price first reaches to 1R level. On there we cut 50% of the losses.

But in here price did not stop after reaching 1R profit level, it moves down and hit our 1.5R profit level. Right after that, we can move the stop-loss to breakeven and take all the risk out of the table.

Now we have no risk attached to the trade, next, all we have to do is to let the trade play out and manage the trade as the price move in our favour.

Managing trade is easy. You just have to trail your stop loss while the price move in your favour.

With that let’s talk about how to manage our trade.

Trade Management and Take Profit

As previously stated, after a trade has hit 1.5R in profit, there should be no risk associated with that trade because the stop-loss has been moved to breakeven to reduce losses.

The next question is how we will manage our trade and profit after the price has reached 1.5R profit while still leaving room for the trade to play out?

So, managing a trade is not that difficult, especially because we apply a set of rules that are simple to follow and execute.

What are these rules? To understand that have a look at the sketch below.

I think you got the idea.

This is simple when the price hit each milestone given in the above table, you’ll have to move your stop-loss accordingly.

For example, when the price is 3.5R in profit, you had to move the stop-loss to 2R in profit. That way we can leave 1.5R room for that trade to play while still managing and booking some profit out of this trade.

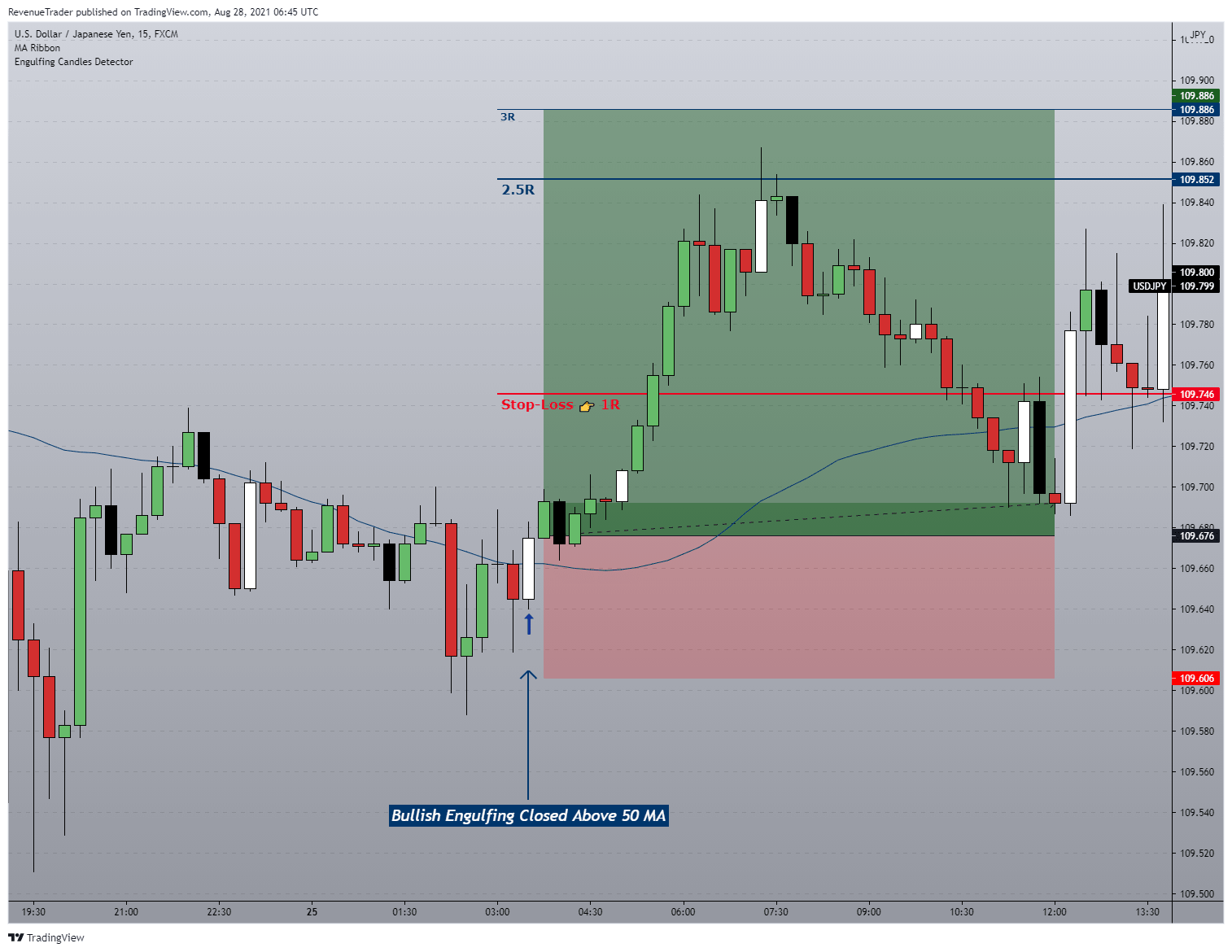

Let’s take a real-world example and see how to book profit as the market move in our favour. Have a look at the chart below.

First of all, have a look at the trade entry. This is an initial breakout entry. Why? Because we got a bullish engulfing candle on the initial breakout and with that, we placed a long trade.

Right after the trade entry, the price moved in our favour without taking much time. As the chart is shown above, price pushes all the way up to 2.5R in profit. Which mean we should trail stop-loss to 1R in the profit. That is what we did the above.

What happened after the price reached 2.5R in profit? Market reverses in the other direction, right?

Fortunately, we had our stop-loss at 1R. Therefore we were able to book 1R profit without giving all the unrealized profit back to the market.

With that, I hope you got the idea behind trade management and profit booking.

One last thing, when trading with this simple profitable forex trading strategy, you should place your Take Profit order at 5R. Have a look at the above table for reference.

Now before we wrap this article let’s talk about one last thing.

Is This Simple Profitable Forex Trading Strategy for You?

What are your thoughts?

Is this simple trading strategy suitable for you? Is it compatible with your daily routine? Is it a good fit for your personality?

Then you may begin backtesting and gradually apply this to your trading.

Finally, I’d want to ask you a question.

Can you really manage your emotions when you’ve had 3 to 5 little losses and yet have to place orders?

Consider this question, and I hope you now understand every detail of this trading strategy. If you have any questions about this method, please leave them in the comments area.

Please help us by sharing this article on social media.

A very good reference for another simple forex trading strategy from forex4noobs: FOREX TRADING STRATEGY: The Ultimate Guide (2020 Update)